കോപ്പി ട്രേഡിങ്ങിനുള്ള സേവനം. ഞങ്ങളുടെ ആൽഗോ സ്വയമേവ ട്രേഡുകൾ തുറക്കുകയും അടയ്ക്കുകയും ചെയ്യുന്നു.

L2T ആൽഗോ കുറഞ്ഞ അപകടസാധ്യതയുള്ള ഉയർന്ന ലാഭകരമായ സിഗ്നലുകൾ നൽകുന്നു.

24/7 ക്രിപ്റ്റോകറൻസി ട്രേഡിംഗ്. നിങ്ങൾ ഉറങ്ങുമ്പോൾ, ഞങ്ങൾ കച്ചവടം ചെയ്യുന്നു.

ഗണ്യമായ ഗുണങ്ങളുള്ള 10 മിനിറ്റ് സജ്ജീകരണം. വാങ്ങലിനൊപ്പം മാനുവൽ നൽകിയിട്ടുണ്ട്.

79% വിജയശതമാനം. ഞങ്ങളുടെ ഫലങ്ങൾ നിങ്ങളെ ഉത്തേജിപ്പിക്കും.

പ്രതിമാസം 70 ട്രേഡുകൾ വരെ. 5 ലധികം ജോഡികൾ ലഭ്യമാണ്.

പ്രതിമാസ സബ്സ്ക്രിപ്ഷനുകൾ £58 മുതൽ ആരംഭിക്കുന്നു.

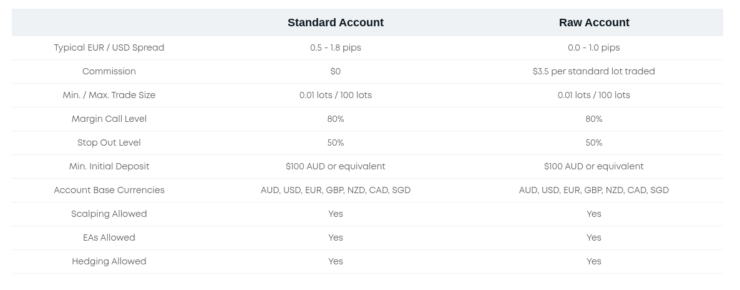

There are many account types to choose from when trading online. At the forefront of this is a choice between a Standard Account and a Raw Spread Account.

Crucially, while the former typically allows you to trade without paying a commission, you might find the spreads slightly higher. The latter will often come with zero spreads, but a fixed commission will be applicable.

എന്നതിനുള്ള മികച്ച ഓപ്ഷൻ നിങ്ങളെ will ultimately depend on your personal trading profile – which we cover in much more detail in this Standard Account vs Raw Spread Guide.

ഉള്ളടക്ക പട്ടിക

എട്ട് ക്യാപ് - ഇറുകിയ സ്പ്രെഡുകളുള്ള നിയന്ത്രിത പ്ലാറ്റ്ഫോം

- എല്ലാ വിഐപി ചാനലുകളിലേക്കും ആജീവനാന്ത ആക്സസ് ലഭിക്കുന്നതിന് ഏറ്റവും കുറഞ്ഞ നിക്ഷേപം വെറും 250 USD

- ഞങ്ങളുടെ സുരക്ഷിതവും എൻക്രിപ്റ്റ് ചെയ്തതുമായ ഇൻഫ്രാസ്ട്രക്ചർ ഉപയോഗിക്കുക

- അസംസ്കൃത അക്കൗണ്ടുകളിൽ 0.0 പിപ്പുകളിൽ നിന്ന് വ്യാപിക്കുന്നു

- അവാർഡ് നേടിയ MT4, MT5 പ്ലാറ്റ്ഫോമുകളിലെ വ്യാപാരം

- മൾട്ടി-ജൂറിസ്ഡിക്ഷണൽ റെഗുലേഷൻ

- സ്റ്റാൻഡേർഡ് അക്കൗണ്ടുകളിൽ കമ്മീഷൻ ട്രേഡിങ്ങ് ഇല്ല

Standard Account vs Raw Spread

When you go through the process of joining an online trading platform – you will usually be offered a selection of accounts to choose from. In many cases, this will be a choice between a Standard Account and a Raw Spread Account.

It is important that you select the right account type for you and your trading needs – as this will dictate what fees you pay and how they are charged.

What is a Standard Account?

In a nutshell, a Standard Account is an option taken by most online traders – especially those that are trading in a relatively casual manner. In the vast majority of cases, Standard Accounts at online trading platforms will see the broker add a mark-up on the asset you wish to trade.

On the flip side, the best brokers offering Standard Accounts will allow you to trade commission-free. This includes the likes of eToro and Capital.com.

ഉദാഹരണത്തിന്:

- Let’s suppose that you are trading GBP/USD at a commission-free broker

- As per real-time wholesale rates – we’ll say that GBP/USD is currently priced at 1.4207

- On a Standard Account, you might see a price of 1.4210 on GBP/USD

- This means that the broker has added a mark-up of 3 pips on this market

As per the above, you were able to trade GBP/USD without paying the broker any trading commissions. You did, however, have to pay a mark-up on the trade – which in this case, was 3 pips. This mark-up is otherwise referred to as the ‘spread’.

As such, Standard Accounts will typically build all trading costs into the spread – which can be fixed or variable. More on this later.

To ensure you understand how Standard Accounts work, let’s look at another example:

- Let’s suppose that you are trading Gold at a commission-free broker

- As per real-time wholesale rates – we’ll say that Gold is currently priced at $1,850 per ounce

- On a Standard Account, you might see a price of $1,859 on your Gold

- This means that the broker has added a mark-up of $9 – or 0.5% on this market

Once again, this means that you are paying $9 above the actual rate that the broker is able to get on the asset – in this case, gold. This means that in order to get to the break-even point – you would need to make gains in excess of 0.5%. Similarly, you didn’t pay a commission on this trade.

What is a Raw Spread Account?

So now that we have covered the basics of a Standard Account, let’s explore the nuts and bolts of a Raw Spread Account. Otherwise referred to as an ECN Account, the broker in question will not make a mark-up on the wholesale prices that they receive.

On the contrary, you will have direct access to the asset in question on a peer-to-peer basis. In other words, when you look to buy an asset, you will be matched with the seller. In taking this route, Raw Spread Accounts give you access to the most competitive spreads in the market.

The commission that you pay will almost always be fixed on a Raw Spread Account. This might come per-slide – meaning you pay it when you open the position and again when you close it.

ഉദാഹരണത്തിന്:

- Let’s say that you open a Raw Spread Account to trade EUR/USD

- The spread on this pair is 0 pips

- Your chosen broker charges a flat commission of $5 per standard lot

- A standard lot on EUR/USD is 100,00 euros

- The value of your position is 50,000 euros (with leverage)

- As such, your trading commission to enter this trade is $2.50 – as you are trading 50% of one standard lot

- When you close the position – it is worth the equivalent of 60,000 euros. This means your exit commission is $3 (60% of one lot)

As you can see from the above, you paid a total commission of $5.50 by trading 50,000 euros worth of EUR/USD. You benefited from a spread of 0 pips, so this is the യഥാർഥ total fee that you paid on this trade.

Should I Open a Standard Account or Raw Spread Account?

So that begs the question – are you better off opening a Standard Account or a Raw Spread Account when trading online? Well, in most cases, the answer to this question will depend on the type of trader you are.

Let us explain this sentiment with some real-world examples:

Professional Trader

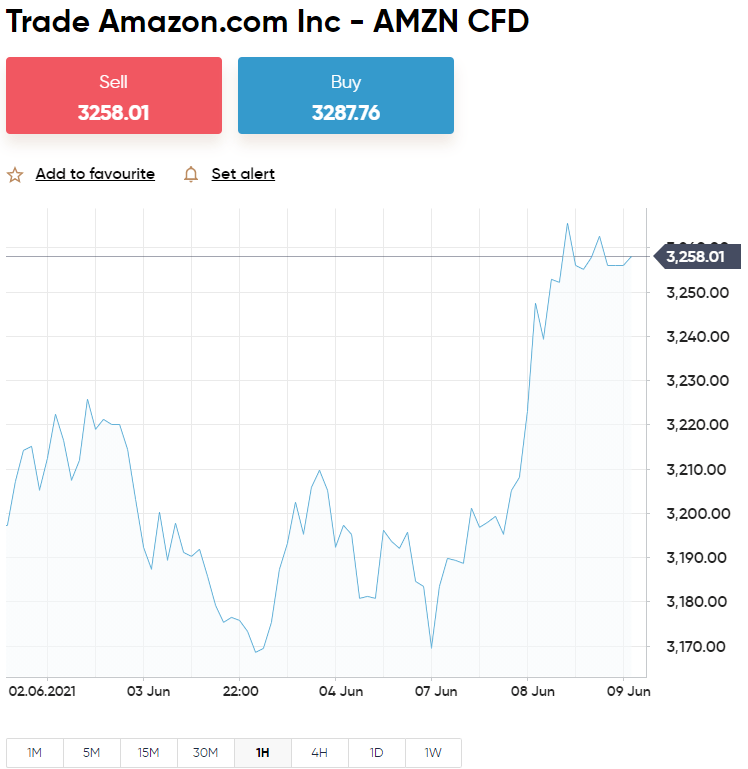

In this example, we will take the role of a professional trader looking to place a trade on Bitcoin.

For the first scenario, we’ll see what the costs are when using a commission-free സ്റ്റാൻഡേർഡ് അക്കൌണ്ട്:

- Your broker allows you to trade Bitcoin commission-free via a Standard Account

- The current spot rate on BTC/USD is $55,000

- Your broker is quoting you a buy price of $55,412.50

- In percentage terms, this means that you are paying a spread of 0.75%

- You decide to stake $10,000 on this trade, with leverage of 10x

- This means that your total trade size is $100,000

As per the above, you didn’t pay any commission on this BTC/USD trade when using a Standard Account. But, you paid a spread of 0.75%. This means that on a leveraged stake of $100,000 – you indirectly paid $750.

After all, this mark-up means that you are starting the trade 0.75% in the red, so you need to make gains of at least $750 to break-even. Anything after this is pure profit.

Now let’s look at the same trade, but this time, on a റോ സ്പ്രെഡ് അക്കൗണ്ട്.

- Your broker charges you a fee of $5 per slide on BTC/USD

- The current spot rate on BTC/USD is $55,000

- Your broker is also quoting you a buy price of $55,000

- As such, you are trading at a spread of 0 pips

- You again decide to stake $10,000 on this trade, with leverage of 10x – so your total trade size is $100,000

- You pay a commission of $5 to enter the position and another $5 to close it.

As per the above, you paid a commission of $10 on this BTC/USD trade. However, you were able to get a spread of 0 pips on this position, which is great. As such, your all-in cost on the Raw Spread Account was just $10.

If you had repeated the same trade on a Standard Account (as per our previous example), this trade would have cost you $750 via the spread! Therefore, we can safely say that if you’re a professional trader placing large volume trades – then a Raw Spread Account is going to be the best option to take.

Casual Retail Trader

So now that we have established that a Raw Spread Account is best-suited for professional traders, in the examples below we are going to show an example of why Standard Accounts are best for retail clients.

To keep things consistent, we’ll use the same metrics as on BTC/USD and we’ll start with a commission-free Standard Account:

- Your commission-free broker is charging a spread of 0.75% on BTC/USD

- This time, you are only staking $200 on the trade

- Although you are not paying any commission, you are paying a spread of 0.75% – so that’s an indirect fee of $1.50

The above trade cost just $1.50 when using a Standard Account.

Now let’s see what the outcome would be when placing the same trade on a റോ സ്പ്രെഡ് അക്കൗണ്ട്.

- Your broker is charging a spread of 0 pips on BTC/USD

- On your Raw Spread Account, you pay a commission of $5 per slide

- Once again, you are only staking $200 on the trade

- Although you are not paying any spreads, you are paying a commission of $5 to enter the trade and another $5 to close it.

As per the above, you paid a total commission of $10 on this trade via a Raw Spread Account. Based on the previous example, the same BTC/USD on a Standard Account would have cost just $1.50. As such, this confirms that a Standard Account is much more conducive for trading smaller amounts!

Standard Account – What to Consider

If you are looking to open a Standard Account with your chosen broker, it is important to remember that you won’t always be guaranteed a commission-free experience. Sure, this is something offered by plenty of providers in this space – but some Standard Accounts come with a small variable commission that needs to be paid per slide.

In addition to this, you also need to check whether you are paying a variable spread or a fixed spread.

വ്യക്തമാക്കാൻ:

- A variable spread will change throughout the day – based on market conditions. For example, you might get a spread of 1 pip on EUR/USD during busy hours, and then 3 pips when the markets are closed.

- A fixed spread, however, will remain constant 24/7. For example, you might always pay a spread of 2 pips on EUR/USD. Naturally, fixed spreads are usually less competitive, but you always know exactly what you are paying.

Ultimately, you need to do plenty of research on the specifics surrounding a Standard Account before taking the plunge.

Raw Spread Account – What to Consider

There is no doubt that Raw Spread Accounts are designed for professional clients that are trading larger volumes. However, there are often a few requirements that you need to consider before opening a Raw Spread Account.

Largely, this is based on a minimum deposit requirement. In many cases, you might need to meet an account minimum of at least $20,000 to get Raw Spreads – sometimes more.

In addition to this, we should make it clear that Raw Spread Accounts won’t always guarantee you 0 pips. On the contrary, you might need to pay a very small spread – based on market conditions. This is especially the case when accessing less liquid assets or trading outside of standard market hours.

Best Standard Account Broker

If you have made the decision that a Standard Account is best for your trading needs – you’ve got hundreds of potential brokers to choose from. In order to find the right one, you need to look at everything from spreads and commissions, tradable markets, regulation, supported platforms, customer support, and more.

To help point you in the right direction, below we discuss the best Standard Account broker in the market right now – eToro.

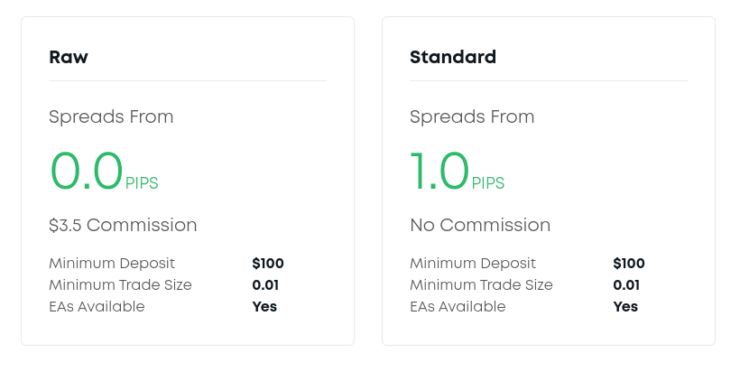

EightCap – Best Raw Spread Account 2023

If you're in the hunt for the best Raw Spread Account in the market right now - we found that EightCap ticks all of the right boxes. By opening a Raw Account with this broker, you will benefit from spreads of 0 pips on most major markets. In other words, any price that EightCap is able to source will be the same price that you get - meaning no mark-ups.

In return for this, EightCap will charge you a commission of just $3.50 per slide - which - is one of the most competitive pricing structures we have come across in the online trading scene.Crucially, it doesn't matter if you are trading $1,000 or $100,000 - you will still pay just $3.50 to enter the market and $3.50 to close the position. What we also like about the Raw Spread Account at EightCap is that the minimum deposit is just $100.

Sure, you'll likely be trading much more than this anyway. But, some Raw Spread brokers require a minimum account balance that runs into 5-figures. In terms of the trading platform itself - EightCap offers support for both MT4 and MT5. This means that you will have instant access to a plethora of trading tools, technical indicators, and the ability to install forex EAs. Plus, you can access EightCap via MT4 and MT5 via the respective mobile app.

In terms of tradable markets, EightCap supports a great selection of forex pairs, commodities, indices, and shares. The main drawback here is that there is no support for cryptocurrencies like Bitcoin and Ripple. Nevertheless, EightCap allows you to deposit funds with several payment methods - including Visa and MasterCard, Neteller, Skrill, wire transfer, and more. Most importantly, EightCap is authorized and regulated by ASIC.

- ASIC നിയന്ത്രിത ബ്രോക്കർ

- 200+ അസറ്റുകൾ കമ്മീഷൻ രഹിതമായി ട്രേഡ് ചെയ്യുക

- Compatible with MT4 and MT5

- ക്രിപ്റ്റോ കറൻസി ട്രേഡിംഗ് ഇല്ല

Standard Account vs Raw Spread: The Verdict?

In summary, whether or not you choose a Standard Account or a Raw Spread Account, will ultimately depend on the type of trading volume that you get through.

As we have noted throughout this guide, if you are a seasoned pro that trades large amounts, then the Raw Spread Account is going to be a lot more sufficient. This is because you will pay a very small commission, but, in return, often have access to 0 spread prices.

On the other hand, Standard Accounts are ideal if you are a casual investor that likes to trade with a small amount of money. In most cases, you will benefit from a 0% commission rate, so it’s only the spread that you need to factor into your trading costs.

എട്ട് ക്യാപ് - ഇറുകിയ സ്പ്രെഡുകളുള്ള നിയന്ത്രിത പ്ലാറ്റ്ഫോം

- എല്ലാ വിഐപി ചാനലുകളിലേക്കും ആജീവനാന്ത ആക്സസ് ലഭിക്കുന്നതിന് ഏറ്റവും കുറഞ്ഞ നിക്ഷേപം വെറും 250 USD

- ഞങ്ങളുടെ സുരക്ഷിതവും എൻക്രിപ്റ്റ് ചെയ്തതുമായ ഇൻഫ്രാസ്ട്രക്ചർ ഉപയോഗിക്കുക

- അസംസ്കൃത അക്കൗണ്ടുകളിൽ 0.0 പിപ്പുകളിൽ നിന്ന് വ്യാപിക്കുന്നു

- അവാർഡ് നേടിയ MT4, MT5 പ്ലാറ്റ്ഫോമുകളിലെ വ്യാപാരം

- മൾട്ടി-ജൂറിസ്ഡിക്ഷണൽ റെഗുലേഷൻ

- സ്റ്റാൻഡേർഡ് അക്കൗണ്ടുകളിൽ കമ്മീഷൻ ട്രേഡിങ്ങ് ഇല്ല

പതിവ്

What is a standard trading account?

When you open a Standard Account with an online broker, you are normally doing so as a retail client. In turn, this will often lead to 0% commissions on all markets. But, in order for the broker to make money - it will add a mark-up on the price you pay to enter and exit your trade. This is know as the spread.

What is a Raw Spread account?

Otherwise referred to as an ECN Account, Raw Spread Accounts are aimed at professional traders that stake large amounts. This is because in most cases, Raw Spread Accounts allow you to trade at zero spreads. In order for the broker to make money, you will normally pay a fixed commission.

What is the best Standard Account broker for forex?

We found that the best Standard Account broker in the online forex space is eToro. You can trade more than 55 forex pairs without paying any commission and spreads are typically very competitive.!

What is the best Raw Spread broker?

If you're looking for the best Raw Spread broker of 2021 - we would argue that EightCap is well worth considering. Its Raw Account comes with zero spreads on many markets, and you'll pay a small commission of just $3.50 per slide.

How do Raw Spread Account brokers make money?

As Raw Spread Account brokers don't make any mark-up from the bid and ask price, they instead charge a commission. This is usually charged at both ends of the trade..