Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

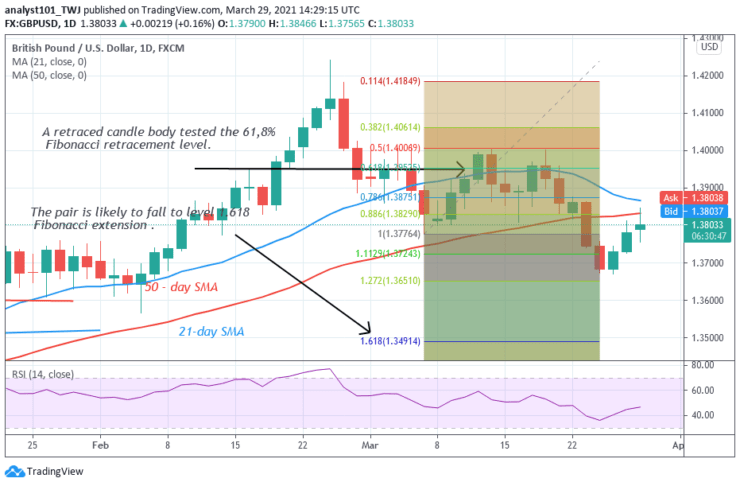

Key Resistance Levels: 1.4200, 1.4400, 1.4600

Key Support Levels: 1.3400, 1.3200, 1.3000

GBP / USD Priis Lange termyn Trend: Bearish

It Britske Pûn has been in a downward move after its rejection at level 1.4200. The pair has fallen and broken below the moving averages. The implication is that the selling pressure will persist. On March 5 downtrend, a retraced candle body tested the 61,8% Fibonacci retracement level. The retracement implies that the pound will further decline to 1.618 Fibonacci extension or level 1.3491.

Yndyske oantsjuttings foar lêzen fan kaart:

The 21-day and 50-SMA are sloping downward. The pair has fallen to level 45 of the Relative Strength Index period 14. This indicates that the Pound is in the downtrend zone and below the centerline 50. The pair is likely to further decline on the downside.

GBP / USD Trend op middellange termyn: Bearish

On the 4-hour chart, the pair is falling after a range-bound movement in March. In February and March, the Pound was fluctuating between levels 1.3850 and 1.4000. On March 19, level 1.3850 was broken by price.

The selling pressure resumed after price pulled back and retested level 1.3850. The pair fell to level 1.3700. The market corrected upward to retest level 1.3850 before resuming downward.

4-oere grafyske yndikatoaren lêze

The GBP/USD pair is currently above the 80% range of the daily stochastic. It indicates that the pair is in the overbought region. Sellers are likely to emerge. The SMAs are sloping southward indicating the downtrend.

Algemiene Outlook foar GBP / USD

The GBP/USD is now in a downward move. The pair has retested level 1.3850 for the resumption of the downtrend. The downtrend is likely to reach 1.618 Fibonacci extension or level 1.3491.

Jo kinne hjir kryptomunten keapje: Munten keapje

Noat: Learn2.Trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen