Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

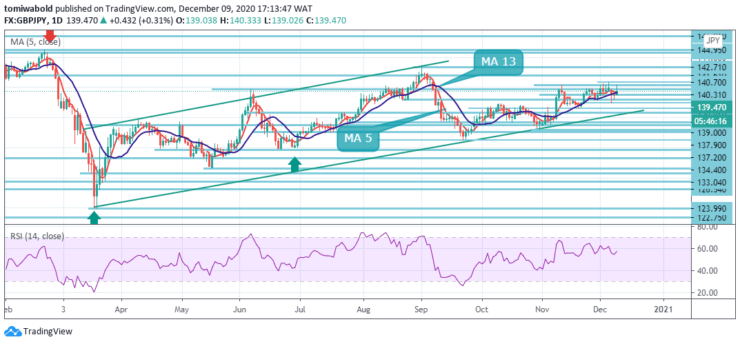

GBPJPY Priisanalyse - 9 desimber

GBPJPY rallies to new weekly highs at the start of the American session, gaining steady positive traction breaking the 140.31 barriers. Optimism for the COVID-19 vaccine has eroded the yen as the Brexit deal gave a strong boost to the British pound.

Key Levels

Fersetsnivo: 147.95, 144.95, 142.71

Stypjenivo's: 138.38, 137.50, 134.40

As seen in the daily chart, the GBPJPY pair has now found a move past the key 140.31 barriers and looks set to continue to rise. On the other hand, a sustained breakout of the 140.70 level could lead to the 142.00 thresholds in the long term. If the GBPJPY bulls are holding the reins higher, the 142.71 high will be visible on the radar.

In a broader context, the rally from 123.99 remains as a cycle of increasing sideways from 122.75 (low). As long as the resistance level of 147.95 remains unchanged, a possible downside breakout remains in effect. However, a break of the 147.95 level could increase the chance of a long-term bullish reversal.

The GBPJPY intraday bias stays initially neutral. On the other hand, a breakout of the 140.70 resistance level could resume the sharp rebound from the 133.04 level. The intraday bias could then be revised upward to retest the 142.71 high.

The GBPJPY cross could then accelerate the upside to 142.71 en route to midpoint 141.50. On the other hand, a break of the 137.90 level could restore the scenario in which the corrective advance from the 133.04 level has ended. Where intraday bias returns to the downside towards the 134.40 support level.

Noat: Learn2Trade.com is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen