Operae ad exemplum mercaturae. Noster Algo sponte aperit et claudit artium.

L2T Algo signa perutilia praebet cum periculo minimo.

24/7 cryptocurrency mercaturae. dum dormimus, negotiamur.

X minute setup cum substantial commoda. Manuale emptionis praeditum.

LXXIX% Success rate. Eventus nostri te excitabunt.

Usque ad 70 artium per mensem. Plus quam 5 paria praesto sunt.

Subscriptiones menstruae ab £58 incipiunt.

The greenback witnessed a strong bullish rally at the end of last week following a better-than-expected US monthly jobs report. A weakened USD price action was believed to be one of the key supports for the yellow metal, however, the prevalent risk-on market sentiment has capped any strong gains for gold.

The ever-growing optimism for a sharp V-shaped global economic recovery, coupled with the outlook that the worst of the pandemic has passed continues to fuel a risk-on mood in the market. This, consequently, is reducing the demand and safe-haven appeal of gold and is holding bulls from becoming aggressive.

Aurum (XAU) Value Underground - June XXIV

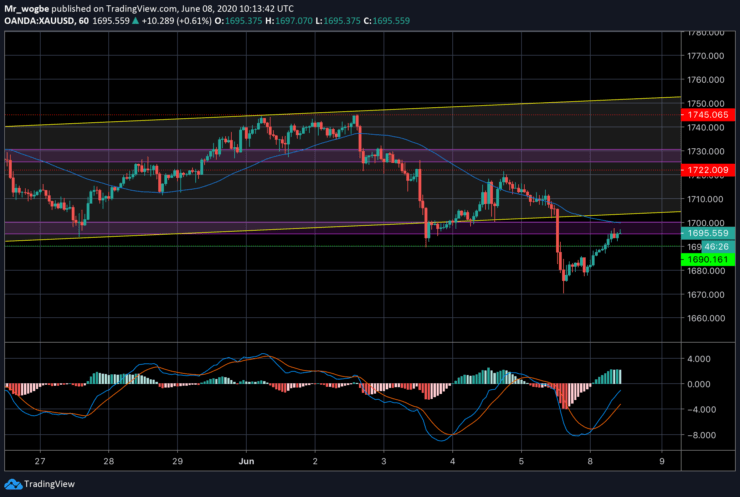

XAU / USD maior Bias: latus

Campester copiam: $ 1,700, 1,710 $ et $ 1,717

Demanda gradus: $ 1,690, 1,677 $ et $ 1,670

Gold (XAU/USD) broke below our ascending trend-channel and proceeded to break our key support at $1,700 after Friday’s unemployment data showed better-than-expected results. This immediately put gold in a bearish light forcing it to break through many support levels. Thankfully, the $1,670 support remained unabashed and has served as a bounce for the price to approach the $1,700 level.

Bulls are now faced with the task of sending the gold price above that pivot line up to $1,710 at least before we can see any further gains. Failure to capture the $1,700-10 level in the coming hours could send the price back to the $1,670 key support. A break below that level could catalyze further declines.

Nota: Learn2.trade non Consiliario pecuniaria. Vestram facere Duis dignissim investigationis priusquam circumvallaret pecunia tua in aliqua financial uber vel res vel praesentatus. Nos es non responsible pro circumsedere results

- COCIO

- min Depositum

- Score

- visit COCIO

- Bonus de $ 20, usque ad XX% gratissimum

- Minimum depositum $ 100

- Quin prius in punctis salutis rationem putatur,

- Per C diversis financial products

- Obsido minus quam $ X ad a

- Recessum ab eodem die fieri potest,

- Fund Monetae mercatis ideo cum minimum $ 250

- L% tui dici uti ut opt forma deposit bonus