Operae ad exemplum mercaturae. Noster Algo sponte aperit et claudit artium.

L2T Algo signa perutilia praebet cum periculo minimo.

24/7 cryptocurrency mercaturae. dum dormimus, negotiamur.

X minute setup cum substantial commoda. Manuale emptionis praeditum.

LXXIX% Success rate. Eventus nostri te excitabunt.

Usque ad 70 artium per mensem. Plus quam 5 paria praesto sunt.

Subscriptiones menstruae ab £58 incipiunt.

S & P D Price Analysis - March III

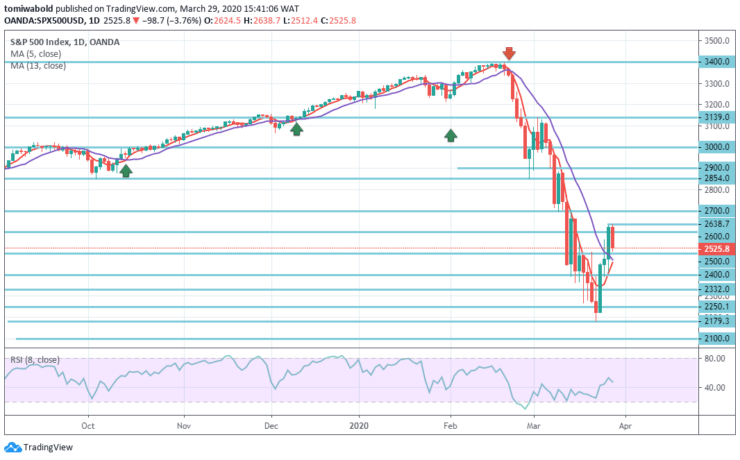

The US benchmark S&P 500 index is down to 2525 level as investors start to factor in the impact of the $2.2 trillion stimulus package for the stabilization of the economy, making it the largest tax reform package ever accepted by the US. Congress.

Key campester

Resistentia gradus, 3139.0, MMCM, MMDCC

Support gradus 2500, 2400, 2179.3

Fossa terminum D Long S & P: INDOCTUS

The S&P 500 consolidates the progress made over the last four days beneath resistance levels of 2600/2700. In the near term, the correction can be shifted back to the 2500 and 2400 levels. Initial resistance is shown in the price levels of 2600/2700.

Sustained break of Moving average 5 and 13 below (now at 2496.77 level) may suggest progress of recovery and may lead in a retest of 2179.3 lower level.

S & P terminum D Short Trend: INDOCTUS

The S&P 500 4-hour time frame scenario is close to that of the daily one, as the rebound from 2179.3 level has lost traction only before the 38.2 percent pullback from 3139.0 to 2179.3 at 2638.7 levels.

As a result, in the short term, the S&P 500 index may establish a new restricted bearish trend, that may offer the potential for new consolidations on the long side, a firm break of 2638.7 horizontal near-term resistance level may now lead to a stronger upside rebound at 2900 level.

Nota: Learn2Trade.com non Consiliario pecuniaria. Vestram facere Duis dignissim investigationis priusquam circumvallaret pecunia tua in aliqua financial uber vel res vel praesentatus. Nos es non responsible pro circumsedere results

- COCIO

- min Depositum

- Score

- visit COCIO

- Bonus de $ 20, usque ad XX% gratissimum

- Minimum depositum $ 100

- Quin prius in punctis salutis rationem putatur,

- Per C diversis financial products

- Obsido minus quam $ X ad a

- Recessum ab eodem die fieri potest,

- Fund Monetae mercatis ideo cum minimum $ 250

- L% tui dici uti ut opt forma deposit bonus