Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

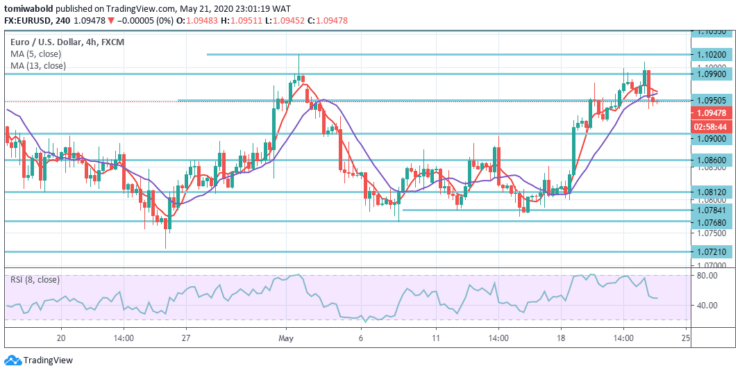

EURUSD Priisanalyse - 21 maaie

During Thursday’s American session, the EURUSD pair tested the 1.10 threshold upside down and was seen 0.20 percent lower on the day. The FX pair extends the recovery and flirts past the level of 1.1000 towards the main barrier potential test in the region of 1.1055 and later lost momentum. PMIs in the Eurozone have, for the most part, surpassed anticipations and yet stay depressed.

Key Levels

Fersetsnivo: 1.1495, 1.1146, 1.1055

Stypjenivo's: 1.0900, 1.0784, 1.0635

EURUSD ran out of steam on the daily chart after reaching the level at 1.1008. The daily bias shifts to the downside. The long term outlook is nevertheless unchanged as the corrective trend from level 1.0635 continues.

A further decrease could be seen from the resistance level 1.0990 beneath level 1.0950. Yet in that scenario, a retracement of 61.8 percent from 1.1495 to 1.0635 at 1.1236 levels may restrict the upside. On the downside, a breach of 1.0784 level may transform bias back to the downside for low level 1.0635 retesting.

The EURUSD pair already is breaking the 1.0950 key support level which is a crucial handle. Consequently, the level of critical resistance above at the horizontal line is located around the 1.0990 level just pips 40 pips beyond this threshold.

Thereby, traders may be selling underneath level 1.0950 with the stop-loss of around level 1.0990. Furthermore, so unless the pair leaps past the level of 1.0990, these stop-losses might be reached, which may drive the pair much further, reaching 1.1020 level in the initial response.

Noat: lear2.trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen