Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

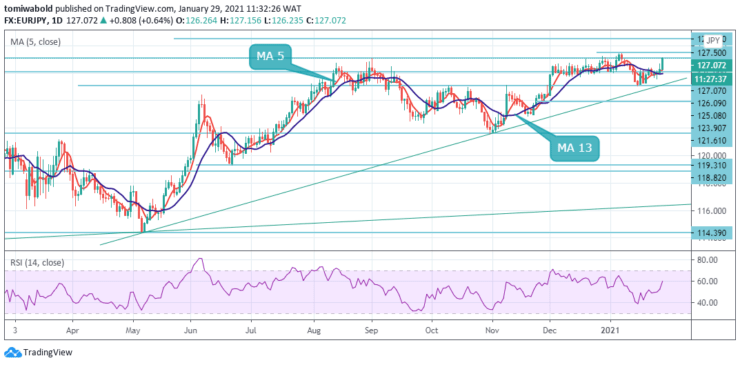

EURJPY Priisanalyse - 29 jannewaris

The common European currency has increased significantly for the 3rd day in a row against the Japanese Yen. At the back of renewed demand for the Euro, the upside momentum in EURJPY gained traction in the 125.00 zones while printing a high price past 127.00 in the present session.

Key Levels

Fersetsnivo: 130.00, 128.50, 127.50

Stypjenivo's: 126.09, 125.08, 123.90

The currency pair rebounded from the lower horizontal level around 126.00 during today’s trading session before moving north for the break of the 127.00 level. All things considered, the EURJPY exchange rate could continue upwards within the following trading session. Bull market investors are eager to force the market toward a level of 127.50.

However, if it recedes during the following trading session, a support cluster created by the moving average 13 and the ascending trendline below 126.00 level could further provide support for the currency exchange rate. Otherwise, sentiment in the event of a rebound may stay bearish.

The intraday bias in EURJPY remains mildly on the upside at this point. The present rebound from 125.08 would target a test on 127.50 high. On the downside, below 126.09 minor support will turn bias neutral again initially. The latest price activity further unlocked the path to a potential stay in the short-term timeframe to the 2020 highs in the 127.50 range.

As EURJPY remains vulnerable to an upward bias in the near term, a breach underneath the support level of 126.09 may deliver weakness towards the support zone of 125.08/121.61. On the other side, one can see resistance near the price level of 127.50.

Noat: Learn2.trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen