Operae ad exemplum mercaturae. Noster Algo sponte aperit et claudit artium.

L2T Algo signa perutilia praebet cum periculo minimo.

24/7 cryptocurrency mercaturae. dum dormimus, negotiamur.

X minute setup cum substantial commoda. Manuale emptionis praeditum.

LXXIX% Success rate. Eventus nostri te excitabunt.

Usque ad 70 artium per mensem. Plus quam 5 paria praesto sunt.

Subscriptiones menstruae ab £58 incipiunt.

Resistentia Key LevelS: (VI)C, (VI), (V)CM

Key gradus Support: 0.6200, 0.6000, 0.5800

NZD / USD Long-term Fossa Price: Bullish

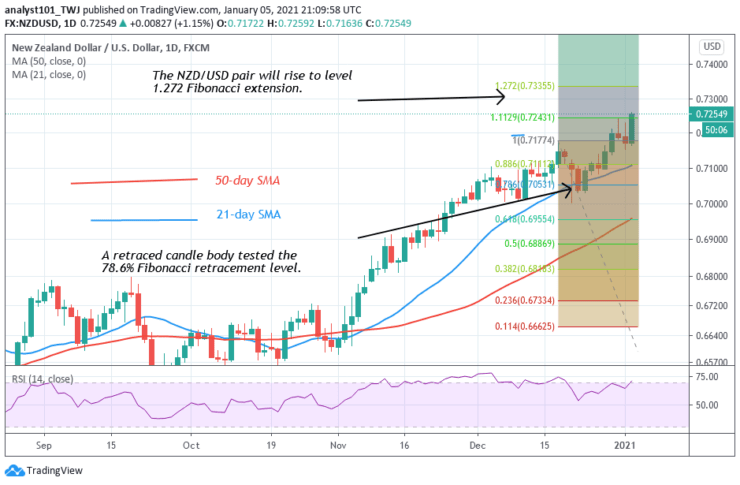

The Kiwi has resumed an upward move. On December 17 uptrend; a retraced candle body tested the 78.6% Fibonacci retracement level. The NZD/USD pair will rise to level 1.272 Fibonacci extension and reverse. That is reversal will be at level 0.7335.

Charta cotidiana lectio Indicatores,

The Kiwi has risen to level 70 of the Relative Strength Index period 14. It indicates that the pair is in the overbought region. The 50-day SMA and 21-day SMA are sloping upwardly indicating the uptrend.

NZD / USD Medium-terminus Trend: Bullish

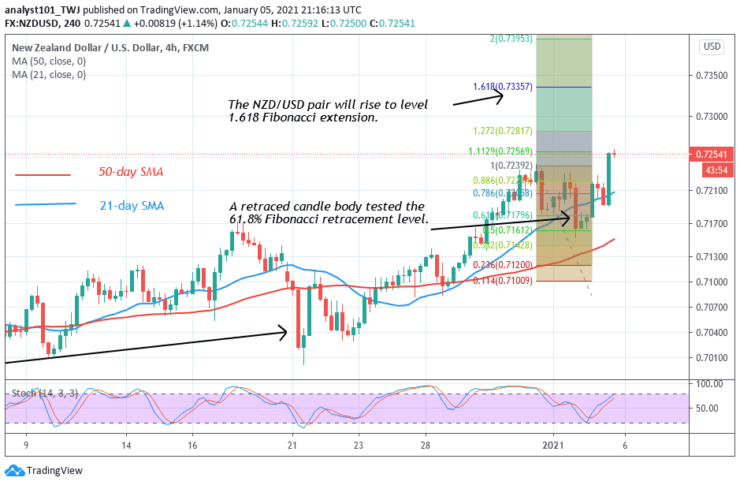

On the 4-hour chart, the NZD/USD pair is retracing and in a downward move. On December 27 uptrend; a retraced candle body tested 61.8% Fibonacci retracement level. The retracement indicates that the pair will rise to level 1.618 Fibonacci extension and reverse. That is a high of level 0.7335.

Top IV-hora lectio Indicatores

The 50-day and 21-day SMAs are sloping upward. It indicates the previous uptrend. The Kiwi is above the 60% range of the daily stochastic. It indicates that the market is in a bullish momentum.

General Outlook for NZD/USD

The NZD/USD pair is in an upward move. The pair is trading above level 0.7200 at the writing. According to Fibonacci tool analysis, the pair will rise to level 0.7335.

Nota: Learn2.Trade non Consiliario pecuniaria. Vestram facere Duis dignissim investigationis priusquam circumvallaret pecunia tua in aliqua financial uber vel res vel praesentatus. Nos es non responsible pro circumsedere results

- COCIO

- min Depositum

- Score

- visit COCIO

- Bonus de $ 20, usque ad XX% gratissimum

- Minimum depositum $ 100

- Quin prius in punctis salutis rationem putatur,

- Per C diversis financial products

- Obsido minus quam $ X ad a

- Recessum ab eodem die fieri potest,

- Fund Monetae mercatis ideo cum minimum $ 250

- L% tui dici uti ut opt forma deposit bonus