Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

However, the risk-off sentiment quickly fizzled out following reports of damning global issues. One of the catalysts for the renewed market risk-tone comes from the declining numbers of Coronavirus cases in mainland China and Beijing. Additionally, President Trump’s refusal to place further disciplinary measures on Chinese diplomats involved in the Xinjiang issue has weighed heavily on the yellow metal.

Also, China’s refusal to honor a meeting with US Secretary of State Mike Pompeo over measures taken on China by the US has further deteriorated ties between the two world powers.

Furthermore, attempts by the US to push a ceasefire in Libya and the geopolitical tensions in Asia are some of the factors weighing down on further price gains in gold.

Market participants will be paying keen attention to the virus updates as well as the US-China rift for clues on what the markets will do in the near-term.

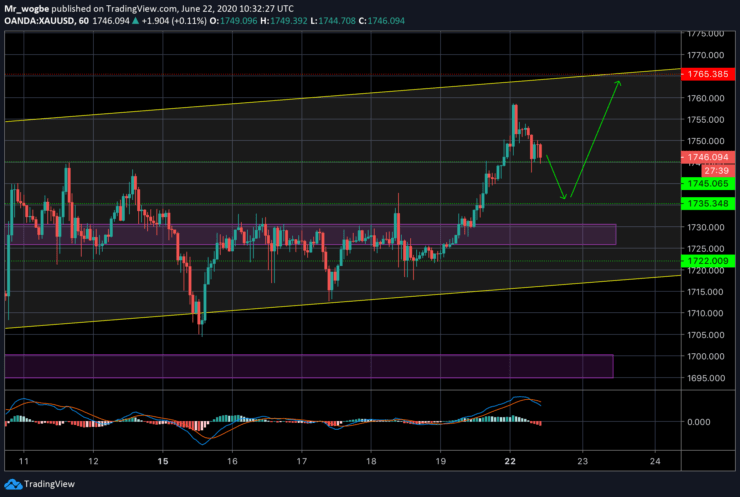

Gold (XAU) Value Forecast — June 22

XAU/USD Major Bias: Bullish

Supply Levels: $1,753, $1,763, and $1,775

Demand Levels: $1,745, $1,735, and $1,722

Gold has become significantly bullish and will remain so for as long as it stays above the $1,745 mark. However, a decline from its present spot ($1,746) will be considered as a minor pullback and not a reversal. This pullback, if it occurs, will likely be strongly supported by the $1,735 mark. In the meantime, gold looks very likely to take the top of our ascending channel resistance ($1,765) and break above that level in the coming days.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus