Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

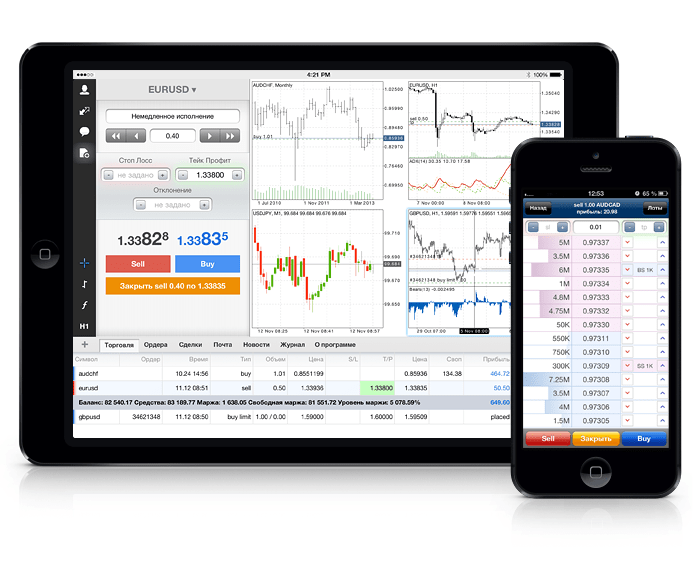

Trading on the go in the 21st century

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

The mobile technology has advanced immensely in the last 10 years. In the 70s and the 80s people held strange and unfeasible concepts when they imagined the technology developments that would occur in 20-30 years. But technology is developed by businesses which pursue profit, so they tend to develop the technology that the public needs, that´s why it´s not a big surprise that most of that imaginary futuristic technology was never materialized. Instead, the technology moved towards practical and indispensable things like mobile trading. People are always on the move nowadays and spend a lot of time traveling so if they want to trade they need to do it while in motion. The technology developers perceived this need and developed the mobile trading platforms.

4

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

0.0

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$10

Spread min.

- pips

Leverage max

10

Currency Pairs

60

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Cryptocurrencies

Average spread

EUR/GBP

1

EUR/USD

1

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Your capital is at risk.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Most of the brokers now offer the option of mobile trading platforms to their customers. The mobile trading platforms can be downloaded and used in most of the mobile devices like smart phones, tablets, blackberries, androids etc. This is very suitable for traders and the statistics show an increasing interest in mobile trading. The number of people who trade on mobile devices has increased by 600% in the last 4-5 years and mobile trading now accounts for 27% of the total transactions. But mobile trading has some disadvantages as well. Below we´ll list the pros and cons of mobile trading.

Advantages

Entering trades – In Forex, there are always good trading opportunities throughout the day.

I used to miss a lot of these opportunities before the smartphones were invented, especially during the afternoon. But now that I use a mobile device for trading I can enter a trade immediately when I spot a good opportunity anytime of the day.

Exiting trades – The Forex market can be very volatile where the economic news and political events have an immense impact on the currencies. So, there are many occasions when you need to get out of a trade immediately because of a certain event which might send the pair you are trading in the opposite direction within minutes. Mobile trading is the perfect solution for that.

Practicing– If you are new to Forex you can practice trading with mobile devices. In order to be successful, you have to watch the price action and practice during different times of the day. This way you see how the price reacts to different events during different sessions and get to feel the market. With mobile devices, you can practice anytime, anywhere.

Part-time traders – Many people trade Forex part-time for an extra income along with their daily jobs, so they might not have access to a computer. The statistics show that the peak hours of mobile trading are between 7-9 am and 1-3 pm, which means people trade while they commute to work or in their lunchtime. Without mobile trading, they wouldn´t be able to trade at all.

Full-time traders- Even the full-time traders like me cannot stay in front of a computer all the time like zombies and it is not recommended either. We have our personal lives like everyone else, but with mobile devices, we can trade and take care of our family obligations at the same time. Our judgment becomes impaired if we stay in front of a PC for more than 4-5 hours non-stop looking at the charts, so I usually go out for a coffee at noon for about an hour and take my iPad with me. This way I can check the market and relax at the same time.

Disadvantages

Lack of indicators – Not all the indicators of the MT4, MT5 and other trading platforms for PCs can be found or applied on the trading platforms for mobiles. Most of these are minor indicators and I don´t use them so they don´t affect my trading, but there might be traders who rely on them.

The indicator window – The screen is smaller, therefore it´s harder to conduct proper technical analysis. This is made harder by the indicator window at the bottom of the screen. I like to use Stochastics, RSI, and MACD, so the indicator window gets a little messy when I apply the three of them.

No multiple charts – I like to have the charts of 4-5 different currency pairs on my screen at all times so I get updated continuously with their behavior and price action. With the mobile trading platforms you cannot open multiple charts; you have to close one in order to open another. So when you are analyzing a certain pair, you kind of lose touch with the other pairs.

Dropped connection – There are some places where the mobile connection might get lost, like in tunnels, elevators or underground parking and bars. If you have open trades during volatile times and you lose connection you might end up with severe losses.

Addiction – Last but not least, addiction. Having a trading platform with you all the time may lead to excessive trading. Some people with addictive personalities tend to develop an addiction to trading and overtrade as a result, which is one of the biggest mistakes a trader can do.

So like most of the new technology gadgets, mobile trading has its upsides and its downsides. In my opinion and as we described in this article, the advantages outweigh the disadvantages. After all, everything in life has its upsides and downsides and if we manage to minimize the latter we can turn this new trading technology into a powerful tool which could really help us become better traders.

This may also interest you:

- Check out our Forex Trading Platforms reviews

- You can also read more about how to create your own trading plan