Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

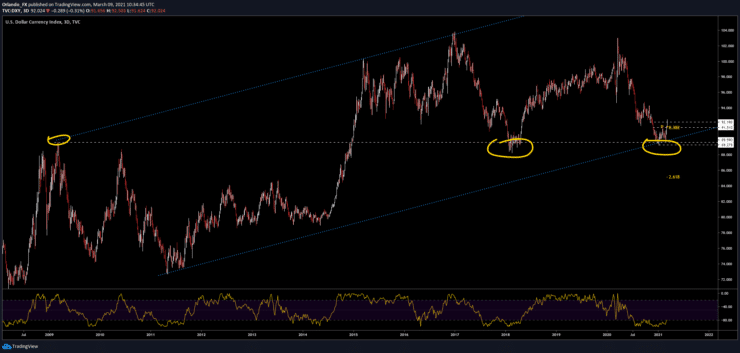

This comes from a rejection of a 12 year bullish structure (chart below) that, because of how fundamentally bearish the US Dollar is, was the make it or brake it level.

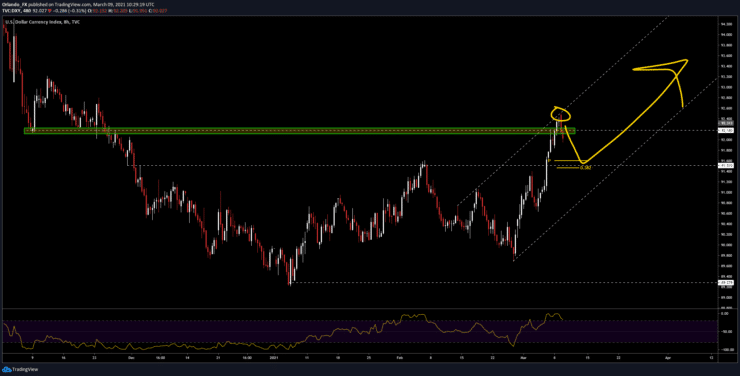

Having said that, the break above 92.20 was capped by the 92.50 level and now price has pulled back below that November 2020 base.

Should price pull back to this level, sellers will have trouble swiping all those buy orders and if this level holds we will look for opportunities to buy USDs on a super high probability trade.

This is what we do, this is what we need to focus on, being patient and get in hard when these scenarios play out. The most likely markets that we will trade USD longs will be short metals, short EURUSD or long USDJPY-USDMXN.

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen