Seirbhís le haghaidh trádála cóipe. Osclaíonn agus dúnann ár Algo ceirdeanna go huathoibríoch.

Soláthraíonn an L2T Algo comharthaí an-bhrabúsach le riosca íosta.

24/7 trádála cryptocurrency. Agus tú ag codladh, déanaimid trádáil.

Socrú 10 nóiméad le buntáistí suntasacha. Cuirtear an lámhleabhar ar fáil leis an gceannach.

79% Ráta ratha. Cuirfidh ár dtorthaí sceitimíní ort.

Suas le 70 ceirdeanna in aghaidh na míosa. Tá níos mó ná 5 phéire ar fáil.

Tosaíonn síntiúis mhíosúla ag £58.

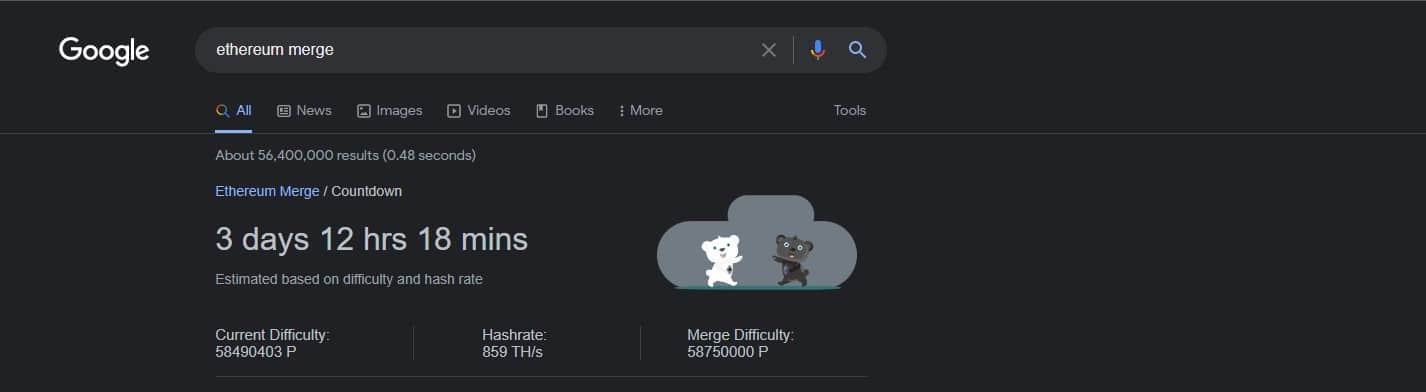

As the Ethereum Merge draws closer, speculations about what could play out are all over the news space. Financial analyst Chris Campbell recently gave some predictions about what could happen post-Merge and how best to position for it.

Campbell on Ethereum Price After the Merge

Campbell believes that many analysts who argue that the Cumaisc event hasn’t already been priced into the market and that ETH could skyrocket after the event are wrong. The analyst noted that he belongs to a camp that believes that there would be a small rally towards the event followed by a sell-off.

Campbell sees this possible sell-off as an opportunity for traders and investors to get into the market, especially through small coins, which he believes would benefit significantly post-Merge.

The analyst then preferred a lucrative opportunity for Ethereum holders, encouraging others who don’t hold Ether to get in on his “free money” leid.

Profit Potential from the Merge Event

Campbell narrated that he foresees a slew of hard forks popping up over the coming weeks and months. A hard fork refers to when developers create a copycat version of a blockchain to create a new token. According to Campbell, many of these forks end up being a pump and dump scheme.

However, sometimes (as seen with Bitcoin Cash, a hard fork of the Bitcoin blockchain) hard forks do succeed and go on to be significantly valuable. In 2017, part of the Bitcoin community believed the network should have bigger blocks to support more transactions. However, BTC developers turned down this proposition, explaining that it would compromise network decentralization.

Dissatisfied with this explanation, the “big blockers” forked the network and created Bitcoin Cash (BCH) and gave it bigger blocks just like it wanted. Shortly afterward, the tokens recorded a notable surge, with whales heavily speculating on the token.

This event triggered a flurry of other forks on the network, all trying to replicate the successes of BCH. This “Block Size Wars” led to the creation of 15 Bitcoin forks, some of which still exist today.

According to Campbell, the best part about this was that you were entitled to receive these forks as a Bitcoin holder.

Citing examples, the analysts explained that someone holding 10 BTC in 2017 would have gotten the same number of the forked tokens. Bitcoin Diamond, for example, peaked at $104 meaning BTC holders that cashed in their hard fork tokens would’ve walked away with "saor" $1,040 in tokens.

Bitcoin Cash, with a peak of $4,355, would’ve seen the BTC holder walk away with $43,550 in free money. Campbell explained that he expects a similar scenario to play out with Ethereum.

The analysts highlighted that some developers believe Ethereum should remain a Proof-of-Work consensus mechanism blockchain plan on forming the network to create the ETH POW.

Like in 2017, Campbell expects this fork to trigger a flurry of hard forks, many of which would shoot up in price based on speculation.

Capturing Hard Fork Tokens

As an Ethereum holder, you are automatically entitled to ETH forks. To claim tokens from hard forks, however, users must have custody of their tokens, meaning their ETH must be stored on self-custody wallets like MetaMask or an offline hardware wallet.

Once this is sorted out, Campbell advises holders to simply relax and enjoy the ride. He also advised holders to have an exit point as well.

Is féidir leat Lucky Block a cheannach anseo. Ceannaigh LBlock

- bróicéir

- Taisce Min

- Scór

- Tabhair cuairt ar Bhróicéir

- Ardán trádála Cryptocurrency a bhuaigh duaiseanna

- Éarlais íosta $ 100,

- FCA & Cysec rialaithe

- Fáiltíonn 20% roimh bhónas suas le $ 10,000

- Éarlais íosta $ 100

- Fíoraigh do chuntas sula gcuirtear an bónas chun sochair

- Níos mó ná 100 táirge airgeadais éagsúil

- Infheistiú ó chomh beag le $ 10

- Is féidir aistarraingt an lá céanna

- Ciste Margaí Moneta a mhaoiniú le $ 250 ar a laghad

- Roghnaigh an fhoirm a úsáid chun do bhónas taisce 50% a éileamh