Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

Gold prices are moving higher on Monday, supported by lower Treasury yields and lower demand for shares. Poor business conditions because of the U.S. bank vacation. They could likewise be affecting the price activity. Moreover, a lower U.S. dollar is likewise expanding demand for gold designated in dollars.

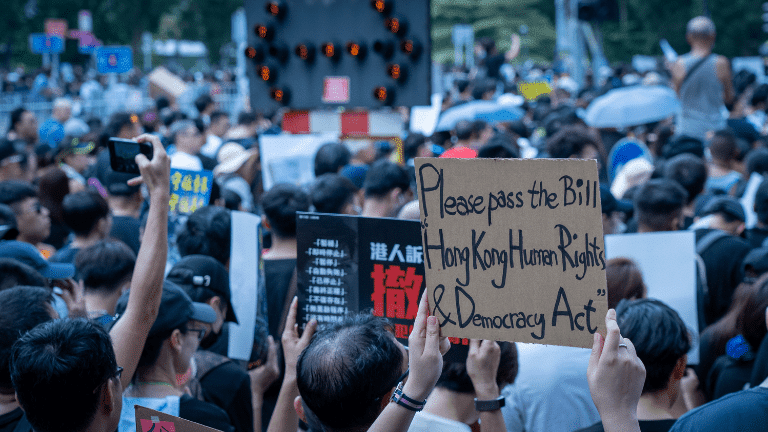

There is additional proof of the acquisition of haven with futures from the Treasury, the Japanese yen and the upward gold trade. This is being powered by the acceleration of violence in Hong Kong.

At 12:53 GMT, December Comex gold is trading at $ 1464.20, an increase of $ 1.30 or + 0.09%.

Gold experienced its greatest loss of single week in three years a week ago after the U.S. Treasury yields. They took shots at their most elevated levels since August 1. A decline in downturn fears was primarily the reason. Financial specialists sold Treasury securities, sent higher rates and moved their profit to higher-yielding shares.

Business Bargain Concerns

An impetus that offers help for gold is false news about trade relations between the United States and China after President Trump appeared to limit news of an unavoidable lifting of taxes in a drawn-out trade dispute between the two market forces.

Trump likewise said there had been fake news about the U.S. readiness to raise duties as a feature of a “phase one” agreement, the news on which had supported markets.

Citi experts said in a note: “We anticipate that a high level of vulnerability should be kept up regardless of whether a tax reversal is accomplished,” clarifying that investments and money related issues between the two biggest economies on the planet are probably going to proceed.

Unrest in Hong Kong Increases

The fights in Hong Kong took a fierce turn on Monday, heightening an effectively unpredictable circumstance days after a gathering of legislators for democracy was arrested in the city, as indicated in the news lately.

In an occurrence, a dissident from Hong Kong is in a serious situation after taking a bullet from the Police. In another occurrence, police stated that a gathering of nonconformists poured the combustible fluid over a man and set it ablaze.

The most recent mass protest happen after three legislators in support of democracy were detained on Saturday and news demonstrated that others were cautioned that they could before long be detained.

Shares in Hong Kong plunged on Monday, with the Hang Seng index crashing more than 2 percent. Firms in China’s main territory include roughly 50% of the organizations recorded on the stock exchange, as per the most recent figures from the CIA World Factbook.

Price Prediction

Gold is by all accounts settled for a short-covering rally after the substantial plunge a week ago. The present news might be sufficient to oust the absolute weakest short sellers from the market. Likewise, with the Treasury market shut today for U.S. Veterans Day. In the U.S., yields are crashing, which makes the U.S. dollar a less attractive asset, while expanding the demand for dollar-denominated gold.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus