Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

The yellow metal remained within a narrow trading range throughout the day and was last spotted trading around $1928. Gold has traded in a ‘seesawed’ manner for the fourth consecutive session now. The Federal Reserve continues on its loose monetary policy, which may be the most crucial driver of the choppiness in gold.

This has given the US dollar a little boost, which has further caused stagnation for the dollar-denominated commodity. However, worries over the prospects of a sharp US economic recovery has extended further support for gold’s safe-haven status and has limited further declines. Investors appear to be unwilling to become aggressive at the moment considering the holiday-induced volatility thinning in the markets today.

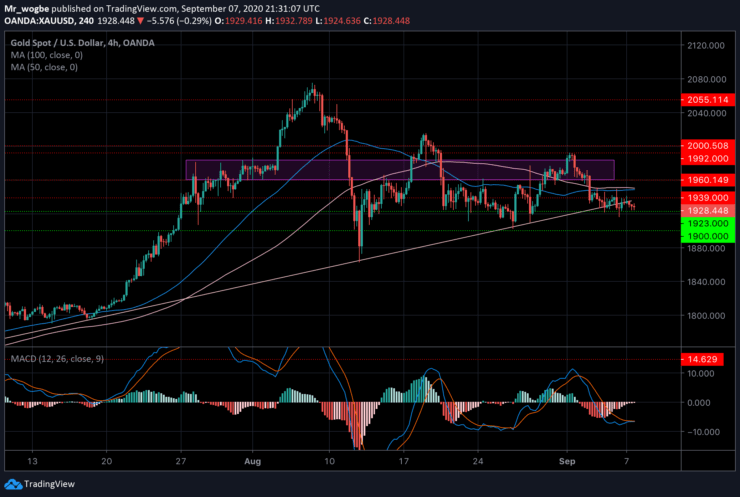

Gouden (XAU) weardefoarspelling - 7 septimber

XAU / USD Major Bias: Bearich

Oanbiedingsnivo's: $ 1940, $ 1960, en $ 1983

Fraachnivo's: $ 1923, $ 1909, en $ 1900

Gold bulls remain in a fight for control, however, given the prevailing market conditions, a gold recovery doesn’t seem likely in the near-term.

The commodity also failed to rally back above the 4-month ascending trendline, widening its distance the longer it stays below.

Moving on, we have a confluence of indicators (100 and 50 SMA) around the $1950 level, signifying that that’s the level to beat in the near-term for bulls to get comfortable again is the $1950.

Regardless, it seems increasingly likely that we will see the $1900 mark soon and subsequently the $1862 August low if bulls fail to resuscitate the market.

Noat: Learn2.Trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen