Sèvis pou komès kopi. Algo nou an otomatikman louvri epi fèmen echanj.

L2T Algo bay siyal trè pwofitab ak risk minim.

Komès kriptografik 24/7. Pandan w ap dòmi, nou fè komès.

10 minit konfigirasyon ak avantaj sibstansyèl. Manyèl la bay ak acha a.

79% Pousantaj siksè. Rezilta nou yo pral eksite ou.

Jiska 70 echanj pa mwa. Gen plis pase 5 pè ki disponib.

Abònman chak mwa kòmanse nan £ 58.

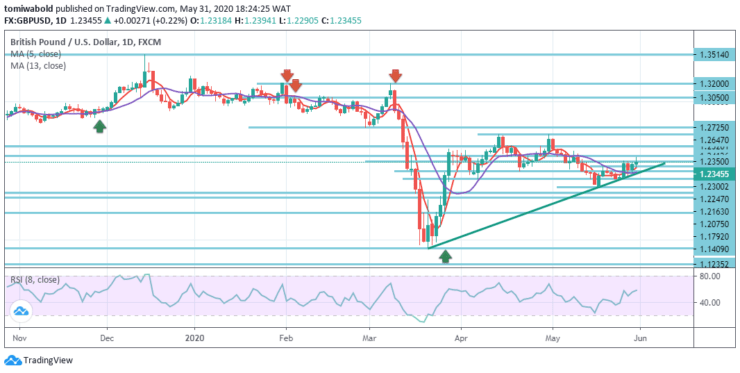

GBPUSD Analiz Pri - 31 me

In the previous session, the GBPUSD pair hit 1.2395 level, a two-week high, pulling back rapidly from the level to regain afterward on recovery and getting stuck at 1.2345 level. By the close of the week, the UK had not provided macroeconomic data with the emphasis now on Brexit deal and emerging trends in coronavirus. Besides that, this week’s concluding round of UK-EU dialogue is set to take place.

Nivo kle yo

Nivo Rezistans: 1.3514, 1.2647, 1.2412

Nivo sipò: 1.2075, 1.1792, 1.1409

The GBPUSD pair may have ended the week with growth but as per the daily chart, the bullish impact is constrained. The rebound from Sterling’s low level of 1.2247 hit two-week highs at 1.2395 level. That being said, the pair could not stabilize at those levels and tumbled down to level 1.2345.

In the wider context, although the turnaround from level 1.1409 is positive, there is still no confirmation of trend reversal. In whichever way, in case of a strong rebound, the trend may even stay bearish as long as 1.3514 resistance level holds intact.

GBPUSD’s 1.2075-level rebound advanced higher last week and this week’s initial trend stays on the upside. The latest trends assert that the 1.1409 rebounds may still be underway.

Another rally can be seen at a level of 1.2647 and a break can reach a forecast of 61.8 percent from 1.1409 to 1.2647 from 1.2075 to 1.2725 levels next. That being said, on the downside beneath 1.2247 minor support level may instead alter bias back to the downside at 1.2075 level.

Remak: Learn2.trade se pa yon konseye finansye. Fè rechèch ou anvan ou envesti lajan ou nan nenpòt avantaj finansye oswa prezante pwodwi oswa evènman. Nou pa responsab pou rezilta envesti ou

- Fè

- Min depo

- Nòt

- Vizite Fè

- Prim-genyen platfòm komès Cryptocurrency

- $ 100 depo minimòm,

- FCA & Cysec reglemante

- 20% bonis akeyi jiska $ 10,000

- Depo minimòm $ 100

- Verifye kont ou anvan yo bonis la kredite yo

- Plis pase 100 diferan pwodwi finansye

- Envesti nan ti kòm $ 10

- Retrè menm jou a posib

- Fon Moneta Mache kont ak yon minimòm de $ 250

- Opt nan lè l sèvi avèk fòm nan reklamasyon 50% bonis depo ou