Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

Horizontal Levels is one of the simplest yet incredibly useful ideas in Forex trading. Horizontal levels are fundamental in most Forex trading strategies and aid us in analyzing charts. However, they can also be used on their own as a strategy rather than just a tool for other strategies. By watching the most obvious price changes and drawing their horizontal levels we can make successful trades. In fully understanding the horizontal levels of more complex charts we can spot trends that we would have otherwise missed.

4

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

0.0

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$10

Spread min.

- pips

Leverage max

10

Currency Pairs

60

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Cryptocurrencies

Average spread

EUR/GBP

1

EUR/USD

1

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Your capital is at risk.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

The importance of horizontal levels

Most traders consider horizontal levels to be just as important as price action, which is the core to Forex trading. Analyzing the combination of the price change and the horizontal levels can allow us to understand the trend and predict where the market will go next. Although horizontal levels is a very basic Forex trading strategy, many famous and experienced traders such as Jesse Livermore, Warren Buffett, and George Soros have confirmed that they use it as a basis to many of their strategies.

To learn more about How to read and trade the price action – Forex Trading Strategies

Horizontal levels help us spot key areas on a chart where a change in trend is likely to occur. This can help us when deciding where to place a stop, or when we want to enter a trade but don’t know the right time to do so. Precise timing can be crucial in many Forex trading strategies and a careful analysis of the horizontal levels can help us find the correct timing and place a good trade. Keep in mind that horizontal levels may be the foundation for many strategies but on its own, it is usually not enough and must be used in combination with other forex trading strategies.

Horizontal Levels and ‘Swing Points’

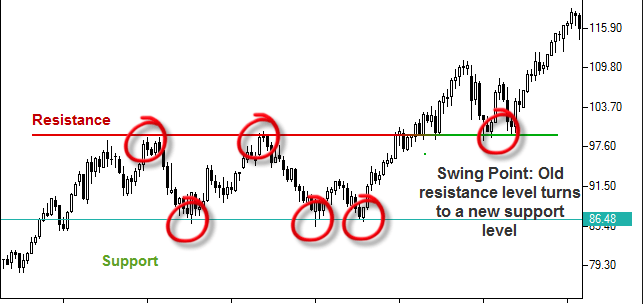

The best way to use horizontal levels to our advantage is by analyzing the swing points. Swing points are points where the trend changes, and by marking horizontal levels at these points we can find prices where there is likely to be a change in trend. The illustration below clearly shows how we can use horizontal levels to our advantage.

Notice how the swing points have the tendency to repeat themselves. Support levels can turn into resistance levels and vice versa. By marking the horizontal levels on the chart we can predict when the next swing point will occur and enter/exit a trade at the perfect time. The blue circles on the chart are the points that we should have been able to notice in advanced. These are the most obvious entry points, and by noticing them we would have given an edge to any strategy that we chose to use.

Horizontal Levels and Ranging Markets

Horizontal levels are also very useful in range-bound markets. Range-bound markets are markets where the price has very clear upper and lower boundaries that the price doesn’t cross. By watching the price as it approaches one of the boundaries we can predict with great accuracy where the price will trend next. As always, the price can be unpredictable and might break the boundary just as we decide to enter a trade, but overall this strategy is very reliable and safe. The illustration below shows an example of a range-bound market.

Notice how the price jumps back and forth between two very obvious boundaries. By marking these boundaries as our horizontal levels we can use them to our advantage. Wait for the price to approach one of the boundaries to make a move. As we know that the price is not likely to cross the horizontal level at the boundary, we can enter a trade, expecting the trend to switch, and the price to go back away from the horizontal level.

If the price was approaching the upper boundary, expect the trend to be bearish and the price to go down and if the price was approaching the lower boundary expect a bullish trend and an up-going price change. Risk and reward levels are also very easy to choose in this kind of market. The risk level should be just above or below the boundary that you entered the trade from and the reward level should be at the opposite boundary of the range-bound market.

It is important to remember that these are only three Forex trading strategies which are based on technical analysis of the charts. There are dozens of unique strategies out there. Some are long term and some are short term. Some forex trading strategies involve great risk while others are almost risk-free. Some strategies are based on a deep understanding of current economic events while others are based on a technical analysis of the market and trends. The list is endless and diverse.