Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

EURUSD Priisanalyse - 16 febrewaris

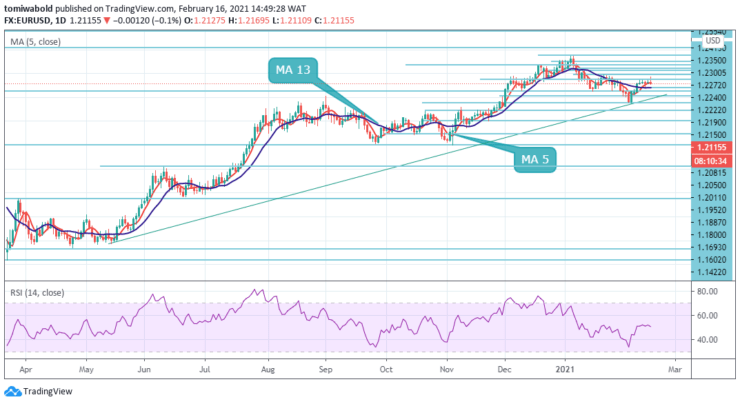

The EURUSD pair continues to trade in multi-day highs and targets the 1.2200 marks during the mid-week. The single currency rises higher and propels the EURUSD in an attempt to run past prior highs. The recently released Eurozone data was upgraded to 0.6% in Q4 while the German ZEW Economic Sentiment beat estimates.

Key Levels

Fersetsnivo: 1.2240, 1.2222, 1.2190

Stypjenivo's: 1.2081, 1.2011, 1.1952

As seen on the daily chart, the EURUSD lifts higher from the 1.2125 level supported by the MA 5 and it’s likely the exchange rate gains support below at the MA 13 at 1.2088 in the event of a pullback. On the broader picture, the constructive stance in EURUSD stays unaltered while above the critical horizontal level, today at 1.2150.

However, the EURUSD still confronts a tough barrier in the 1.2200 zones ahead of the current price. The rebound from 2021 lows near 1.1952 (Feb. 5) follows the constructive outlook for the pair in the longer run. On the downside, the next support lines are up at 1.2011 followed by 1.1952, and finally 1.1887 low.

EURUSD has been struggling to pull out of the MA 5 and 13 regions on the four-hour chart and trades above at 1.2040. The Relative Strength Index is below 60, thus outside overbought conditions and allowing for further gains.

The pair’s next resistance awaits at 1.2190 level, which has capped its price, although more further move beyond the 1.2190 and 1.2222 levels is eyed. Some support is at the low of 1.2118, followed by 1.2081 levels, a swing low from last week. A more significant cushion is at the 1.2050 level.

Noat: Learn2.Trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen