Sèvis pou komès kopi. Algo nou an otomatikman louvri epi fèmen echanj.

L2T Algo bay siyal trè pwofitab ak risk minim.

Komès kriptografik 24/7. Pandan w ap dòmi, nou fè komès.

10 minit konfigirasyon ak avantaj sibstansyèl. Manyèl la bay ak acha a.

79% Pousantaj siksè. Rezilta nou yo pral eksite ou.

Jiska 70 echanj pa mwa. Gen plis pase 5 pè ki disponib.

Abònman chak mwa kòmanse nan £ 58.

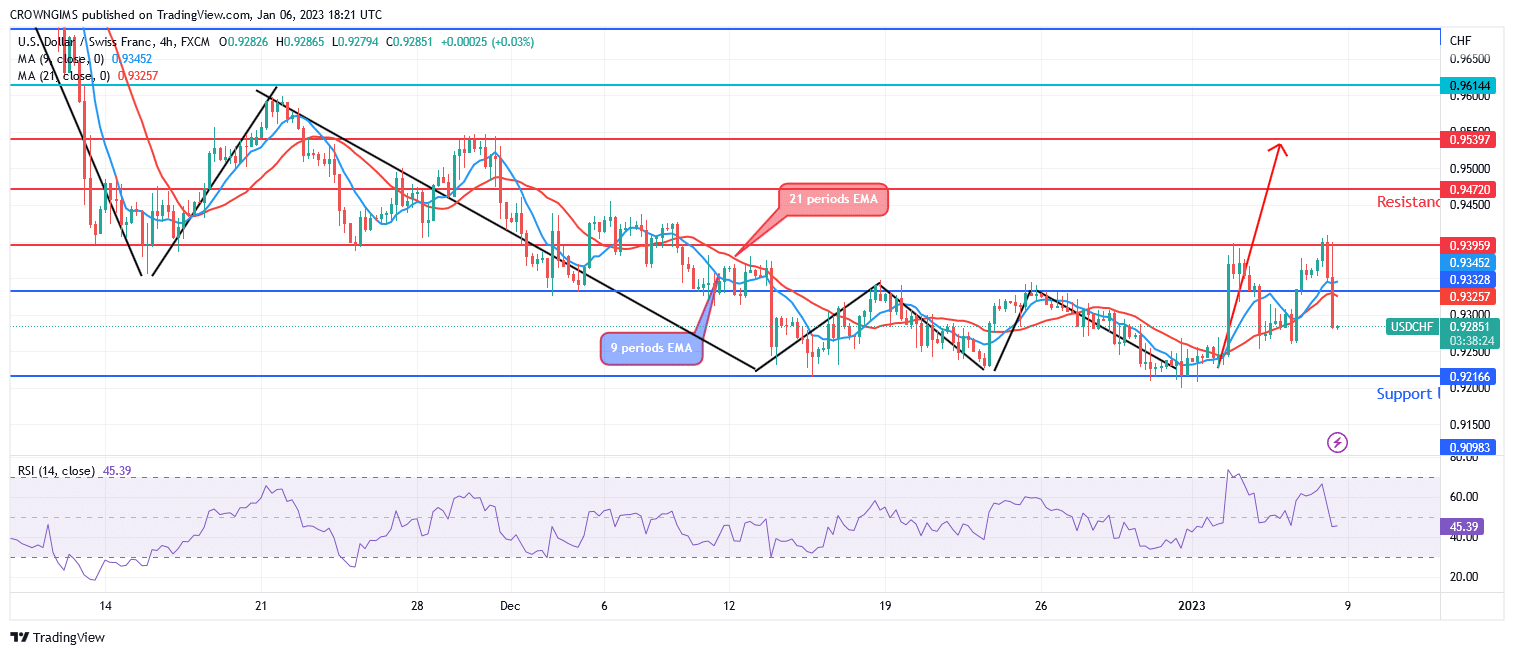

Bears are dominating USDCHF market

Analiz pri USDCHF - 06 janvye

The $0.92 support level may be breached on the downside if the sellers exert more pressure, and the downward trend may continue to the $0.91 and $0.90 levels. USDCHF ap kraze through the $0.93 level and go up toward the resistance levels of $0.94 and $0.95 if buyers apply additional pressure and defend the $0.92 support level.

USDCHF mache

Nivo kle yo:

Nivo rezistans: $ 0.93, $ 0.94, $ 0.95

Nivo sipò yo: $ 0.92, $ 0.91, $ 0.90

USDCHF Tandans alontèm: Bearish

Long-term prospects for USDCHF are promising. The bearish swing from the previous week is still evident in the daily time period. Increased seller pressure on December 14 led to a breakdown of the support level of $0.93, which caused the price to drop and test the $0.92 support level. Due to the power of the purchasers, the price increased the next day. Currently, the $0.93 resistance level is being tested. At $0.92, a triple bottom chart pattern is seen, indicating a potential price increase.

The 9-period EMA is below the 21-period EMA, and USDCHF is trading above the 9 periods EMA. A bearish market direction is indicated by the Relative Strength Index period 14 being at 44 levels and leaning downward. The $0.92 support level may be breached on the downside if the sellers exert more pressure, and the downward trend may continue to the $0.91 and $0.90 levels. Price will break through the $0.93 level and go up toward the resistance levels of $0.94 and $0.95 if buyers apply additional pressure and defend the $0.92 support level.

USDCHF Tandans a mwayen tèm: Bearish

The USDCHF is bearish in the medium-term outlook. The price was driven by the bears to the $0.92 support level, which has a significant chance of reversal. It appears that the bulls’ push is steadily building while the bears’ impetus is waning. The price attempted to overcome the $0.93 level of resistance but sellers opposed the buyers due to the low strength of U.S Dollars at non-farm payroll fundamental news.

Currently, the 21-period EMA is below the 9-period EMA. The USDCHF is currently trading below the two EMAs, indicating a bearish move. The signal line on the Relative Strength Index period 14 is pointing downward at 44 levels.

Ou ka achte pyès monnen crypto isit la: Achte LBLOCK

- Fè

- Min depo

- Nòt

- Vizite Fè

- Prim-genyen platfòm komès Cryptocurrency

- $ 100 depo minimòm,

- FCA & Cysec reglemante

- 20% bonis akeyi jiska $ 10,000

- Depo minimòm $ 100

- Verifye kont ou anvan yo bonis la kredite yo

- Plis pase 100 diferan pwodwi finansye

- Envesti nan ti kòm $ 10

- Retrè menm jou a posib

- Fon Moneta Mache kont ak yon minimòm de $ 250

- Opt nan lè l sèvi avèk fòm nan reklamasyon 50% bonis depo ou