Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

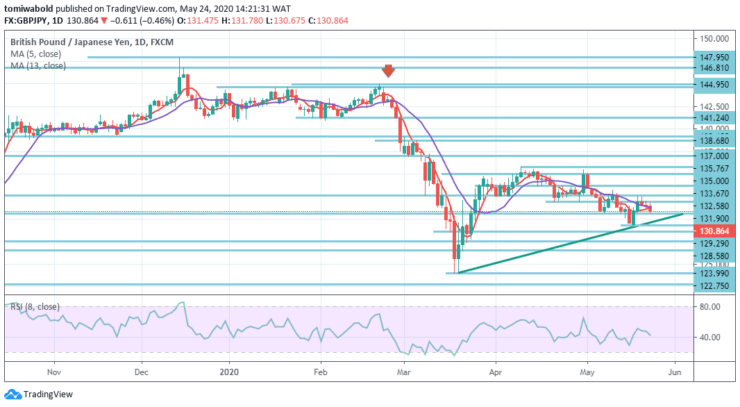

GBPJPY Price Analysis – May 24

The sterling stays selling against the Japanese yen on a bid tone, poised for a three-day negative note, unable to bounce from the ascending trendline, now at 130.86 level. And the pair kept the downside bias steady, with the pound softer against the safe haven-yen as the bleak UK macroeconomic data added anxiety to the potential uncertainty of Brexit.

Key Levels

Resistance Levels: 147.95, 138.68, 132.58

Support Levels: 129.29, 126.54, 123.99

The pair should break beneath the ascending trendline support, as the price is now around 130.85 level and the horizontal support line, to ease pressure at 130.60 area, which could increase buyers’ confidence, to reach May 11 highs at 133.67 level.

On the contrary, the local support emerges at level 129.29 (low May 18) and well below here, level 128.58 (which is 23.6 percent fall from Feb.-Mar.) and level 123.99 level (lows from Mar. 23).

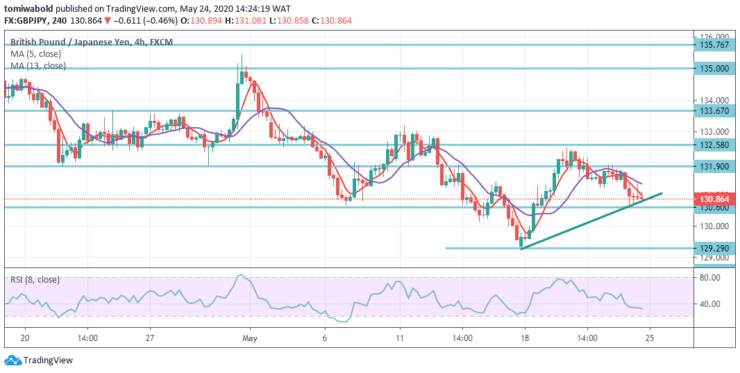

As seen from the 4-hour context, GBPJPY has deteriorated since April 20, slipping back underneath the 5 and 13 moving averages several times after near-term reversals reported at these intervals and the psychological level of 132.58, being the down leg’s 38.2 percent mark from 144.95 to 123.99 levels.

The moving averages are displaying bearish crossovers as per the momentum metrics while the RSI is grinding lower in the negative range. The price may hit the level at 123.99, which is a low of about 3 years, in the event of a stronger downward trend.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus