Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

EURJPY Priisanalyse - 27 desimber

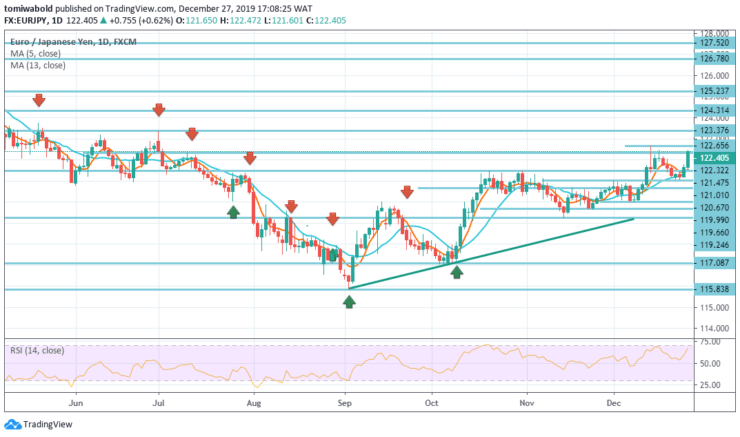

EURJPY buyers ride on the upside momentum to the level at 122.46 during the European session into American Session on Friday. The pair recently bounced off the moving average 5 while the upper line of the ascending trend-line channel since early-September may bolster the pair’s advances past the level at 123.37.

Key Levels

Fersetsnivo: 127.52, 124.31, 122.65

Stypjenivo's: 121.47, 119.99, 115.86

EURJPY Lange termyn Trend: Bullish

In the longer term, EURJPY remains within the falling structure set at 127.52 (high). Progress from the level of 115.86 is currently considered as a corrective movement.

Meanwhile, with a focus on the horizontal resistance (currently at the level of 124.31), a solid resistance is seen, which inhibits growth. Nevertheless, a steady breakthrough of the horizontal resistance may carry an indication of bullish implication and approach the level at 127.52 of the key resistance next.

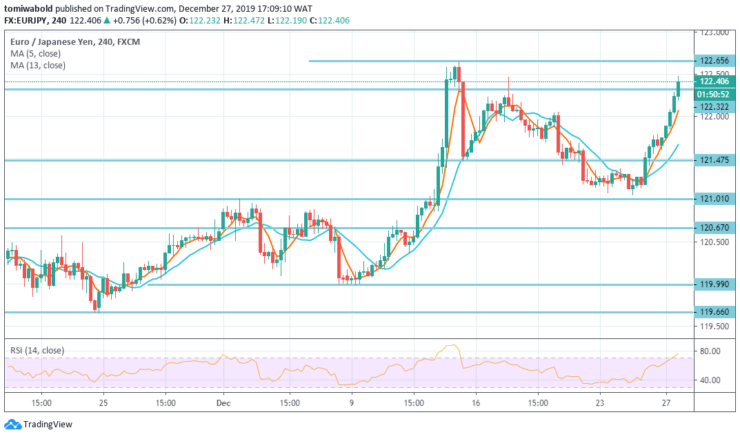

EURJPY Koarte termyn Trend: Bullish

EURJPY is recovering today but remains beneath the resistance level of 122.65. The initial bias within the day remains neutral. And consolidation may increase, but the decline should be limited by the support level of 119.99 to start a new rally.

On the other hand, the breakdown of the level at 122.65 may approach the resistance level of 123.37. However, the breakdown may come close to the resistance of the key horizontal zone(now on the level of 124.31).

Ynstrumint: EURJPY

Oarder: keapje

Yntreepriis: 122.32

Stopje: 119.99

Doel: 123.37

Noat: Learn2Trade.com is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen