Ọrụ maka ịzụ ahịa nnomi. Algo anyị na-emepe ma mechie azụmaahịa na-akpaghị aka.

L2T Algo na-enye akara ngosi bara uru nke ukwuu na obere ihe egwu.

24/7 ahia cryptocurrency. Mgbe ị na-ehi ụra, anyị na-azụ ahịa.

Nhazi nkeji 10 nwere nnukwu uru. Enyere akwụkwọ ntuziaka na ịzụrụ.

Ọnụego ịga nke ọma 79%. Nsonaazụ anyị ga-atọ gị ụtọ.

Ruo azụmaahịa 70 kwa ọnwa. Enwere ihe karịrị ụzọ abụọ ise dị.

Ndebanye aha kwa ọnwa na-amalite na £58.

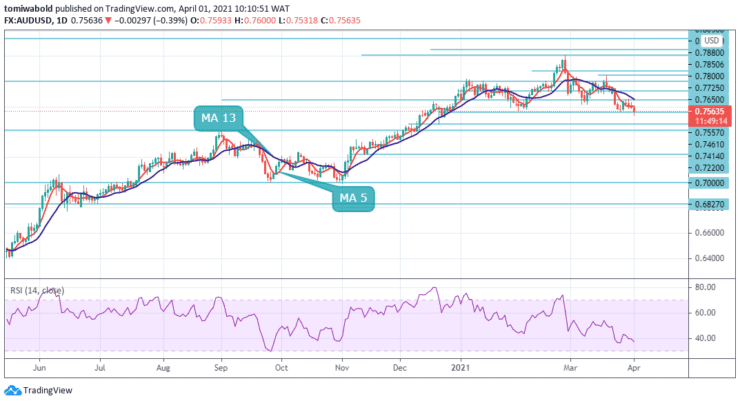

AUDUSD Nyocha Ahịa - Eprel 1

The AUDUSD pair plunges to the 4th day in a row low on Thursday after buyers repeatedly failed to breach beyond the MA 13 barrier around the mid 0.7600 level. The pair extends losses to 0.7531 low level as the upbeat US economic outlook capped gains for the AUDUSD and prompted some fresh selling at top zones.

Nzọụkwụ Isi

Nguzogide eguzogide: 0.8000, 0.7800, 0.7650

Nkwado Ọkwa: 0.7461, 0.7220, 0.7000

The AUDUSD has breached the minor support level at 0.7557 level at the beginning of the European session. A break lower is a sell signal targeting the sub 0.7500 levels, perhaps as far as strong support at 0.7461 level for profit-taking on shorts. All things being equal, the AUDUSD exchange rate could continue to edge lower during the following trading session.

The potential target for bears would be near the 0.7414 level. In the larger context, while the retracement from the 0.8000 level is ongoing, there is not enough evidence to confirm bullish trend reversal yet. That is, it could be just a correction inside the long-term consolidation trend. On the upside, a bullish return past the 0.7650 level will return buyers’ confidence to a higher level.

On the 4-hour time frame, the momentum indicators, though, are currently encouraging an ongoing sell-off in the very short-term. The RSI is returning towards the oversold threshold of 30, while the 4-hour moving averages 5 and 13 are falling and above price while still in the negative region.

However, a closing price above the minor resistance at 0.7650 level in subsequent sessions could boost buying interest and confirm additional gains towards the 0.7800 barriers, being high of March 2021. In the event of a solid rebound, the 0.8000 barriers could be the next target which is the resistance identified in February 2021.

- Broker

- Min ego

- Akara

- Nleta Broker

- Onyinye-emeri Cryptocurrency trading n'elu ikpo okwu

- $ 100 nkwụnye ego kacha nta,

- FCA & Cysec chịkwara

- 20% nabata ego nke ihe ruru $ 10,000

- Obere nkwụnye ego $ 100

- Nyochaa akaụntụ gị tupu daashi na-otoro

- N'ime 100 ngwaahịa ego dị iche iche

- Tinye ego na $ 10

- Withdrawalwepu otu ụbọchị ga-ekwe omume

- Ahịa Moneta Ahịa nwere akaụntụ opekata mpe $ 250

- Banye iji mpempe akwụkwọ iji kwuo ego nkwụnye ego 50% gị