Sèvis pou komès kopi. Algo nou an otomatikman louvri epi fèmen echanj.

L2T Algo bay siyal trè pwofitab ak risk minim.

Komès kriptografik 24/7. Pandan w ap dòmi, nou fè komès.

10 minit konfigirasyon ak avantaj sibstansyèl. Manyèl la bay ak acha a.

79% Pousantaj siksè. Rezilta nou yo pral eksite ou.

Jiska 70 echanj pa mwa. Gen plis pase 5 pè ki disponib.

Abònman chak mwa kòmanse nan £ 58.

GBPUSD Analiz Pri - 15 Desanm

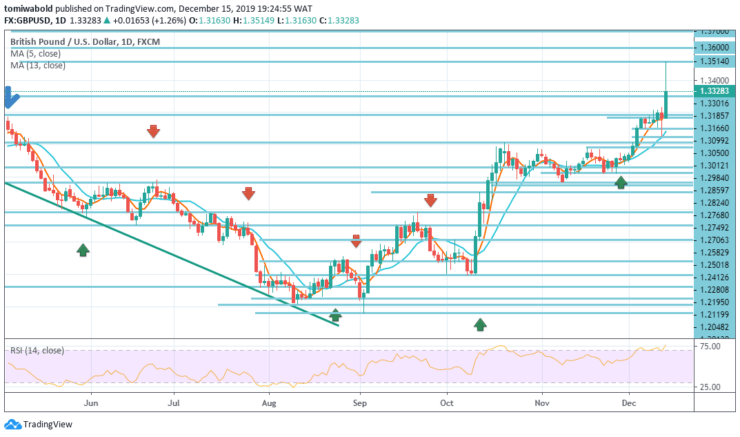

The GBPUSD pair reached 1.3514 level last Friday, a level that was last seen in May 2018, after the Conservative Party led by British Prime Minister Boris Johnson won the general elections in the United Kingdom. The pair fell all day on Friday, amid a higher dollar and profit-taking, ending the week with significant gains above the 1.3301 level.

Nivo kle yo

Nivo Rezistans: 1.3700, 1.3600, 1.3514

Nivo sipò: 1.3050, 1.2824, 1.2195

GBPUSD Long tèm tandans: optimis

In the long term direction, advance from the level at 1.1958, is viewed as a long term bottom on the right path to retest the level at 1.3700 in the near term resistance. The feedback from there may determine if it is combined from the level of 1.1958 (low).

On the other hand, a bullish breach of the level at 1.3700 might indicate a long term bullish reversal. However, for the time being, the outlook may remain bullish as long as the support level of 1.2824 remains constant.

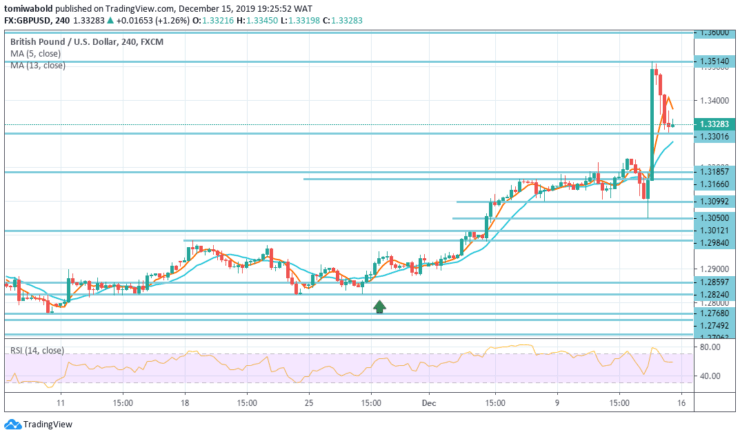

GBPUSD Kout tèm tandans: Sòti

GBPUSD accelerated to a high of 1.3514 level last week. Given that a temporary top with a subsequent pullback is forming, the initial bias is neutral this week for consolidation first.

However, the downside may be limited above the level at 1.3050 support to bring in another high. On the upside, above the level at 1.3514, the rise could extend from the level at 1.1958 to full expectations for the level at 1.2195 to 1.3012 from 1.2824 to 1.3700 upside threshold.

Remak: Learn2Trade.com se pa yon konseye finansye. Fè rechèch ou anvan ou envesti lajan ou nan nenpòt avantaj finansye oswa prezante pwodwi oswa evènman. Nou pa responsab pou rezilta envesti ou

- Fè

- Min depo

- Nòt

- Vizite Fè

- Prim-genyen platfòm komès Cryptocurrency

- $ 100 depo minimòm,

- FCA & Cysec reglemante

- 20% bonis akeyi jiska $ 10,000

- Depo minimòm $ 100

- Verifye kont ou anvan yo bonis la kredite yo

- Plis pase 100 diferan pwodwi finansye

- Envesti nan ti kòm $ 10

- Retrè menm jou a posib

- Fon Moneta Mache kont ak yon minimòm de $ 250

- Opt nan lè l sèvi avèk fòm nan reklamasyon 50% bonis depo ou