Sèvis pou komès kopi. Algo nou an otomatikman louvri epi fèmen echanj.

L2T Algo bay siyal trè pwofitab ak risk minim.

Komès kriptografik 24/7. Pandan w ap dòmi, nou fè komès.

10 minit konfigirasyon ak avantaj sibstansyèl. Manyèl la bay ak acha a.

79% Pousantaj siksè. Rezilta nou yo pral eksite ou.

Jiska 70 echanj pa mwa. Gen plis pase 5 pè ki disponib.

Abònman chak mwa kòmanse nan £ 58.

Sitting in the basic materials sector, Swiss-based Ferrexpo, as its name suggests, is in the iron ore business. It makes iron pellets for the metallurgical industry – the pellets are consumed by blast furnaces.

With resources stocks continuing to outperform on hopes of the recovery in industrial production spreading out from China to the rest of the world, companies involved with the production of the metal inputs for industry are being rerated accordingly.

The latest comes from Credit Suisse, which slapped a price target on the stock of 470p, assuming coverage with an outperform rating.

That comes on the back of strong production figures released on 6 April, with quarterly production coming in at 2.7 million tonnes. Ferrexpo also expects capacity to increase by between 0.5 to 1 million tonnes per annum.

First-quarter production also improved in terms of quality. High-quality pellets which contain 65-67% Fe (measure of iron purity content) made up 100% of production in Q1, compared to 97% in the same period last year.

Production of high-grade concentrates also increased and an upgrade of one of the company’s pelletizer lines was completed with other improvement work continuing.

Nan rezilta plen ane li yo rapòte sou 16 mas, nimewo yo te montre ke malgre Covid konpayi an te kapab avèk siksè kenbe operasyon yo ak amelyore pèfòmans pa upping pwodiksyon ak kontwole depans yo. Yon pivot byen egzekite nan Lachin ak yon detant fò nan pri minrè fè underlay gaya pèfòmans finansye a, ki te reflete nan yon peman dividann espesyal ak yon ogmantasyon jeneral ane pase a nan 26% nan peman aksyonè.

Revni ogmante 13% to $1.7 billion (Ferrexpo reports in US dollars), which reflected rising production volumes and destocking.

Underlying EBITDA was an impressive 46% better at $859 million compared to $586 million in 2019, while net cash flow from operations grew 45% to $687 million from $473 million the previous year.

Total amount paid out in dividends in 2020 was $195 million (2019: $155 million).

The pleasing dividend position was achieved notwithstanding reinvesting $206 million of profits into continuing operations and paying off debt of $148 million, placing the company in a $4 million net cash position.

Kòmantè sou rezilta yo plen ane, Ferrexpo prezidan Lucio Genovese te di: "Malgre ke COVID-19 ki te lakòz dezòd nan modèl demann mondyal fè minrè, santral kote jeyografik nou an ant Ewòp ak Azi, makonnen ak fleksibilite kapasite lojistik nou yo, pèmèt nou efikas pivote nan direksyon Lachin nan 2020, menm jan li byen vit sòti nan pandemi an ak yon konsantrasyon kwasans fò sou metal. Ogmantasyon rezilta nan pri minrè fè, makonnen ak ogmantasyon Gwoup la nan pwodiksyon ak kontwòl pri, te kondwi gwo pèfòmans finansye pou Gwoup la nan 2020. "

Earnings per share has been climbing since 2015 and in 2020 was $1.08 a share – a growth rate of 57% on the previous year, with EPS forecast to rise to $1.43 in 2021.

Dividend yield was 2.57% in 2020 and is projected at 8.36% for this year.

The company’s vertically integrated business encompasses iron ore mining through to the production of iron ore concentrates and pellets, plus allied logistic and sales interests.

Ferrexpo owns two mines in Ukraine and a processing plant as well as port interests in Odessa. In addition it also operates a fleet of vessels that work on the major European waterways plus an ocean-going vessel that plies international sea routes.

As of 1 June 2020, the company reported proven and probable iron ore reserves of 1.7 billion tonnes. Ferrexpo supplies steel mills in Austria, Slovakia, the Czech Republic, Germany and other European countries, as well as mills in China, India, Japan, Taiwan and South Korea.

Ferrexpo’s strong anchor for earnings growth

Although it may still be too early to talk of a commodities super-cycle that persists across economic cycles, judging by the strengthening industrial production figures from China, demand in 2021 should underpin continued momentum for earnings growth and the share price.

Ferrexpo is currently priced at 411p, 11% behind the analysts’ consensus price target of 482p, according to Stockopedia.

There are risks associated with any setbacks on the progress with reopening economies, given the Covid pandemic continuing to grow in size at the global level, despite the prospect of improved vaccine rollouts in the economically advanced countries, particularly those in Europe as far as much of Ferrexpo’s business is concerned.

In addition, its operations in Ukraine may be disrupted if there is a Russian invasion of the country. However, Ferrexpo’s worked deposits at theYerystivske and Poltava mining complexes are near the city of Kremenchuk, which sits of the Dnieper river and is around 200 miles west of Donetsk, so hopefully out of harms way.

Of the nine broker analysts covering the stock, two rate it a strong buy, two a buy and two a hold. Two rate it a sell and one a strong sell.

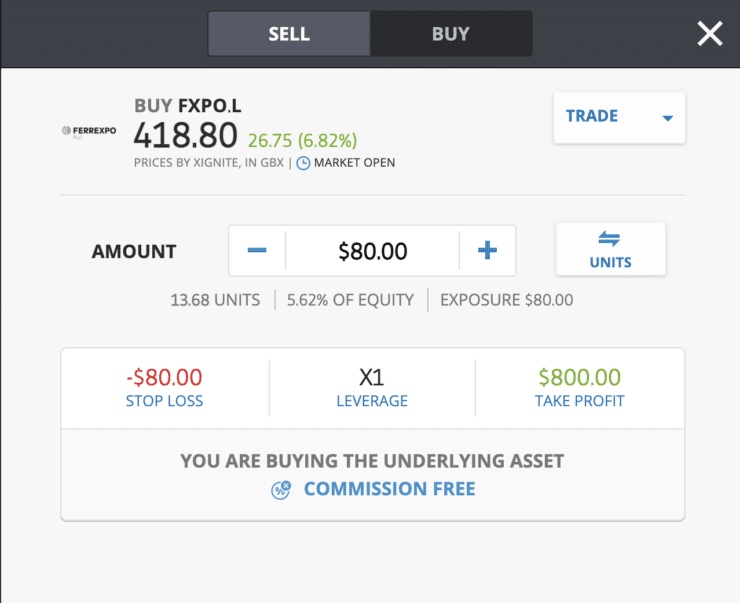

Buy Ferrexpo (FXPO) at global investment platform eToro for 0% commission

8cap - Achte ak envesti nan byen

- Depo minimòm jis 250 USD pou jwenn aksè pou tout lavi nan tout chanèl VIP yo

- Achte plis pase 2,400 aksyon nan 0% komisyon

- Komès dè milye de CFDs

- Depo lajan ak yon kat debi / kredi, Paypal, oswa transfè labank

- Pafè pou komèsan Senior Member ak lou reglemante

- Fè

- Min depo

- Nòt

- Vizite Fè

- Prim-genyen platfòm komès Cryptocurrency

- $ 100 depo minimòm,

- FCA & Cysec reglemante

- 20% bonis akeyi jiska $ 10,000

- Depo minimòm $ 100

- Verifye kont ou anvan yo bonis la kredite yo

- Plis pase 100 diferan pwodwi finansye

- Envesti nan ti kòm $ 10

- Retrè menm jou a posib

- Fon Moneta Mache kont ak yon minimòm de $ 250

- Opt nan lè l sèvi avèk fòm nan reklamasyon 50% bonis depo ou