Service fir Kopiehandel. Eis Algo mécht automatesch Handelen op a mécht zou.

De L2T Algo bitt héich rentabel Signaler mat minimale Risiko.

24/7 cryptocurrency Handel. Iwwerdeems Dir schléift, mir Handel.

10 Minutte Setup mat wesentleche Virdeeler. D'Handbuch gëtt mam Kaf geliwwert.

79% Succès Taux. Eis Resultater wäerten Iech begeeschteren.

Bis zu 70 Handel pro Mount. Et gi méi wéi 5 Pairen verfügbar.

Monatlecht Abonnementer fänken u bei £ 58 un.

Bulls may dominate USDCHF market

USDCHF Präis Analyse -09 Dezember

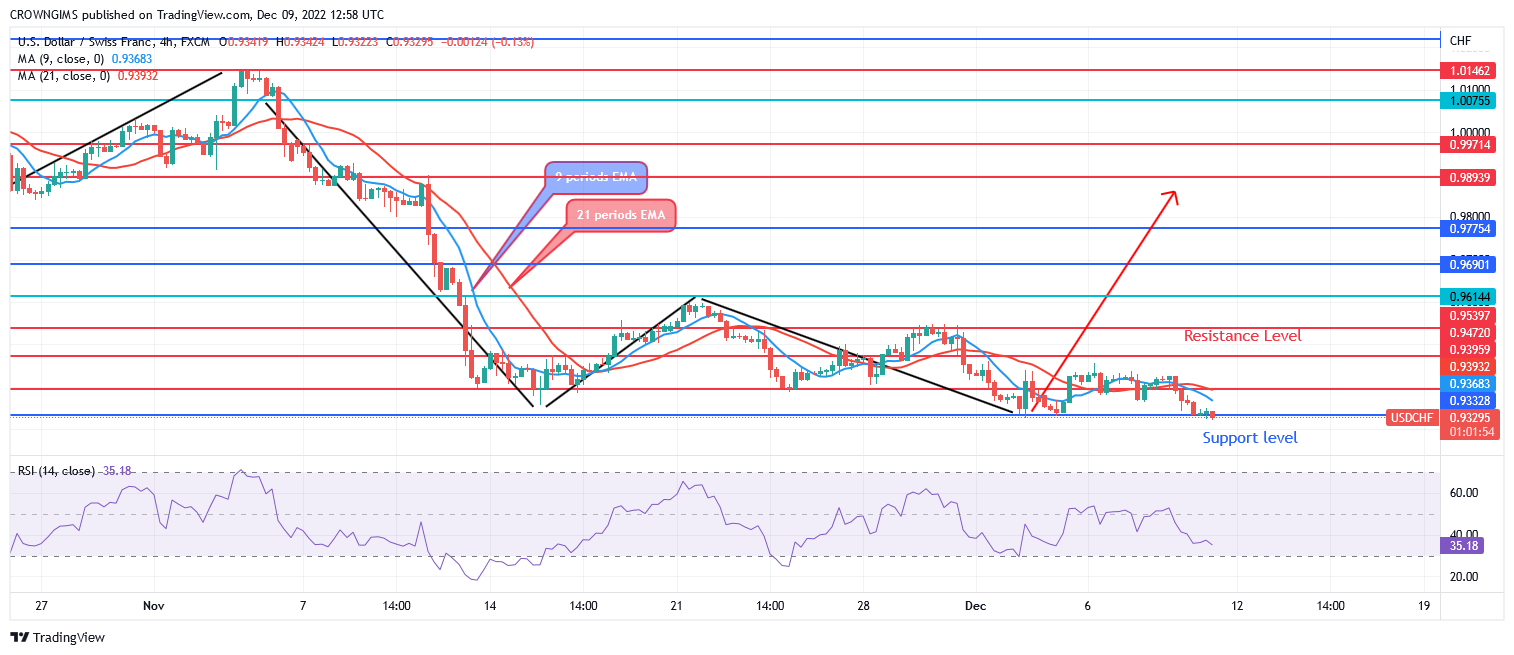

In case the buyers defend the support level of $0.93 and exert more pressure in the USDCHF market, the Price will increase toward the resistance levels of $0.94, $0.95, and $0.96. When the support level of $0.93 is penetrated downside, bearish momentum may increase, USDCHF price may sink to $0.92, and $0.91 support levels.

USDCHF Maart

Schlëssel Niveauen:

Resistenzniveauen: $ 0.94, $ 0.95, $ 0.96

Ënnerstëtzungsniveauen: $ 0.93, $ 0.92, $ 0.91

USDCHF Laangfristeg Trend: Bearish

USDCHF is bearish on the long-term outlook. There was no significant movement in the U.S. Dollar/Swiss France market last week. On December 05, the price pulled back to retest the resistance level of $0.94. Today, sellers dominate the market and the price is trying to break down the support level of $0.93. Further price reduction is envisaged in case of sellers exert more pressure.

USDCHF is trading below the two EMAs and the 9-periods EMA is below the 21-period EMA. The Relative Strength Index period 14 is at 34 levels bending down to indicate a bearish market direction. In case the buyers defend the support level of $0.93 and exert more pressure in the USDCHF market, the Price will increase toward the resistance levels of $0.94, $0.95, and $0.96. When the support level of $0.93 is penetrated downside, bearish momentum may increase, USDCHF price may sink to $0.92, and $0.91 support levels.

USDCHF Mëttelfristeg Trend: Bearish

USDCHF is bearish in the medium-term outlook. The price has been trading within the $0.94 and $0.93 levels for more than three weeks. Last week, the price was dangling within the just mentioned levels. Today, sellers are trying to exert more pressure to break down the support level of $0.93.

Den 9-Period EMA ass schonn ënner der 21-Period EMA. USDCHF handelt ënner den zwee EMAs als bearish Bewegungssignal. De Relative Strength Index Period 14 ass op 36 Niveauen mat enger Signallinn déi eng bearish Richtung weist.

Dir kënnt Krypto Mënzen hei kafen: Kafen LBLOCK

- broker

- Min Depot

- Score

- Besicht de Broker

- Award-Zouschlag Cryptocurrency Handelsplattform

- $ 100 Minimum Depot,

- FCA & Cysec geregelt

- 20% wëllkomm Bonus vu bis zu $ 10,000

- Minimum Depot $ 100

- Verifizéiert Äre Kont ier de Bonus geschriwwe gëtt

- Iwwer 100 verschidde Finanzprodukter

- Investéiert vu sou kleng wéi $ 10

- Deeselwechten Dag Austrëtt ass méiglech

- Fund Moneta Markets Kont mat engem Minimum vun $ 250

- Entscheet Iech mat der Form fir Ären 50% Depot Bonus ze kréien