Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

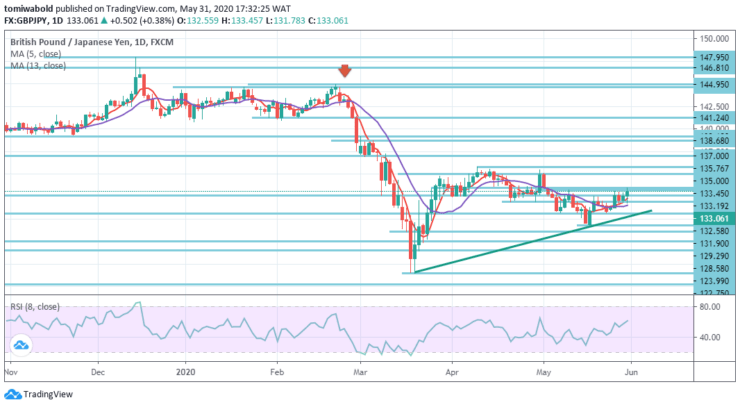

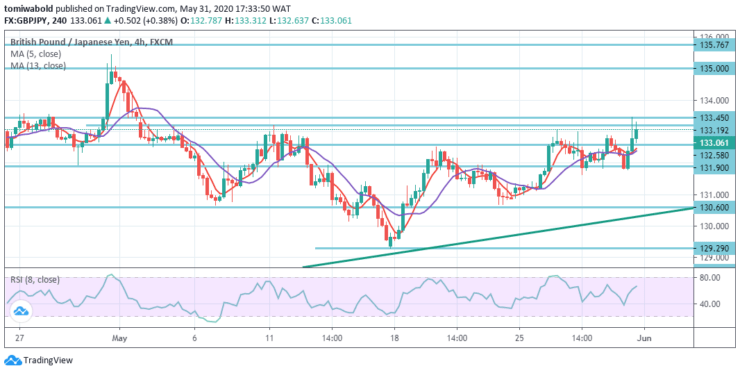

GBPJPY Priisanalyse - 31 maaie

Traders might sustain a selling bias on GBPJPY in the expectation that the pound weakness may extend more in the near term. As the cross tends to stay at 133.00, around the level. Negative Brexit news tends to weaken the pound, with persistent rumors that the BoE (Bank of England) may hold out negative rates.

Key Levels

Fersetsnivo: 147.95, 138.68, 135.00

Stypjenivo's: 131.90, 126.54, 123.99

The GBP has persisted to perform poorly during the last week. GBPJPY tested the resistance at a level of 133.19 but did not break beyond during the first attempt, however, a second and more positive move came through after a slight correction.

lA breach over key-resistance at 133.19 further shifted the potential alternative level to the ideal target, and this result looks probable towards a 135.00 level of significant resistance. Nevertheless, the potential downside is intended to push out as long as the level of resistance stays intact at 147.95 level.

Despite attempting one more time to pull beyond the level of resistance of 133.45, GBPJPY stays tight as May ends. While the general trend appears bearish, sellers may aim for a split underneath the level of 132.58 with the prospect of collapse towards the levels of 131.90 and 130.60.

In comparison, the spot is expected to face heavy resistance near the level of 133.45. Initial bias for a resistance level of 135.76 is now on the upside this week. A split there will trigger the entire growth from 123.99 to 135.76 from 129.29 at 137.00 levels for a forecast of 61.8 percent.

Noat: Learn2.trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen