Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

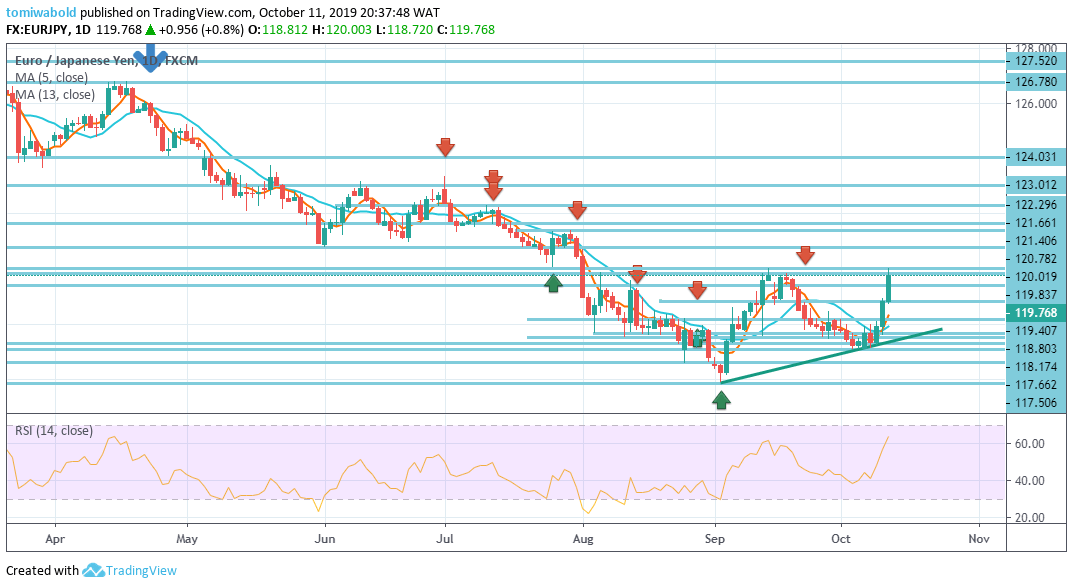

EURJPY Price Analysis – October 11

On the upside zone of the pair is the risk-limiting its momentum for a further advance while buyers dominated the common European currency against the Japanese Yen on Friday. Presently, it’s retracing but buyers remain in control and attempting to cross above the level at 120.00.

Key Levels

Resistance Levels: 127.52, 123.01, 120.78

Support Levels: 118.80, 117.08, 115.86

EURJPY Long term Trend: Bearish

In the long term trend, for as long as the horizontal zone on the level at 120.78 support turned resistance holds, then the downtrend from the level at 127.52 (high) should still be in progress.

Meanwhile, the break of the level at 115.86 will target the lower low. However, the sustained break of the level at 120.78 will be the first indication of a medium-term reversal. where the further rise would then be seen to the level at 127.52 resistance for confirmation.

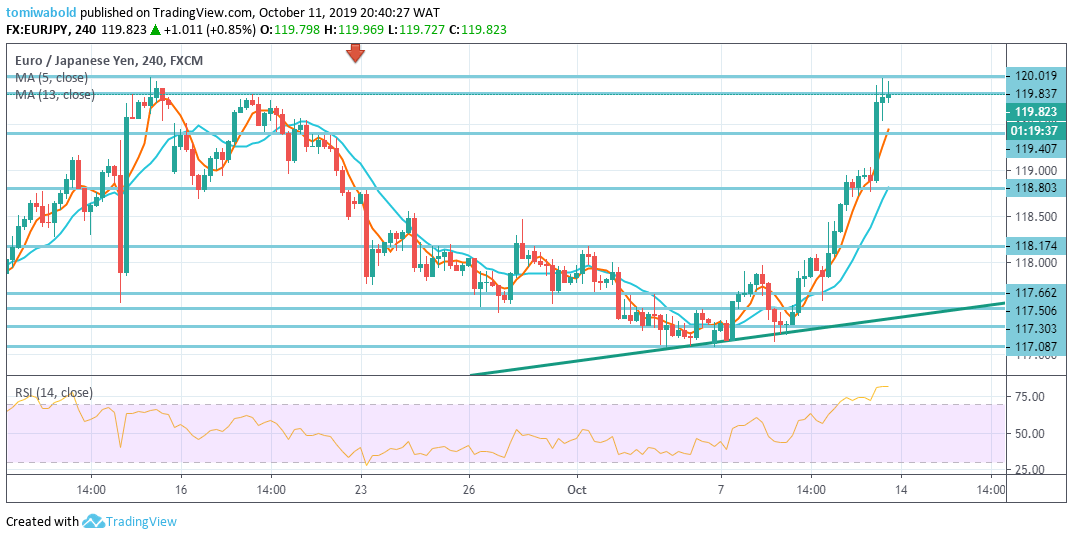

EURJPY Short term Trend: Ranging

The EURJPY exchange rate is likely to retrace towards the support level formed by the moving average 5 and 13 in extension on the level at 119.40 and 118.80 area respectively.

As it is with the steady upside momentum, a Further buying might move prices higher should the market test the nearby high at 120.78, While EURJPY is experiencing a short-term upswing, this could simply be a rectification, as both the medium and long term patterns are as yet bearish.

Instrument: EURJPY

Order: Sell

Entry price: 120.00

Stop: 120.78

Target: 118.40

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus