Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

The upbeat market sentiment appears to be a factor in keeping the yellow metal under pressure. However, a weaker US dollar, coupled with fears over a second wave of the virus, and growing geopolitical tensions might sustain the commodity from falling lower.

The global risk sentiment was bolstered by the Fed’s decision to begin buying investment-grade US corporate bonds, the Trump administration’s decision to inject another $1 trillion into infrastructure spending, and a positive breakthrough in the battle against the Covid-19 pandemic.

However, investors are becoming increasingly bearish following a sharp rise in Covid-19 infection in the US and the escalating geopolitical tensions in Asia. It was reported yesterday that tensions in the Korean Peninsula intensified after North Korea blew up a joint liaison office in South Korea. Also, India and China suffered some casualties in a clash at the Himalayan border area.

Furthermore, a weaker USD caused by a fresh leg down in the US Treasury bond yields could provide more boost for the dollar-denominated commodity.

In the meantime, market participants will be focused on the US housing market data and the Fed Chair’s second-day testimony today for meaningful trading opportunities.

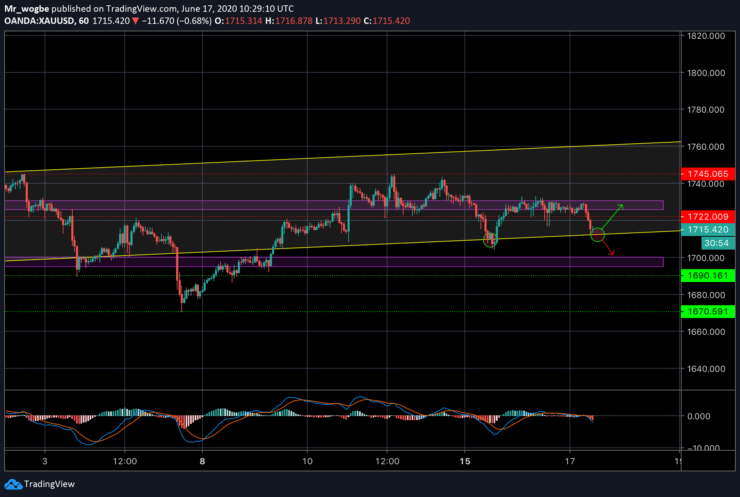

Gold (XAU) Value Forecast — June 17

XAU/USD Major Bias: Sideways

Supply Levels: $1,730, $1,735, and $1,745

Demand Levels: $1,710, $1,704, and $1,700

Gold remains under a strong bearish influence and a drop below $1,700 could confirm this sentiment. However, it seems very unlikely that bears will take control considering the macroeconomic conditions at play. We will be looking at our key support at $1,711 (ascending channel baseline) for the near-term trading sentiment. A bounce off that line could send gold back to the $1722 – $1,735 consolidation range and possibly higher. On the flip side, a failure to bounce off that line could send gold quickly to the $1,704 – $1,700 region.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus