Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

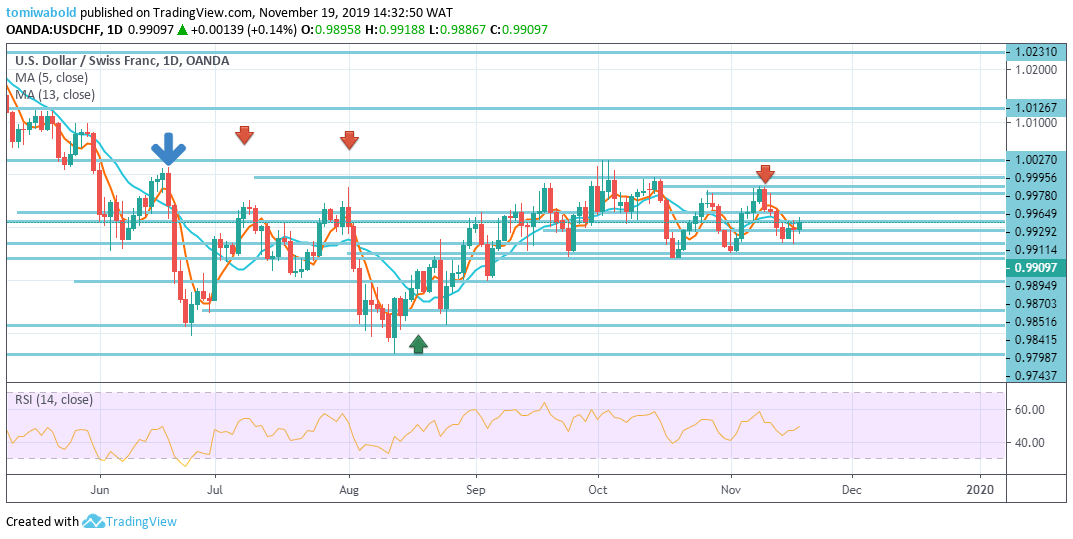

USDCHF Price Analysis – November 19

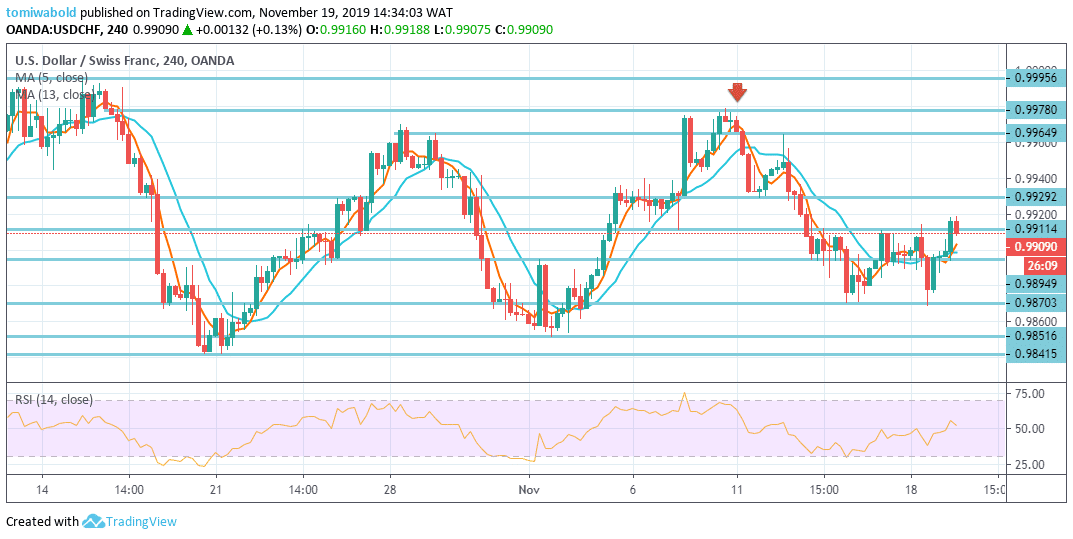

The FX pair moved past the moving average 5 and 13 while breaking the horizontal zone on the key level at 0.9911 early during the European session, but could not sustain the momentum. As at the time of composing, USDCHF dived again below the key level at 0.9911. The bias becomes weaker at the break, but traders may pay attention to the missed break.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9995

Support Levels: 0.9851, 0.9798, 0.9659

USDCHF Long term Trend: Ranging

USDCHF exited Monday on the level at 0.9896, down slightly by 2 pips (-0.02%). In today’s trading, while trending up to 23 pips after the opening, the FX pair managed to reverse yesterday’s low during the session as the bulls took control and may end the day above its opening price.

In the longterm, its outlook stays bullish but the USDCHF is also staying in the range of the level at 0.9659/1.0231. Meanwhile, a decisive break of the level at 1.0231 is required to confirm the uptrend resumption.

USDCHF Short term Trend: Ranging

The FX pair displays short-term strength, supported by its long-term uptrend, with the medium-term trend being bearish only. Although new fresh selling may lower price if the market tested the lowest mark in October on the level at 0.9841.

Intraday bias in USDCHF stays neutral at this stage. Consolidation from the level at 1.0027 may extend to the level at 0.9851. In this scenario, a further plunge may be observed towards the level at 0.9659 low. On the upside, the breakout of the level at 0.9978 will target the level at 1.0027 first.

Instrument: USDCHF

Order: Sell

Entry price: 0.9911

Stop: 0.9978

Target: 0.9851

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus