Account Information

Full Review

ATFX is an award-winning global spread betting, forex, and CFD broker headquartered in London. The company provides a platform where users from around the world can trade and make money in the financial market. ATFX also provides additional tools to traders to empower them achieve better results in their trading. ATFX was started in 2017 and is regulated by the Financial Conduct Authority (FCA). It is owned by AT Global Markets, a company that is also a member of the Financial Services Compensation Scheme. In addition, the company uses an Electronic Communications Network (ECN) model using the straight through processing technology.

ATFX Advantages and Disadvantages

Advantages

- An award-winning company offering more than 200 assets.

- A free demo account is offered to all traders.

- Competitive spreads that start at 0.6 pips on the EUR/USD pair.

- Free daily analysis is offered.

- A free comprehensive economic calendar.

- A comprehensive education package to all traders.

- High leverage of up to 400:1

Disadvantages

- ATFX does not offer ETFs and bonds as other brokers are offering.

- ATFX does not have a deal cancellation feature.

- ATFX does not offer a freeze rate feature.

- ATF does not have a copytrading feature

Supported Assets

ATFX offers more than 200 assets on its platforms. On currencies, the company offers majors like EUR/USD, USD/JPY, GBP/USD, and NZD/USD. It also offers minor currencies like AUD/CAD, GBP/JPY, NZD/CAD, and NZD/CHF. It also has exotics like EUR/HUF, USD/MXN, and USD/DKK among others.

ATFX also offers commodities like crude oil, natural gas, and corn. It also has precious metals like gold, platinum, palladium, and silver. The company also offers indices like the Dow Jones Industrial Average, DAX, and S&P 500. It also offers cryptocurrencies like Bitcoin, Ethereum, and Ripple. Finally, ATFX offers shares like Amazon, Apple, and Google.

A company that offers all these products is a good thing because it allows for diversification. It allows traders to have freedom to trade in assets that they are interested or skilled at.

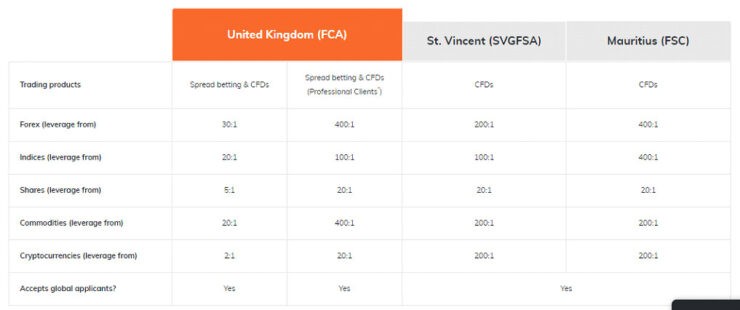

ATFX Leverage

Leverage is the amount of additional capital that a broker gives a customer to trade with. For example, if you have $100 and you chose a 100:1 leverage, it means that you can trade with $10,000. In 2018, after the European Union signed into law the MIFID regulations, the maximum amount of leverage to EU customers became 30:1.

In line with these regulations, ATFX offers a maximum leverage of 30:1 for European traders. The maximum leverage for indices, shares, commodities, and crypto is 20:1, 5:1, 20:1, and 2:1 respectively. For global customers, the maximum leverage for currencies, indices, shares, commodities, and crypto is 400:1, 100:1, 20:1, 400:1, and 20: respectively. The table below shows a comparison of these leverages.

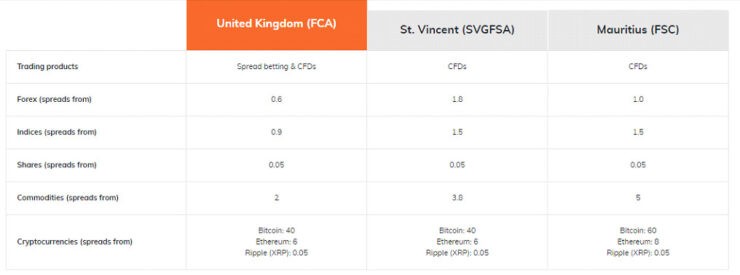

ATFX Spreads

As with most brokers, ATFX does not make money by charging a commission on trades. Instead, the company makes money from the spread. A spread is the difference between the ask and bid price. The chart below shows the spreads the company charges across its assets.

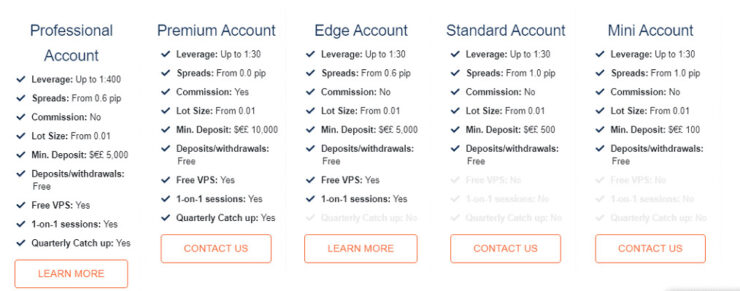

ATFX Type of Accounts

ATFX offers its clients four types of accounts. These accounts are tailored to suite the different types of traders. These types of accounts are:

- Mini account – The minimum deposit in a mini account is $£€ 100. The maximum leverage is up to 30:1 while the spreads start from 1.0 pip.

- Standard account – The minimum deposit in a standard account is $£€ 500. The maximum leverage is up to 30:1 while spreads start at 1.0 pip.

- Edge account – The minimum deposit in the Edge account is $£€ 5,000. The maximum leverage is 30:1 while spreads start at 0.6 pip.

- Premium account – The premium account has a minimum deposit of $£€ 10,000 and leverage of up to 30:1. This account charges a commission of up to $25 per mio per side.

- Professional account – This account has a minimum deposit of $£€ 5,000. It has a maximum leverage of 400:1. Spreads start from 0.6 pip.

Edge, premium, and professional accounts have additional perks such as a premium account manager, one-on-one Skype session with the Chief Market Strategist, and invitations to ATFX events. The table below shows more differences between these account types.

ATF Trading Platforms

ATFX offers its traders the MetaTrader 4 platform. The MT4 is the most popular trading platforms in the world. The platform offers a number of features such as custom indicators, automated trading with expert advisors, charting tools, and the access to the MQL5 marketplace. ATFX also offers the Android and iOS version of MT4. It also offers the web version of the MT4.

Unlike other brokers, ATFX does not have its own trading platform. In addition, it does not offer MetaTrader 5 and other third-party trading platforms.

Tutorial: How to Register and Trade with ATFX

The process of registering for an account with ATFX is very simple. If you are a starter, we recommend that you start by creating a demo account. On the home page, you should follow the links shown in red below.

On this link, you will be asked to enter a few details about yourself. These are your first and last name, phone number, email address, your preferred account type, account currency, and the amount you want to start with. You will then be given access to download the MT4.

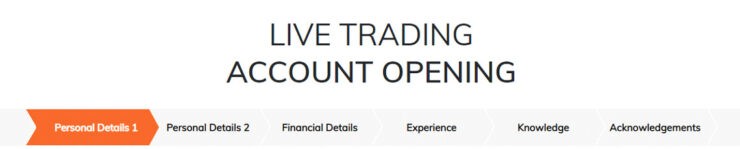

If you are an experienced trader, you should go straight to the open live account page. In this page, you will first be asked to select your preferred language. You should then enter the personal details, financial details, experience, knowledge on finance, and acknowledgements as shown below.

After you have entered these details, you need to submit your personal documents like the identification card and a proof of residence. This is required by the law. It is used to ensure that companies abide to the know your customer (KYC) and anti-money laundering (AML) laws.

After this, you need to download the MT4, create an MT4 account, deposit funds to your account, move it to MT4, and then start trading.

Account Verification

ATFX is a company that is regulated by the Financial Conduct Authority (FCA). This means that the company needs to abide by the law. The first type of verification is the email verification. You do this by clicking a link that is sent to you as soon as you register. After this, you will need to upload your ID or passport and a proof of residence.

Deposits and Withdrawals

The ease of deposits and withdrawals is very important. Customers want to feel safe to transact. They also want the deposits and withdrawals to be fast. ATFX provides three main methods of funds deposits. It accepts credit and debit cards, e-wallets like Skrill, Neteller, and SafeCharge, and direct bank deposits.

Credit and debit card transactions and e-wallets take less than 30 minutes to reflect into your account. Bank transfer tends to take longer but this depends on the bank and the country of origin.

On withdrawals, the company accepts credit and debit cards, e-wallets, and bank transfer. Like with deposits, the company only accepts cash in euro, the USD, and sterling. The funds take about one working day to clear.

To deposit and withdraw, you just need to go to your account dashboard, select the process you want, and then follow the process.

ATFX Regulation

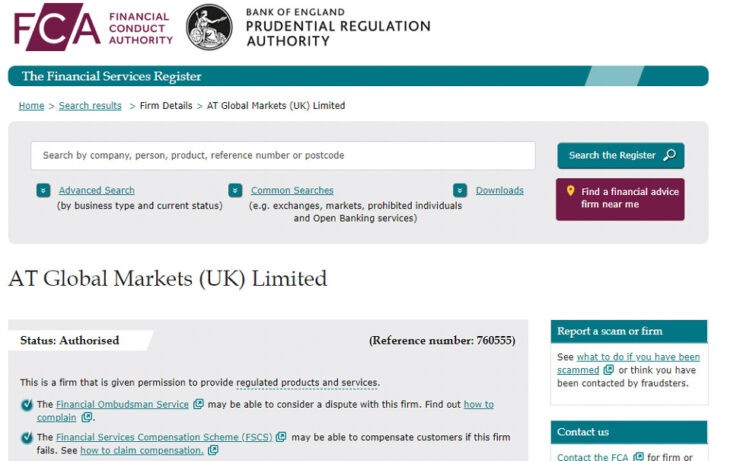

ATFX is under the regulation and supervision of the Financial Conduct Authority (FCA). This is the main regulator in the United Kingdom. Its FCA number is 760555. Its registered company number is 09827091.As a country in the European Union, ATFX works in compliance with the Markets in Financial Instruments Directive (MIFID II).

ATFX Customer Service

ATFX has invested a lot on customer service. On the website, customers can use the chat feature to communicate with the company. They can also make a call using the customer service hotline (0800 279 6219 or +44 203 957 7777). They can also send emails.

How ATFX Compares to Other Brokers

ATFX is similar to other brokers. It provides the MT4 platform that many other brokers provide. It has a market analysis portal, just like other brokers. It also has an economic calendar like other brokers. Customer service and cash withdrawals and deposits are also similar to what other brokers provide.

Is ATFX a Safe Broker?

ATFX is a safe broker. It is under the supervision of the FCA, which is one of the toughest regulators in the world. It is a company that has won a number of awards and has sponsored a number of sporting events. The company also offers great spreads, which can help traders save a lot of money.

Your capital is at risk of loss when trading CFDs at this platform.

BROKER INFORMATION

Website URL:

https://www.atfx.com/

PAYMENT OPTIONS

- Credit cards,

- Debit cards,

- E-wallets,

- Direct bank deposits,