Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

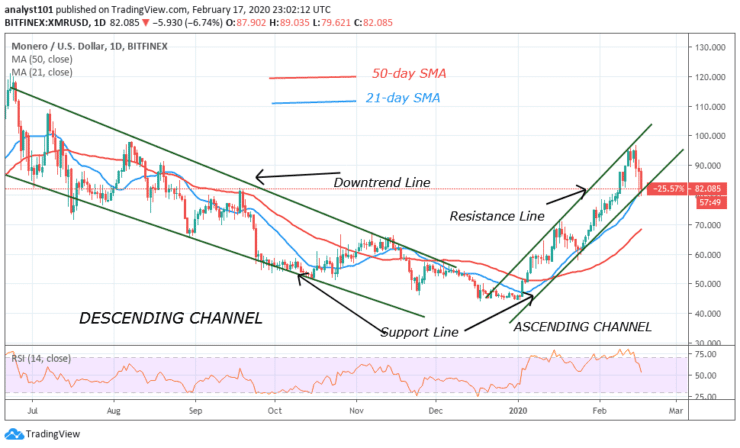

Key Support Zones: $40, $30, $20

XMR/USD Long-term Trend: Bullish

Monero reached its peak price of $96 after a rebound from the low of $60. The bulls could not sustain the upward move as the price was resisted and a downward move ensued. At the $96 price level, the bulls made two attempts at the resistance without breaking it. The bulls were resisted and the price fell to the low of $83. It appears current support is likely to hold.

Daily Chart Indicators Reading:

The price is on a downward move if it breaks the support line of the ascending channel Monero will drop to a low of $60. Meanwhile, the Relative Strength Index period 14 level 62 indicates that XMR is still in uptrend zone. The coin has the propensity to rise.

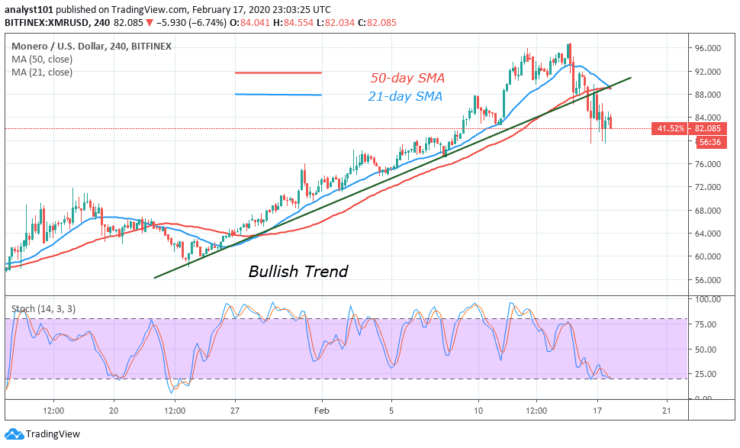

XMR/USD Medium-term bias: Bullish

On the 4-hour chart, the pair is in a smooth uptrend. The coin fell to a low of $80 and continued its consolidation. The price action formed a bearish double top before the downward move. As price breaks the trend line the upward move ought to be terminated.

4-hour Chart Indicators Reading

Monero is above 25% range of the daily stochastic. It means that the coin is in bullish momentum. The 21-day SMA and 50-day SMA are sloping upward indicating the uptrend.

General Outlook for Monero (XMR)

Monero is in a bullish trend. The downward move was a result of the overbought condition of the coin. The sellers were generated during the overbought period to push XMR downward. If the support holds the bulls will retest the overhead resistance.

XMR Trade Signal

Instrument: XMR/USD

Order: Buy

Entry price: $82

Stop: $80

Target: $110

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus