Serviciu de copy-trading. Algo nostru deschide și închide automat tranzacțiile.

L2T Algo oferă semnale extrem de profitabile cu risc minim.

Tranzacționare 24/7 cu criptomonede. În timp ce dormi, facem schimb.

Configurare de 10 minute cu avantaje substanțiale. Manualul este furnizat odată cu achiziția.

Rata de succes de 79%. Rezultatele noastre vă vor entuziasma.

Până la 70 de tranzacții pe lună. Sunt mai mult de 5 perechi disponibile.

Abonamentele lunare încep de la 58 GBP.

Horizontal Levels is one of the simplest yet incredibly useful ideas in Forex trading. Horizontal levels are fundamental in most Forex trading strategies and aid us in analyzing charts. However, they can also be used on their own as a strategy rather than just a tool for other strategies. By watching the most obvious price changes and drawing their horizontal levels we can make successful trades. In fully understanding the horizontal levels of more complex charts we can spot trends that we would have otherwise missed.

4

Modalitati de plata

Platforme de tranzacționare

Reglementat de

Suport

Depozit min

Levier max

Perechi valutare

Clasificare

Mobile App

Depozit min

$100

Spread min.

Sâmburi de variabile

Levier max

100

Perechi valutare

40

Platforme de tranzacționare

Metode de finanțare

Reglementat de

FCA

Ce poți face schimb

Forex

Indici

Acţiuni

Cryptocurrencies

materii prime

Spread mediu

EUR / GBP

-

EUR / USD

-

EUR / JPY

0.3

EUR / CHF

0.2

GBP / USD

0.0

GBP / JPY

0.1

GBP / CHF

0.3

USD / JPY

0.0

USD / CHF

0.2

CHF / JPY

0.3

Taxa aditionala

Rată continuă

Variabile

transformare

Sâmburi de variabile

Regulament

Da

FCA

Nu

CYSEC

Nu

ASIC

Nu

CFTC

Nu

RNP

Nu

BAFIN

Nu

CMA

Nu

SCB

Nu

DFSA

Nu

CBFSAI

Nu

BVIFSC

Nu

FSCA

Nu

FSA

Nu

FFAJ

Nu

ADGM

Nu

FRSA

71% din conturile investitorilor de retail pierde bani atunci când tranzacționează CFD-uri cu acest furnizor.

Depozit min

$100

Spread min.

- sâmburi

Levier max

400

Perechi valutare

50

Platforme de tranzacționare

Metode de finanțare

Reglementat de

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

Ce poți face schimb

Forex

Indici

Acţiuni

Cryptocurrencies

materii prime

Etfs

Spread mediu

EUR / GBP

1

EUR / USD

0.9

EUR / JPY

1

EUR / CHF

1

GBP / USD

1

GBP / JPY

1

GBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

Taxa aditionala

Rată continuă

-

transformare

- sâmburi

Regulament

Nu

FCA

Da

CYSEC

Da

ASIC

Nu

CFTC

Nu

RNP

Nu

BAFIN

Nu

CMA

Nu

SCB

Nu

DFSA

Da

CBFSAI

Da

BVIFSC

Da

FSCA

Da

FSA

Da

FFAJ

Da

ADGM

Da

FRSA

71% din conturile investitorilor de retail pierde bani atunci când tranzacționează CFD-uri cu acest furnizor.

Depozit min

$10

Spread min.

- sâmburi

Levier max

10

Perechi valutare

60

Platforme de tranzacționare

Metode de finanțare

Ce poți face schimb

Forex

Indici

Cryptocurrencies

Spread mediu

EUR / GBP

1

EUR / USD

1

EUR / JPY

1

EUR / CHF

1

GBP / USD

1

GBP / JPY

1

GBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

Taxa aditionala

Rată continuă

-

transformare

- sâmburi

Regulament

Nu

FCA

Nu

CYSEC

Nu

ASIC

Nu

CFTC

Nu

RNP

Nu

BAFIN

Nu

CMA

Nu

SCB

Nu

DFSA

Nu

CBFSAI

Nu

BVIFSC

Nu

FSCA

Nu

FSA

Nu

FFAJ

Nu

ADGM

Nu

FRSA

Capitalul dvs. este în pericol.

Depozit min

$50

Spread min.

- sâmburi

Levier max

500

Perechi valutare

40

Platforme de tranzacționare

Metode de finanțare

Ce poți face schimb

Forex

Indici

Acţiuni

materii prime

Spread mediu

EUR / GBP

-

EUR / USD

-

EUR / JPY

-

EUR / CHF

-

GBP / USD

-

GBP / JPY

-

GBP / CHF

-

USD / JPY

-

USD / CHF

-

CHF / JPY

-

Taxa aditionala

Rată continuă

-

transformare

- sâmburi

Regulament

Nu

FCA

Nu

CYSEC

Nu

ASIC

Nu

CFTC

Nu

RNP

Nu

BAFIN

Nu

CMA

Nu

SCB

Nu

DFSA

Nu

CBFSAI

Nu

BVIFSC

Nu

FSCA

Nu

FSA

Nu

FFAJ

Nu

ADGM

Nu

FRSA

71% din conturile investitorilor de retail pierde bani atunci când tranzacționează CFD-uri cu acest furnizor.

The importance of horizontal levels

Most traders consider horizontal levels to be just as important as price action, which is the core to Forex trading. Analyzing the combination of the price change and the horizontal levels can allow us to understand the trend and predict where the market will go next. Although horizontal levels is a very basic Forex trading strategy, many famous and experienced traders such as Jesse Livermore, Warren Buffett, and George Soros have confirmed that they use it as a basis to many of their strategies.

To learn more about How to read and trade the price action – Forex Trading Strategies

Horizontal levels help us spot key areas on a chart where a change in trend is likely to occur. This can help us when deciding where to place a stop, or when we want to enter a trade but don’t know the right time to do so. Precise timing can be crucial in many Forex trading strategies and a careful analysis of the horizontal levels can help us find the correct timing and place a good trade. Keep in mind that horizontal levels may be the foundation for many strategies but on its own, it is usually not enough and must be used in combination with other forex trading strategies.

Horizontal Levels and ‘Swing Points’

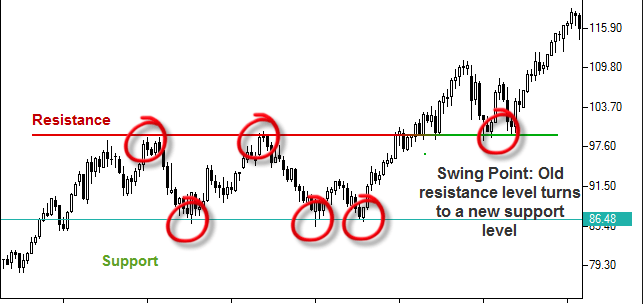

The best way to use horizontal levels to our advantage is by analyzing the swing points. Swing points are points where the trend changes, and by marking horizontal levels at these points we can find prices where there is likely to be a change in trend. The illustration below clearly shows how we can use horizontal levels to our advantage.

Notice how the swing points have the tendency to repeat themselves. Support levels can turn into resistance levels and vice versa. By marking the horizontal levels on the chart we can predict when the next swing point will occur and enter/exit a trade at the perfect time. The blue circles on the chart are the points that we should have been able to notice in advanced. These are the most obvious entry points, and by noticing them we would have given an edge to any strategy that we chose to use.

Horizontal Levels and Ranging Markets

Horizontal levels are also very useful in range-bound markets. Range-bound markets are markets where the price has very clear upper and lower boundaries that the price doesn’t cross. By watching the price as it approaches one of the boundaries we can predict with great accuracy where the price will trend next. As always, the price can be unpredictable and might break the boundary just as we decide to enter a trade, but overall this strategy is very reliable and safe. The illustration below shows an example of a range-bound market.

Notice how the price jumps back and forth between two very obvious boundaries. By marking these boundaries as our horizontal levels we can use them to our advantage. Wait for the price to approach one of the boundaries to make a move. As we know that the price is not likely to cross the horizontal level at the boundary, we can enter a trade, expecting the trend to switch, and the price to go back away from the horizontal level.

If the price was approaching the upper boundary, expect the trend to be bearish and the price to go down and if the price was approaching the lower boundary expect a bullish trend and an up-going price change. Risk and reward levels are also very easy to choose in this kind of market. The risk level should be just above or below the boundary that you entered the trade from and the reward level should be at the opposite boundary of the range-bound market.

It is important to remember that these are only three Forex trading strategies which are based on technical analysis of the charts. There are dozens of unique strategies out there. Some are long term and some are short term. Some forex trading strategies involve great risk while others are almost risk-free. Some strategies are based on a deep understanding of current economic events while others are based on a technical analysis of the market and trends. The list is endless and diverse.