សេវាកម្មសម្រាប់ការជួញដូរចម្លង។ Algo របស់យើងបើក និងបិទការជួញដូរដោយស្វ័យប្រវត្តិ។

L2T Algo ផ្តល់សញ្ញាផលចំណេញខ្ពស់ជាមួយនឹងហានិភ័យតិចតួចបំផុត។

ការជួញដូររូបិយប័ណ្ណឌីជីថល 24/7 ។ ខណៈពេលដែលអ្នកគេងយើងធ្វើពាណិជ្ជកម្ម។

ការរៀបចំ 10 នាទីជាមួយនឹងអត្ថប្រយោជន៍យ៉ាងច្រើន។ សៀវភៅណែនាំត្រូវបានផ្តល់ជូនជាមួយនឹងការទិញ។

79% អត្រាជោគជ័យ។ លទ្ធផលរបស់យើងនឹងធ្វើឱ្យអ្នករំភើប។

រហូតដល់ 70 ពាណិជ្ជកម្មក្នុងមួយខែ។ មានច្រើនជាង 5 គូ។

ការជាវប្រចាំខែចាប់ផ្តើមនៅ£ 58 ។

ការវិភាគតម្លៃ GBPUSD - ថ្ងៃទី ៩ ខែកុម្ភៈ

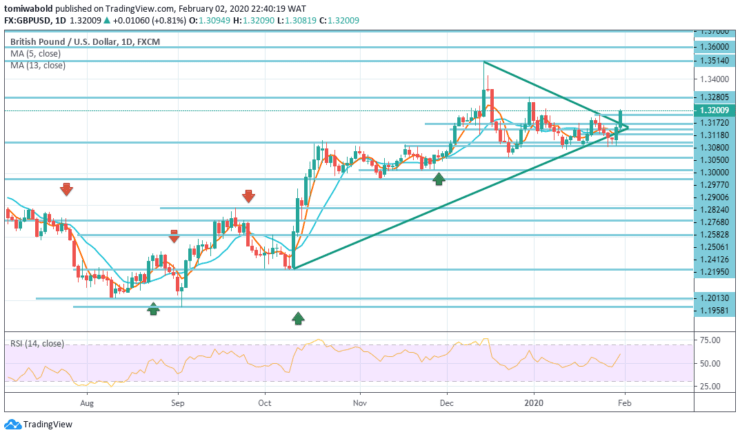

The GBPUSD pair exited the week with a few points past the 1.3200 level, its highest level in about a month. Its the start of a fresh age, while the focus is now shifting more clearly from the “Brexit deal” to a “business partnership” with the European Union. On the other hand, the US dollar was neglected on the back of the US Treasury yield curve due to risk aversion.

កំរិតគន្លឹះ

កម្រិតតស៊ូ: 1.3600, 1.3514, 1.3280

កំរិតគាំទ្រ: 1.3000, 1.2582, 1.1958

GBPUSD និន្នាការរយៈពេលវែង: កើនឡើង

The GBPUSD pair is trending around the 50% correction level to the 1.3514 / 1.2900 level, which is technically bullish. On the daily chart, the pair has moved past all its moving averages, 5 and 13, despite remaining unchanged at 1.3080 level.

In the larger structure, the advance is anticipated to continue from the long term bottom of 1.1958 level to the upside to retest the major resistance at 1.3280 level. The result from there may determine whether its coherent from 1.1958 (low) level. The trend may stay bullish as long as the resistance at 1.2582 level stays as support.

និន្នាការរយៈពេលខ្លីរបស់ GBPUSD: មានការកើនឡើង

In the 4 hours chart, the risk also tends to the upside, as the pair has moved past all its moving averages, while technical indicators have barely dampened its advance in overbought levels.

The GBPUSD strong rebound and the breach of the 1.3172 resistance level last week indicate that the sideways pattern from the 1.3280 level has been completed at 1.2977 level. Initial bias to the upside this week may return to 1.3280 first. The breakout might reach the 1.3600 level while on the downside, breaking the minor support at 1.3118 level may turn neutral throughout the day.

ចំណាំ: Learn2Trade.com មិនមែនជាទីប្រឹក្សាហិរញ្ញវត្ថុទេ។ ធ្វើការស្រាវជ្រាវរបស់អ្នកមុនពេលវិនិយោគមូលនិធិរបស់អ្នកនៅក្នុងទ្រព្យសម្បត្តិហិរញ្ញវត្ថុណាមួយឬផលិតផលឬព្រឹត្តិការណ៍ដែលបានបង្ហាញ។ យើងមិនទទួលខុសត្រូវចំពោះលទ្ធផលវិនិយោគរបស់អ្នកទេ។

- ឈ្មួញកណ្តាល

- ប្រាក់បញ្ញើអប្បបរមា

- ពិន្ទុ

- ទស្សនាឈ្មួញកណ្តាល

- កម្មវិធីជួញដូរគ្រីបតូកូរ៉ូដៀរដែលទទួលបានពានរង្វាន់

- ការដាក់ប្រាក់អប្បបរមា ១០០ ដុល្លារ,

- FCA & Cysec មានបទប្បញ្ញត្តិ

- ប្រាក់បន្ថែមស្វាគមន៍ ២០% រហូតដល់ ១០,០០០ ដុល្លារ

- ការដាក់ប្រាក់អប្បបរមា ១០០ ដុល្លារ

- ផ្ទៀងផ្ទាត់គណនីរបស់អ្នកមុនពេលប្រាក់រង្វាន់ត្រូវបានបញ្ចូល

- ផលិតផលហិរញ្ញវត្ថុជាង ១០០ ប្រភេទផ្សេងៗគ្នា

- វិនិយោគចាប់ពី ១០ ដុល្លារឡើងទៅ

- ការដកប្រាក់នៅថ្ងៃតែមួយគឺអាចធ្វើទៅបាន

- គណនីមូលនិធិម៉ូនីតាម៉ាឃីតដែលមានអប្បបរមា ៥០០ ដុល្លារ

- រើសយកដោយប្រើបែបបទដើម្បីទាមទារប្រាក់បន្ថែមពីការដាក់ប្រាក់ ៥០% របស់អ្នក