Operae ad exemplum mercaturae. Noster Algo sponte aperit et claudit artium.

L2T Algo signa perutilia praebet cum periculo minimo.

24/7 cryptocurrency mercaturae. dum dormimus, negotiamur.

X minute setup cum substantial commoda. Manuale emptionis praeditum.

LXXIX% Success rate. Eventus nostri te excitabunt.

Usque ad 70 artium per mensem. Plus quam 5 paria praesto sunt.

Subscriptiones menstruae ab £58 incipiunt.

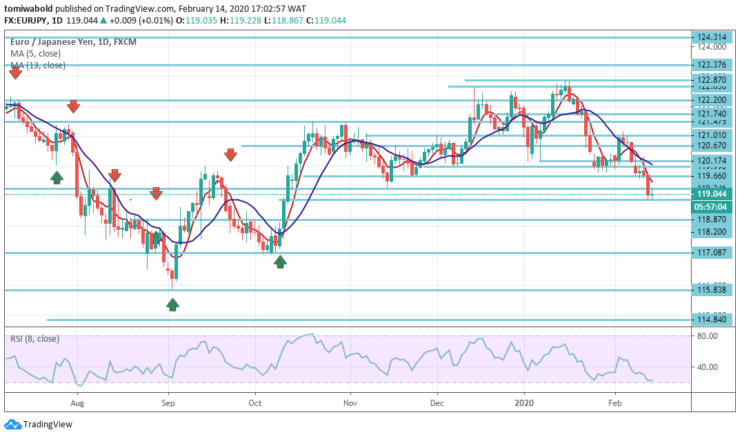

EURJPY Price Analysis - February VII

The consistent delicate tone encompassing the European currency joined with a relentless pace in the Japanese safe-haven, compels EURJPY to exchange inside the proposed sentiment at the level of 119.00 handles.

Key campester

Resistentia gradus, 123.37, 121.01, 119.66

Campester Support: 118.20, 117.08, 115.83

Fossa EURJPY Long term: INDOCTUS

In the larger structure, EURJPY quite remains in the plunging channel, set at 127.52 (high) level. Thus, the tend stays bearish. An increase from 115.83 level is seen as corrective growth, which may have completed.

A solid breakthrough of the level at 115.83 may continue the downtrend to the support level of 114.84 level in the next, at the moment while the cross loses 0.04% at 118.87 and a drop below 118.87 level (2020 low on February 14 ) will reveal 118.81 (‘flash) collapse’ on January 3, 2019), and then 117.08 (monthly low on October 7, 2019).

Short EURJPY terminus Trend: INDOCTUS

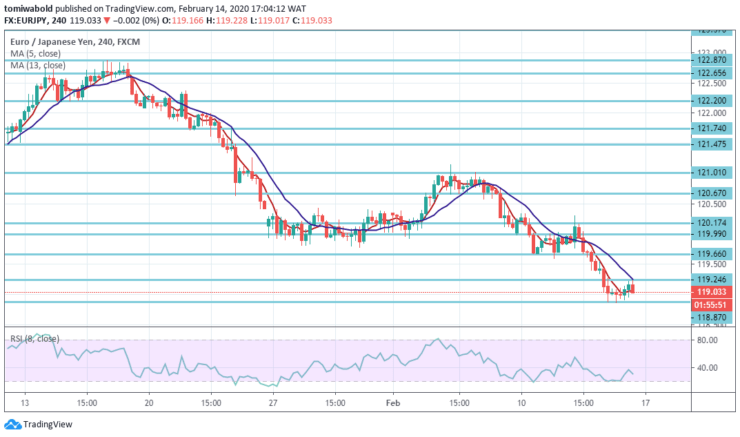

The fall of EURJPY from the level of 122.87 is in the process and still reaches the level of 118.87, and its intraday bias remains in the lower part for the forecast of 100% from 122.87 to 119.66 from 121.01 to 118.20 levels further.

On the other hand, overcoming the level of 119.66 of secondary resistance may initially change the neutrality of the bias within the day, while the recovery should be much lower than the resistance level of 121.01 to continue the plunge.

Title: EURJPY

Ordo deest:

Ingressum price: 119.24

Siste: 119.66

Scopum, 118.20

Nota: Learn2Trade.com non Consiliario pecuniaria. Vestram facere Duis dignissim investigationis priusquam circumvallaret pecunia tua in aliqua financial uber vel res vel praesentatus. Nos es non responsible pro circumsedere results

- COCIO

- min Depositum

- Score

- visit COCIO

- Bonus de $ 20, usque ad XX% gratissimum

- Minimum depositum $ 100

- Quin prius in punctis salutis rationem putatur,

- Per C diversis financial products

- Obsido minus quam $ X ad a

- Recessum ab eodem die fieri potest,

- Fund Monetae mercatis ideo cum minimum $ 250

- L% tui dici uti ut opt forma deposit bonus