Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

This issue caused investors’ appetite for riskier assets to diminish which was evident from the watered-down trading sentiment seen in equity markets. This consequently boosted demand for conventional safe-haven assets like gold. Gold’s upward move was further bolstered by the enduring US dollar selling bias.

The USD witnessed further depression on Thursday following the release of the US Q1 GDP print, which indicated that the US economy contracted by 5% annualized pace. This coupled with a new “leg down” in the US Treasury bonds yield further caused the USD to drop and provided an extra boost for the yellow metal asset.

Although gold looks very bullish at the moment, all that could change in the blink of an eye as the President of the United States, Donald Trump, is set to have a news conference later today. Trump’s comments on the prevailing issue between China and Hong Kong will determine what the price of gold will likely do next.

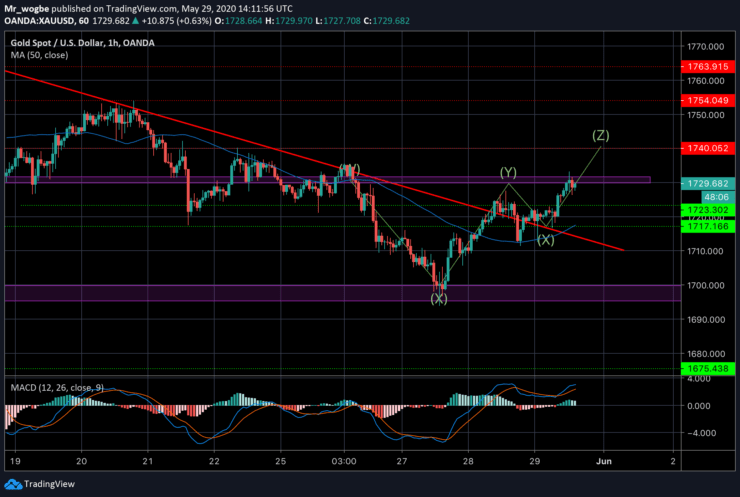

Gold (XAU) Value Forecast — May 29

XAU/USD Major Bias: Bullish

Supply Levels: $1,740, $1,754, and $1,763

Demand Levels: $1,722, $1,717, and $1,706

Gold (XAU/USD) continues to go in our projected direction smoothly. We anticipated that the $1,730 level would pose a strong resistance which we are seeing play out now. The price of gold is expected to break and sustain above this pivot level and continue to the $1,745 resistance. However, failure to defeat this level could send gold down to previous support zones. Also, President Trump’s comments in the upcoming conference could greatly influence the fall from this level if sustained.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus