Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

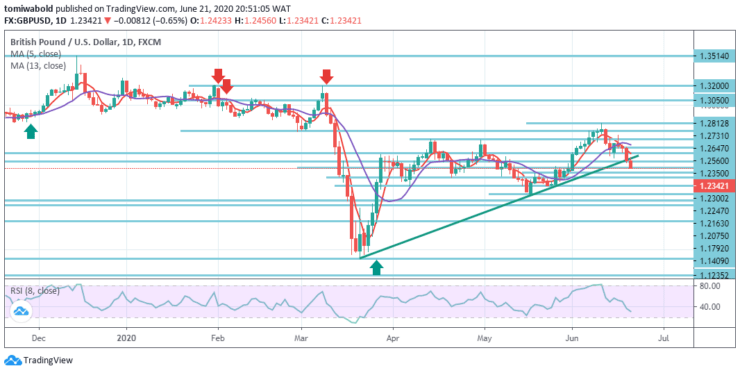

GBPUSD Price Analysis – June 21

The GBPUSD pair settled down at 1.2342 level for a second straight week, a fraction of pips beyond its monthly low at 1.2320 level. The pair dropped as the Retail Sales was better-than-expected, even though it still indicated a large decline. Although GBPUSD bearish slump may accelerate beneath the level at 1.2300.

Key levels

Resistance Levels: 1.3514, 1.2812, 1.2560

Support Levels: 1.2300, 1.2075, 1.1409

In the wider context, although the 1.1409 pullback is intense, there is still an insufficient basis for a trend reversal. Eventually the downward trend from 2.1161 (high) level may continue.

Nonetheless, momentous breach of 1.3514 level may validate medium to long term bottoming and shift trend to bullish for 1.4376 level resistance initially.

GBPUSD’s drop from the high of the short term range of 1.2812 last week continued lower. The steady breach of ascending trendline support now suggests that the entire rebound from level 1.1409 has been finalized with three waves to level 1.2812.

Initial bias remains on the downside for support level of 1.2075. The momentous breach there will validate and strive for a test at a low level of 1.1409. On the positive side, breakage of 1.2560 minor levels of resistance may instead alter bias back to the upside.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus