Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

As a retaliation to the suspension of American carriers from re-entering China, the US government has placed a ban on Chinese airline passenger flights from entering or leaving the country. This travel ban will take effect from the 16th of this month.

The recent development has thrown a heavy blanket on the hopes for a sharp V-shaped recovery for the global economy. This has consequently provided strong support for the yellow metal and boosted its safe-haven appeal.

The USD index was in strong demand yesterday allowing it to stage a strong recovery from its lowest point since March. A strong USD is one of the major factors keeping investors from becoming aggressively bullish with gold.

Traders are now looking forward to the Weekly Jobless Claims data from the US believed to have a strong short-term influence on price dynamics of the XAU/USD. However, the major focus for the week is the monthly jobs/unemployment report, popularly known as the NFP which will be released tomorrow.

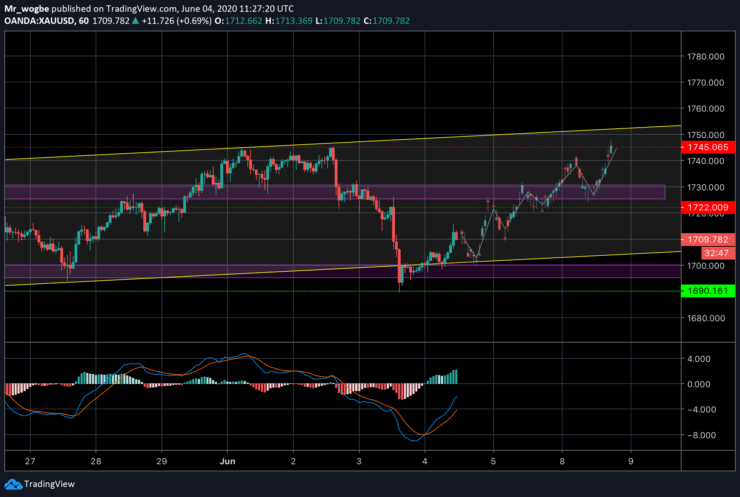

Gold (XAU) Value Forecast — June 4

XAU/USD Major Bias: Bullish

Supply Levels: $1,722, $1,730, and $1,745

Demand Levels: $1,706, $1,700, and $1,690

Gold remains bullish despite yesterday’s plunge below the $1,700 pivot. Losses were swiftly capped by the $1,690 support level. The price appears to have stabilized above the pivot and will be attempting to get back to its previous highs at the top of the channel. Another decline from this level is not out of the picture, however, it will likely be strongly supported by the $1,690 price mark.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus