Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

NEO-priisanalyse - 26 oktober

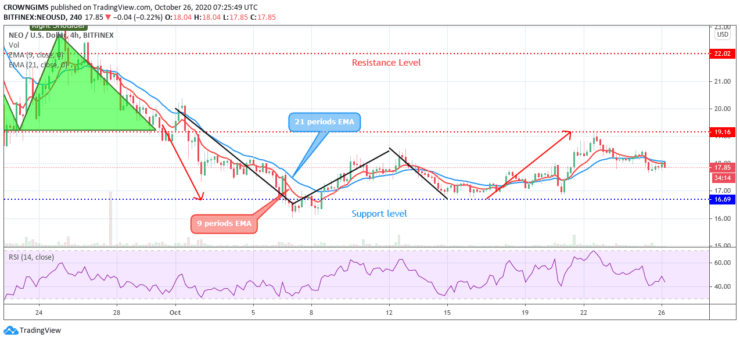

The crypto may retest the support level at $16 and break down the level, decline to $14, and $12 support level. In case the price is rejected at $16, then the ranging movement may continue. At the upper side of the market above $19 levels, resistance levels can be found at $22 and $25.

NEO / USD Merke

Key Levels:

Fersetsnivo's: $ 19, $ 22, $ 25

Stypjenivo's: $ 16, $ 14, $ 12

NEO / USD Trend op lange termyn - Bearish

The resistance level at $19 and the support level at $16 has been a ranging level for NEO/USD for more than four weeks. The scenario started on October 20 when the price bottomed at the support level of $19, the bears could not break down the level due to weak momentum. The resistance level at $19 also has been a barrier for the bulls. Since then the price has been ranging within the above-mentioned levels.

The coin tested the upper range level on October 22 and currently declining towards the support level at $16. It has already penetrates the two dynamic support level downside, meaning that, the bears are prevailing. The crypto may retest the support level at $16 and break down the level, decline to $14, and $12 support level. In case the price is rejected at $16, then the ranging movement may continue. At the upper side of the market above $19 levels, resistance levels can be found at $22 and $25. The relative strength index period 14 is at 50 levels bending down to display the sell signal.

NEO / USD Medium-termyn Trend - Bearish

NEO is bearish on the medium-term outlook; the buyers dominated the NEO Market last week and the resistance level of $19 was reached. The mentioned level rejects the price and prevents further increase. Sellers gather momentum, exerts pressure, price starts to decline towards the support level at $16.

The Crypto is trading below the two EMAs and the 9 periods EMA is below the 21 periods EMA. However, the relative strength index period 14 is at 40 levels bending down to indicate a sell signal.

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen