Kev pabcuam luam tawm. Peb Algo cia li qhib thiab kaw kev lag luam.

L2T Algo muab cov txiaj ntsig tau zoo heev nrog kev pheej hmoo tsawg.

24/7 cryptocurrency trading. Thaum koj pw, peb pauv.

10 feeb teeb nrog ntau qhov zoo. Phau ntawv yog muab nrog kev yuav khoom.

79% Kev vam meej. Peb cov txiaj ntsig yuav zoo siab rau koj.

Txog li 70 kev lag luam hauv ib hlis. Muaj ntau tshaj 5 khub muaj.

Kev tso npe txhua hli pib ntawm £ 58.

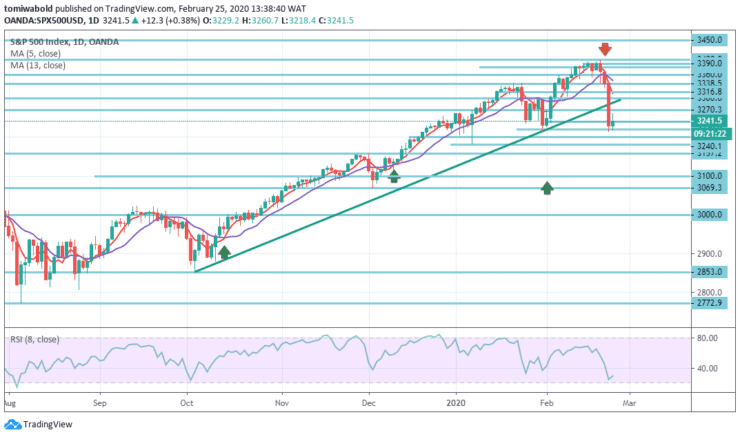

S&P 500 Kev Tshawb Fawb Nqe - Lub Ob Hlis 25

On Monday, the S & P 500 had a huge rally, breaking the main uptrend line downwards quite significantly during the trading session, testing the lows at 3215 levels. Finally, the impact of COVID-19, better known as coronavirus, began to strongly affect financial markets.

Cov theem tseem ceeb

Kuj qib: 3400, 3360, 3300

Kev Txhawb Kev Txawj: 3200, 3100, 3000

S&P 500 long term Trend: Bullish

The S&P 500 Index trend is retracing significantly beneath the moving averages of 5 and 13 as the bulls are keen to keep the uptrend going and to protect low of 2020 and vital figure at 3200 levels.

Failure to do so, however, could see the bears extend the downward movement towards 3100 and the 3000 levels. On the flip side, a bullish recovery can uncover a resistance near the levels of 3300 and 3360.

S&P 500 Lub Sij Hawm Luv Luv: Bearish

The 3200 levels underneath break would result in a major breach of support on the 4-hour time frame, and if the market breaks down beneath here, the S&P 500 will likely go down in the future.

It’s not a market at this stage that can be followed through with the bearish bias and start selling, but the downside risk may increase on the off chance it breaks down beneath the 3200 levels.

Kev Ntsuas: S&P 500

Txim: Yuav

Nkag tus nqi: 3220

Nres: 3200

Hom phiaj: 3270

Nco ntsoov: Kawm2Trade.com tsis yog kws pab tswv yim nyiaj txiag. Tshawb nrhiav koj cov kev tshawb fawb ua ntej nqis peev rau koj cov peev nyiaj hauv cov peev nyiaj txiag lossis nthuav tawm cov khoom lag luam lossis kev tshwm sim. Peb tsis yog lub luag haujlwm rau koj cov txiaj ntsig kev nqis peev

- broker

- Min Tso nyiaj

- Score

- Mus ntsib Broker

- Cov puav pheej yeej Cryptocurrency trading platform

- Them $ 100 qhov tsawg kawg nkaus,

- FCA & Cysec yog kev tswj hwm

- 20% txais tos lawm ntawm upto $ 10,000

- Qhov tsawg kawg nkaus tso $ 100

- Xyuas koj tus lej nyiaj uantej cov nyiaj yuav suav tau

- Hla 100 txawv cov khoom lag luam nyiaj txiag

- Nqes los ntawm me ntsis li $ 10

- Kev tshem tawm tib hnub yog ua tau

- Kev Nqis Tus Nqi Nqis Tshaj

- 50% Zoo Siab Txais Tos

- Kev yeej-yeej 24 Teev Kev Pab Txhawb

- Fund Moneta Markets account nrog yam tsawg kawg ntawm $ 250

- Xaiv siv daim foos los thov koj qhov nyiaj 50% tso nyiaj ntxiv