Operae ad exemplum mercaturae. Noster Algo sponte aperit et claudit artium.

L2T Algo signa perutilia praebet cum periculo minimo.

24/7 cryptocurrency mercaturae. dum dormimus, negotiamur.

X minute setup cum substantial commoda. Manuale emptionis praeditum.

LXXIX% Success rate. Eventus nostri te excitabunt.

Usque ad 70 artium per mensem. Plus quam 5 paria praesto sunt.

Subscriptiones menstruae ab £58 incipiunt.

Resistentia key gradus: 0.6600, 0.6800, 0.7000

Key gradus Support: 0.6200, 0.6000, 0.5800

NZD / USD Long-term Fossa Price: INDOCTUS

NZD/USD resumes upward move but faces resistance at level 0.6800. Buyers are resuming a fresh uptrend at the 0.6545 support level. The pair will move up to retest the 0.67000 price level.

Charta cotidiana lectio Indicatores,

The Kiwi has risen to level 46 of the Relative Strength Index period 14. It indicates that the pair is now in the downtrend zone. The 50-day SMA and 21-day SMA are sloping upward indicating the uptrend.

NZD / USD Medium-terminus Trend: INDOCTUS

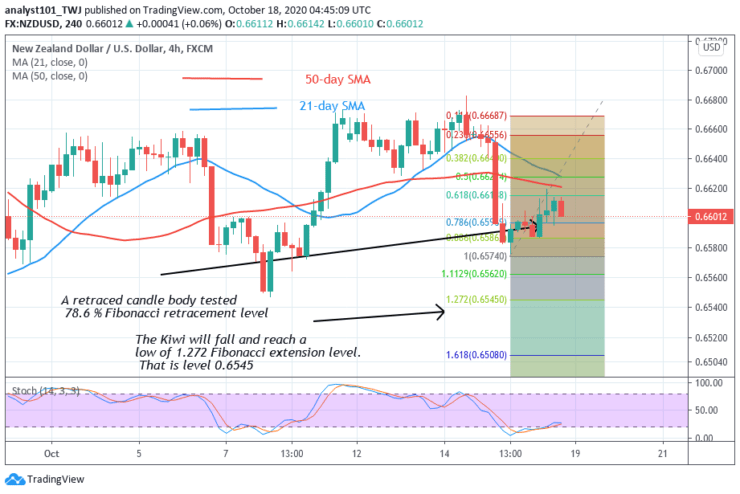

On the 4-hour chart, the NZD/USD pair is in an uptrend. A retraced candle body tested the 78.6%% Fibonacci retracement. The Kiwi will fall and reach a low of 1.272 Fibonacci extension level. That is level 0.6545.

Top IV-hora lectio Indicatores

The 50-day and 21-day SMAs are sloping upward. It indicates that the uptrend. The pair is above 25% range of the daily stochastic. It indicates that the market is in a bullish momentum.

Generalis pro Outlook NZD / USD

The NZD/USD pair is currently falling. However, the overall trend is uptrend. The uptrend will commence when price reaches the low of level 0.6545. According to the Fibonacci tool, the market will fall to level 1.272 Fibonacci extension level or 0.6545 low before upward resumption.

Nota: Learn2.Trade non Consiliario pecuniaria. Vestram facere Duis dignissim investigationis priusquam circumvallaret pecunia tua in aliqua financial uber vel res vel praesentatus. Nos es non responsible pro circumsedere results

- COCIO

- min Depositum

- Score

- visit COCIO

- Bonus de $ 20, usque ad XX% gratissimum

- Minimum depositum $ 100

- Quin prius in punctis salutis rationem putatur,

- Per C diversis financial products

- Obsido minus quam $ X ad a

- Recessum ab eodem die fieri potest,

- Fund Monetae mercatis ideo cum minimum $ 250

- L% tui dici uti ut opt forma deposit bonus