Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

USDCHF-priisanalyse - 19 juny

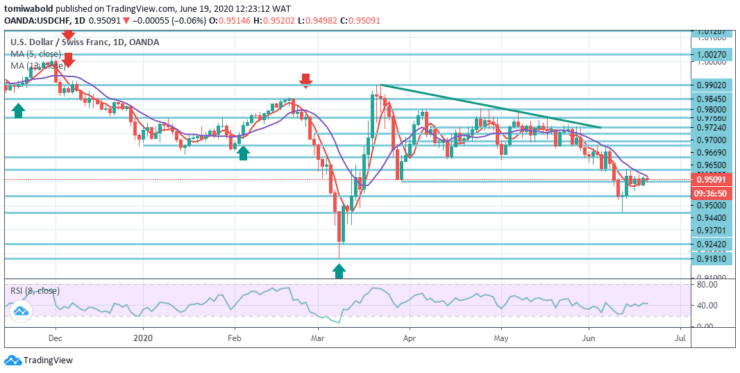

USDCHF price bounces back to about 0.9510 level while hitting intraday low at 0.9498 level, only down 0.05 percent on a day, as at early Friday. The pair’s latest decline from the moving average 5 may be traced from an initial pullback. The focus will be on coronavirus statistics.

Key Levels

Fersetsnivo: 1.0027, 0.9766, 0.9550

Stypjenivo's: 0.9440, 0.9370, 0.9181

USDCHF is now consolidating within the region of 0.9440-0.9550 over the past week, but in the wider context, the fall from level 1.0231 is seen as the third step of the trend from level 1.0342. Having reached 0.9242 main support (low) level, it should have ended at 0.9181 level.

Despite the moving averages relieving downward momentum in the bearish region and the straight RSI resisting to return to its 20 oversold marks, a 0.9902-level breach may expand the rebound from 0.9181 to 1.0027-level resistance. Simply put, medium to long-term trade in ranges is inclined to maintain for some longer between 0.9181/1.0231 levels.

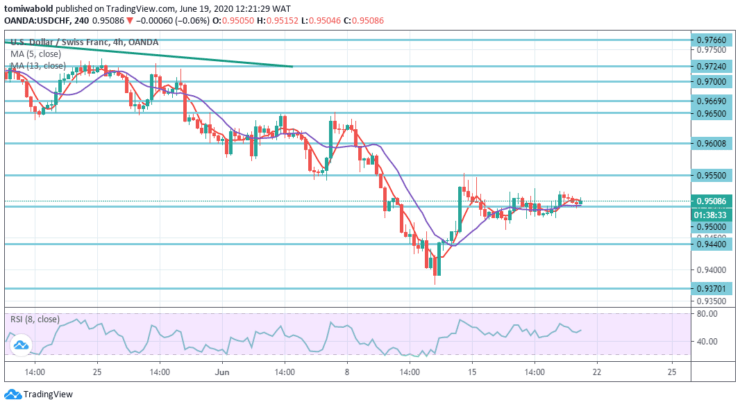

The recent sideways trading by the pair may be linked from a short-term plunge in the four-hour chart in its pullback. The USDCHF intraday bias stays neutral, and the trend stays intact. On the positive side, the 0.9550 level break may continue the rebound from a short term bottoming level of 0.9370.

The continuous trading beyond moving average 13 (now at 0.9500 level) sets the stage back to resistance of 0.9902 level. On the drawback, however, the 0.9370-level breach may then restart the decline from 0.9902 level.

Noat: Learn2.trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen