1. GlaxoSmithKline

Being one of the biggest vaccine creators in the world, this British biotech company is at the forefront amongst the firms. It’s known as a pioneer in groundbreaking vaccine production.

The seasonal flu vaccine and the Human Papillomavirus (HPV) vaccine are among the top contributions to the world. It’s collaborating with Clover Biopharmaceuticals, a biotech firm based in China.

Still, they are collaborating on a product for COVID-19 dependent protein vaccine.

2. Sanofi

Sanofi Pasteur, a French biotech company, is one of the biggest stakeholders in the battle against Coronavirus under its vaccines division.

It is collaborating with the US Biomedical Advanced Research and Development Authority (BARDA) in collaboration.

BARDA is part of the Health and Human Services Department (HHS), operating under the Office of the Assistant Secretary for Preparation and Response (ASPR).

All consider a preclinical vaccine for SARS as a possible candidate. The candidate for a SARS vaccine was identified in 2017. This could give the company an advantage over competitors because SARS belongs to the class of Coronavirus.

3. Johnson & Johnson

Janssen, the vaccine subsidiary of Johnson & Johnson, has also been part of the current battle as of January 2020. To win the battle the American pharmaceutical has taken a dual-pronged approach.

On the one side, the antiviral molecules’ library is scanning for a natural fit for the new virus. And on the other hand, it is operating on a vaccine using the same equipment it had previously developed for experimental vaccination against Ebola.

As Sanofi, this also operates in extensive cooperation with BARDA.

4. Gilead Sciences

Better recognized for its medications against the Hepatitis C Virus (HCV), Gilead has been researching on a COVID-19 vaccine. The Remdesivir drug is currently having tests and has positioned the company high on the pharmaceutical companies ‘ crème de la crème list.

This vaccine was originally supposed to cure the Ebola virus and is said to have already aided one Coronavirus patient in the US. More work in China has commenced and the company is expected to begin its very own late-stage tests later in the month.

5. Regeneron Pharmaceuticals

Often, Regeneron works in conjunction with BARDA to create a cure for the virus. This is using a process that has been effective in developing an Ebola virus drug.

This entails introducing genetically engineered mice to the coronavirus proteins with human-like immune systems. The purpose is to have the mice make antibodies to the proteins. Around the same time, people who have stabilized from the illness are using antibodies.

They intend to choose the absolute best from these, which they will use to make a mixture to cure the virus. The product will be ready for human trials by early summer, the company states.

The Stock Market and Coronavirus

This is deserving of notice the pandemic concerns recently caused significant stock market uncertainty. Although rates for some firms have crashed significantly, many have surged. Healthcare and pharmaceutical firms are amongst others.

Considering that these businesses are focused on highly infectious virus therapies, it logically follows that their stocks carry the opportunity for considerable profits. Their commodities also benefit from higher amounts of requests despite the outbreak.

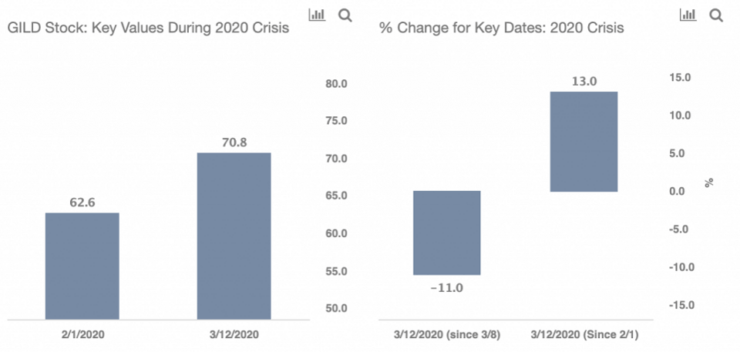

So it’s no mystery that many pharmaceutical stocks, particularly GILD stock, have been on an upswing, surpassing the S&P 500 although it started its steady decline in February.

COVID 19 Vaccine Anticipation

It may take some time, at least one year or more, according to the experts, before the world finally gets a vaccine for the dreaded COVID-19.

Furthermore, introducing those stocks to an investment watchlist is a great way to keep track of their movements as they gain ground in a vaccine’s growth.

A Guide to Invest in Pharma Firms

To U.S. consumers, through Stash Invest, a no-commission stockbroker selling $5 pharmaceutical stocks, you can invest in pharmaceutical companies.

Are you based outside of the USA? We suggest Plus500 which offers low spreads on investments in pharmaceutical stocks and a well-regulated platform.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.