Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

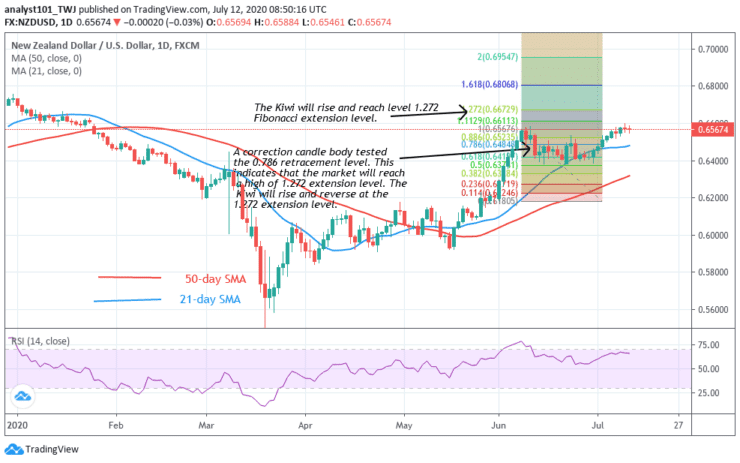

Key Resistance Levels: 0.6600, 0.6800, 0.7000

Key Support Levels: 0.6200, 0.6000, 0.5800

NZD/USD Price Long-term Trend: Bullish

NZD/USD pair is in an upward move. The Kiwi rose to level 0.6600 and was resisted. The pair is currently trading at $0.6567 and it is likely to rise. A correction candle body tested the 0.786 retracement level. This indicates that the market will reach a high of 1.272 extension level. The Kiwi will rise and reverse at the 1.272 extension level. However, the reversal will not be immediate.

Daily Chart Indicators Reading:

The Kiwi is at level 66 of the Relative Strength index period 14. It implies that the pair is in the uptrend zone and above the centerline 50. The 50-day SMA and 21-day SMA are sloping upward. It indicates that the market is rising.

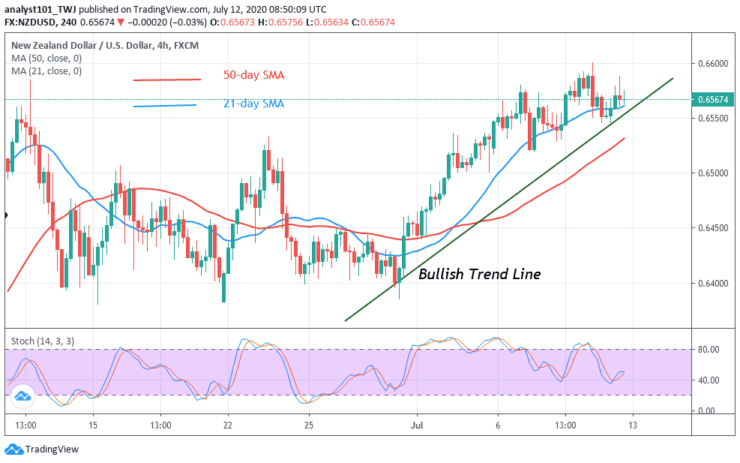

NZD/USD Medium-term Trend: Bullish

On the 4-hour chart, the NZD/USD pair is an uptrend. The pair reached a high of level 0.6600 and was repelled. The price dropped to the level 0.6550 and resumed a fresh uptrend. The market will rise and retest the recent resistance at level 0.6600.

4-hour Chart Indicators Reading

The 50-day and 21-day SMA are sloping upward. It indicates that the recent upward move. The pair is above 40% range of the daily stochastic. It indicates that the market is in bullish momentum.

General Outlook for NZD/USD

The NZD/USD pair is rising again after being repelled at level 0.6600. The Kiwi is negotiating a fresh uptrend to retest the resistance level. A break above the resistance will push the price to level 0.6650. The market will fall if the bulls fail to breach the recent high.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus