Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

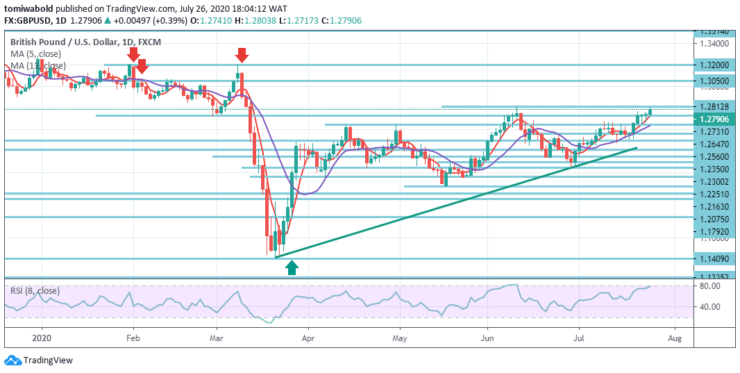

GBPUSD Priisanalyse - 26 july

In the prior session, the GBPUSD pair spiked to level 1.2803, a recent six-week peak, following the weakness of the relentless dollar and optimistic UK numbers. Until it happens, Brexit-headlines controls the Sterling. There’s increased odds of a no-deal Brexit after the fifth round of talks collapsed last week.

Key Levels

Fersetsnivo: 1.3514, 1.3050, 1.2812

Stypjenivo's: 1.2647, 1.2500, 1.2251

From 1.2251 level, GBPUSD recovery resumed last week and reached as high as 1.2803 level. Last week’s initial bias lingers on the upside. The decisive breach of level 1.2812 may restart the entire rally from level 1.1409.

A 100 percent forecast of 1.1409 to 1.2647 levels from 1.2075 to 1.3205 levels may be the next aim. On the negative, the intraday bias may then become neutral, beneath 1.2647 slight support level. Yet as long as 1.2500 support level holds, more growth may stay in order.

For now, chart patterns beneath positive ranges are neutral-to-bullish. A bullish moving average of 5 and 13 proceeds to provide intraday support in the 4-hour chart, presently at 1.2731 level, although technical indicators have lost bullish intensity there, stay within positive ranges, suggesting limited intention of selling.

The monthly high of June at 1.2812 level is the initial support, with potential for more increases on a breach beyond it. The GBPUSD pair also is bullish from a technical perspective while revealing that it stays beyond the moving average of 13 which split upwards, while the moving average of 13 progresses beneath.

Noat: Learn2.trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen