ການບໍລິການສໍາລັບການຊື້ຂາຍສໍາເນົາ. Algo ຂອງພວກເຮົາຈະເປີດ ແລະປິດການຄ້າໂດຍອັດຕະໂນມັດ.

L2T Algo ໃຫ້ສັນຍານທີ່ມີກໍາໄລສູງທີ່ມີຄວາມສ່ຽງຫນ້ອຍ.

ການຊື້ຂາຍ cryptocurrency ຕະຫຼອດ 24 ຊົ່ວໂມງ. ໃນຂະນະທີ່ເຈົ້ານອນ, ພວກເຮົາຊື້ຂາຍ.

ການຕິດຕັ້ງ 10 ນາທີມີຂໍ້ໄດ້ປຽບຢ່າງຫຼວງຫຼາຍ. ຄູ່ມືແມ່ນສະຫນອງໃຫ້ກັບການຊື້.

79% ອັດຕາຜົນສໍາເລັດ. ຜົນໄດ້ຮັບຂອງພວກເຮົາຈະເຮັດໃຫ້ເຈົ້າຕື່ນເຕັ້ນ.

ເຖິງ 70 ການຄ້າຕໍ່ເດືອນ. ມີຫຼາຍກວ່າ 5 ຄູ່.

ການສະໝັກໃຊ້ລາຍເດືອນເລີ່ມຕົ້ນທີ່ £58.

The cryptocurrency market took a beating in 2022 and early 2023 as rising interest rates sent investors fleeing from speculative assets. However, the tide has turned this year, with Bitcoin’s price surging nearly 60% at the time of writing and Ethereum up over 53%. This recovery has reignited investor interest in crypto stocks that could flourish as the “crypto winter” fades.

Three companies stand out as potential leaders in the space through the end of the decade: Coinbase Global (COIN), Marathon Digital (MARA), and MicroStrategy (MSTR).

Let’s dive into what makes each of these crypto stocks so compelling.

Top 3 Crypto Stocks to Watch Out for this Decade

Here are the top 3 crypto stocks, and some honorable mentions, to keep on your radar this year and in the next decade:

1. Coinbase: The Premier Crypto Exchange

Coinbase is the largest cryptocurrency exchange in the United States and one of the biggest globally.

In 2023, a full 34% of its trading volume came from Bitcoin, with Ethereum at 20% and stablecoin Tether at 11%, according to The Motley Fool. This diversification across major crypto assets positions Coinbase to profit from the overall market’s expansion long-term.

The company did see a major slowdown during the crypto winter of the past two years. But with Bitcoin and Ethereum prices rebounding sharply, analysts expect a resurgence in retail investment through Coinbase’s user-friendly platform.

The Motley Fool projects Coinbase’s revenue and adjusted EBITDA will grow at a 9% compound annual rate through 2026. At just 26 times the projected 2023 adjusted EBITDA, the stock looks reasonably valued ($239 at the time of writing).

However, that outlook may be too conservative if crypto prices continue skyrocketing to new highs. In that scenario, Coinbase’s results could blow past expectations, driving the stock to strong outperformance through 2030.

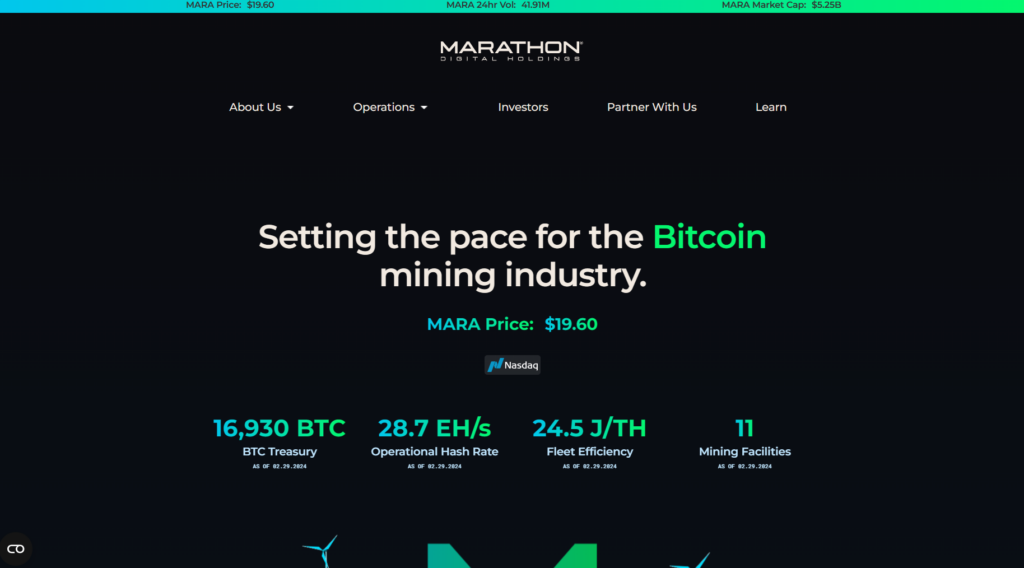

2. Marathon: Scaling Up Bitcoin Mining

Marathon Digital is the world’s largest public pure-play Bitcoin mining company. In 2023, it minted a record 12,852 bitcoins, more than triple its 2022 output as its hash rate (total mining power) surged 253%.

The company strategically sells some mined bitcoin to raise cash while accumulating a stockpile now worth nearly $1 billion.

Marathon is aggressively expanding through new facilities, joint ventures, and potential acquisitions of rivals like Riot Platforms. Achieving massive scale will be key to offsetting the declining economics of bitcoin mining after each “halving” event every four years reduces mining rewards.

The Motley Fool forecasts Marathon’s revenue will grow at a blistering 48% compound annual rate through 2025. But that may be just the beginning if Bitcoin prices skyrocket further and Marathon continues consolidating the mining industry to reap compounding scale advantages.

3. MicroStrategy: Software Firm Turned Bitcoin Vault

Most investors know MicroStrategy today as a company going all-in on Bitcoin accumulation, not for its enterprise analytics software origins.

As of the time of writing, MicroStrategy holds a staggering 193,000 bitcoins worth over $13 billion using the current exchange rate— almost two-thirds of its total enterprise value of $18.5 billion. And the company has made clear it plans to keep buying bitcoin indefinitely.

MicroStrategy ໄດ້ມາເພີ່ມເຕີມ 3,000 BTC ສໍາລັບ ~ $ 155 ລ້ານໃນລາຄາສະເລ່ຍຂອງ $ 51,813 ຕໍ່. #bitcoinມາຮອດວັນທີ 2/25/24, @MicroStrategy ຕອນນີ້ 193,000 ບາດ $ BTC ໄດ້ມາສໍາລັບ ~ $ 6.09 ຕື້ໃນລາຄາສະເລ່ຍຂອງ $ 31,544 ຕໍ່ bitcoin. $ MSTR https://t.co/micudbYf3P

- Michael Saylor⚡ (@saylor) ກຸມພາ 26, 2024

While MicroStrategy’s software business is posting declining revenues, the bulls believe subscription analytics services can stabilize that side over time.

Meanwhile, the firm is effectively transforming into a pioneering way for investors to get exposure to Bitcoin’s price movement without directly holding the cryptocurrency themselves.

As MicroStrategy’s bitcoin treasury keeps growing, it could eventually monetize some holdings to pay down debt and invest more in its software operations through acquisitions and expansion. Playing its cards right on both fronts could allow this unique company to massively outperform by 2030.

Top Crypto Stocks for the Decade: Honorable Mentions

While Coinbase, Marathon Digital, and MicroStrategy may lead the charge, several other companies are also worth keeping an eye on in the crypto stock space through 2030:

- PayPal (PYPL)

The digital payments giant was an early mover in enabling crypto trading on its platform. PayPal is making a broader push into blockchain and digital assets that could pay off massively if adoption keeps rising.

- ບລັອກ (SQ)

Jack Dorsey’s company, formerly known as Square, has made crypto a key focus through its Cash App, Bitcoin trading services, and initiatives like the Spiral cryptocurrency project. Block is deeply entrenched in the crypto economy.

- ເວທີການຈະລາຈົນ (RIOT)

As mentioned earlier, Riot is one of Marathon Digital’s top competitors in the bitcoin mining industry. While smaller, Riot could still thrive through mining revenue and potential consolidation plays.

- Robinhood (HOOD)

The popular trading app has leaned heavily into giving its users exposure to cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. A resurgence in crypto investing would be a boon for Robinhood.

Are Crypto Stocks the Path to Crypto Riches?

After weathering a brutal crypto winter, Coinbase, Marathon, and MicroStrategy look poised to potentially lead the way as rising prices revive investor interest in digital assets. All three crypto stocks provide differentiated ways to capitalize on the cryptocurrency market’s future growth and maturation.

Of course, nothing is guaranteed when it comes to the highly volatile crypto space. But for risk-tolerant investors willing to buy and hold for the long haul, the companies mentioned here could represent a path to crypto riches over the remainder of this decade.

ຕ້ອງການທີ່ເຊື່ອຖືໄດ້ ສັນຍານ crypto ລົງທຶນໃນຕະຫຼາດ swings? ເຂົ້າຮ່ວມກັບພວກເຮົາໃນ Telegram.

ມີຄວາມສົນໃຈໃນການໄດ້ຮັບ "Learn2Trade Experience?"ເຂົ້າຮ່ວມກັບພວກເຮົາທີ່ນີ້

- ນາຍຫນ້າ

- ເງິນຝາກ Min

- ຜະລິດແນນ

- ຢ້ຽມຢາມນາຍຫນ້າ

- ແພລະຕະຟອມການຄ້າ Cryptocurrency ທີ່ໄດ້ຮັບລາງວັນ

- ເງິນຝາກຂັ້ນຕ່ ຳ $ 100,

- FCA & Cysec ເປັນລະບຽບ

- ເງິນ 20% ຍິນດີຕ້ອນຮັບເຖິງ 10,000 ໂດລາ

- ເງິນຝາກຂັ້ນຕ່ ຳ $ 100

- ຢືນຢັນບັນຊີຂອງທ່ານກ່ອນທີ່ເງິນຈະຖືກໂອນເຂົ້າ

- ຫລາຍກວ່າ 100 ຜະລິດຕະພັນການເງິນທີ່ແຕກຕ່າງກັນ

- ລົງທືນຈາກນ້ອຍເປັນ 10 ໂດລາ

- ການຖອນມື້ດຽວກັນແມ່ນເປັນໄປໄດ້

- ຕົ້ນທຶນການຄ້າຕໍ່າທີ່ສຸດ

- ລາງວັນຍິນດີຕ້ອນຮັບ 50%

- ການສະ ໜັບ ສະ ໜູນ 24 ຊົ່ວໂມງທີ່ໄດ້ຮັບລາງວັນ

- ກອງທຶນບັນຊີຕະຫຼາດ Moneta ມີຕໍາ່ສຸດທີ່ຂອງ $ 250

- ເລືອກໃຊ້ແບບຟອມເພື່ອຂໍເອົາເງິນໂບນັດ 50% ຂອງທ່ານ