Sèvis pou komès kopi. Algo nou an otomatikman louvri epi fèmen echanj.

L2T Algo bay siyal trè pwofitab ak risk minim.

Komès kriptografik 24/7. Pandan w ap dòmi, nou fè komès.

10 minit konfigirasyon ak avantaj sibstansyèl. Manyèl la bay ak acha a.

79% Pousantaj siksè. Rezilta nou yo pral eksite ou.

Jiska 70 echanj pa mwa. Gen plis pase 5 pè ki disponib.

Abònman chak mwa kòmanse nan £ 58.

USDCHF Analiz Pri - 2 jen

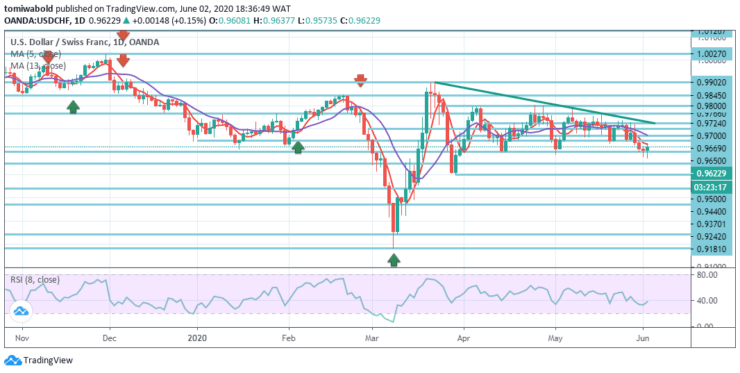

After touching new two-month lows, the USDCHF pair bounced back around 50 pips and leaped to new session highs in the last hour, around the region of 0.9620. The downside stayed shielded, for the moment at least, amid the prevailing risk-on mood, which constrained the safe-haven status of the Swiss franc.

Nivo kle yo

Nivo Rezistans: 1.0231, 1.0027, 0.9724

Nivo sipò: 0.9550, 0.9440, 0.9181

From a technical viewpoint, in the wider context, the pair does have some resilience beyond the 0.9600 round-figure marks, that matches with the lower end of two-month-old price action.

A compelling drop may pave the way for a drop to the psychological mark of the main 0.9500 level. On the contrary, the 0.9902 level breach may expand the 0.9181 level of the rebound phase through a 1.0027 level of resistance. And besides, medium to long-term market in ranges is likely to continue for some longer between 0.9181/1.0231 levels.

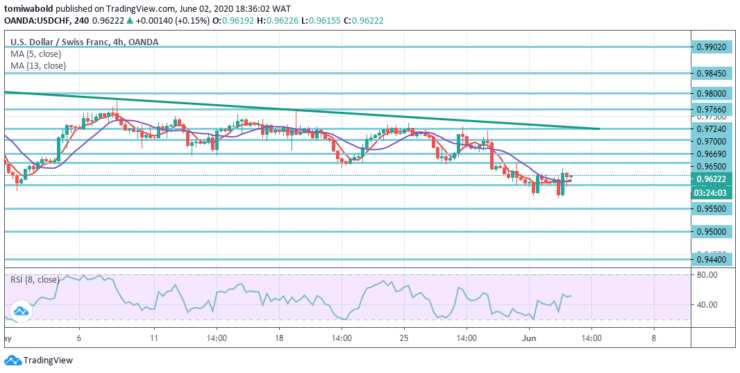

The USDCHF intraday bias is turned bearish with 4 hour RSI keeping around 50 midlines. As long as 0.9724 resistance level holds, another decline will remain in favor. The corrective trend from level 0.9902 might still extend lower and 0.9550 level break with a target at support level 0.9500.

The downside, nevertheless, should be contained by retracing 61.8 percent from 0.9181 to 0.9902 to rebound at 0.9440 levels. On the upside, a break of 0.9724 resistance level instead turns the bias back to the upside.

Remak: Learn2.trade se pa yon konseye finansye. Fè rechèch ou anvan ou envesti lajan ou nan nenpòt avantaj finansye oswa prezante pwodwi oswa evènman. Nou pa responsab pou rezilta envesti ou

- Fè

- Min depo

- Nòt

- Vizite Fè

- Prim-genyen platfòm komès Cryptocurrency

- $ 100 depo minimòm,

- FCA & Cysec reglemante

- 20% bonis akeyi jiska $ 10,000

- Depo minimòm $ 100

- Verifye kont ou anvan yo bonis la kredite yo

- Plis pase 100 diferan pwodwi finansye

- Envesti nan ti kòm $ 10

- Retrè menm jou a posib

- Fon Moneta Mache kont ak yon minimòm de $ 250

- Opt nan lè l sèvi avèk fòm nan reklamasyon 50% bonis depo ou