Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

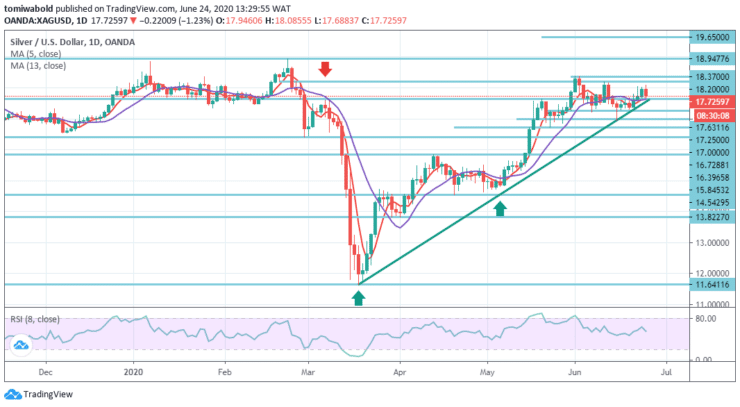

XAGUSD Price Analysis – June 24

Silver buyers are having difficulties holding gains beyond the $18 mark this week, whilst the semi-precious metal experienced opposition at $18.08 level early Wednesday and was last observed trading close to $17.72 level per ounce, reflecting a loss of 0.16 percent on the day. The primary danger to silver buyers on a COVID-19 vaccine might be a rapid rebound in the world markets.

Key levels

Resistance Levels: $18.94, $18.37, $18.20

Support Levels: $17.25, $17.00, $16.72

First, on the higher side, a close beyond $18 level may validate a breakout of the bull flag in the current day, as observed on the daily chart. The preceding uptrend is often intensified by the flag breakout. In the scenario of silver, a price increase beyond $20 level is likely to intensify it.

The frequent rejection underneath $18 is indicative of partial bullish exhaustion and implies prospect for a pullback to the ascending trendline support, presently at $17.63 level where the bias may switch itself to bearish if and when prices fall beneath the moving averages 5 and 13 around $17.50 level.

Since late March, Silver has appreciated against the US Dollar. The exchange rate of XAGUSD has already surpassed the level of $17.00. Some upside potential may probably tend to reign in the market, as the exchange rate drops beneath 4-hour moving averages 5 & 13. The price for silver in this scenario may drop to $17.00 mark.

In the meantime, recall that the exchange rate may have to exceed the level of horizontal support situated at $17.63 and $17.25. If the specified support stays, a reversal to the north is likely to occur. In this scenario, the price may get support at $17.63 level from the horizontal support.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus