Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

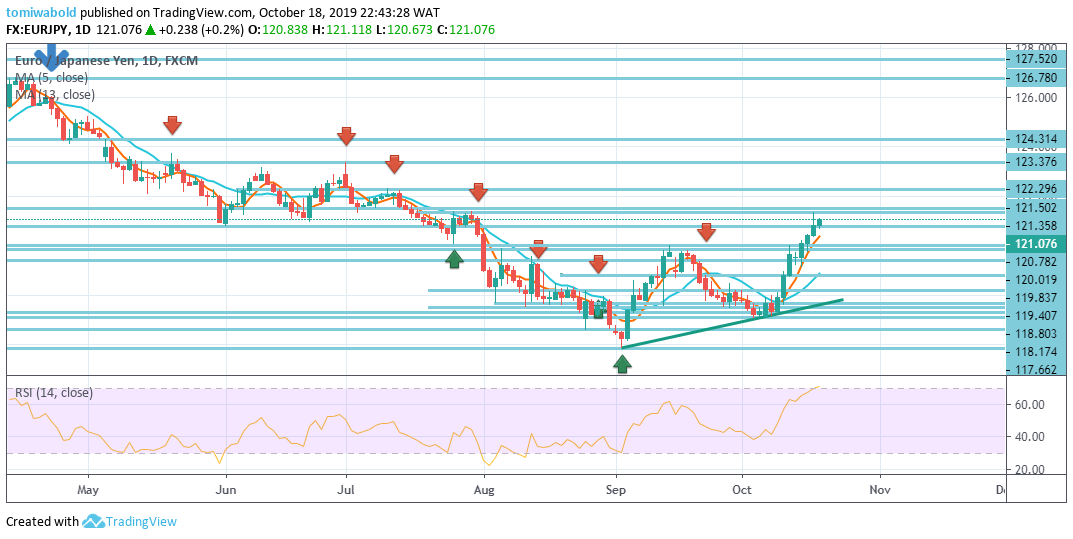

EURJPY Price Analysis – October 18

The Euro had gained positively against the Japanese Yen for 7 days in a row after the market confirmed its breakout through the prior sessions following the upward advance to end the week higher. And in the next session, the exchange rate may likely continue to trade in the ascending trend.

Key levels

Resistance Levels: 124.31, 123.37, 121.50

Support Levels: 120.01, 118.80, 117.08

EURJPY Long term Trend: Bullish

The FX pair is up from the low at the start of the month in large part due to rallies in 7 of the past 8 trading days. And the potential target for the pair today would be at the 121.50 area.

On the contrary, the price of the EURJPY might reverse from the current price level at 121.07 and mildly retrace downwards towards the level at 120.01 area during the next trading session.

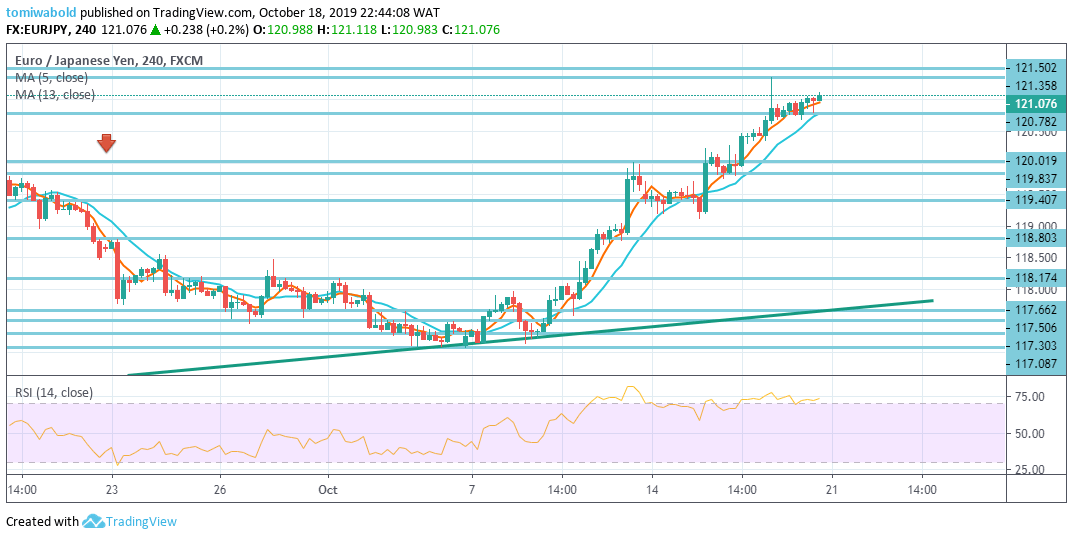

EURJPY Short term Trend: Bullish

On the flip side, the intraday bias for the EURJPY stays on the upside in this zone. Meanwhile, the firm break of the level at 118.80 to 120.01 from 117.08 at 121.07 may proceed for the level at 121.50.

However, on the downside, the break of the level at 119.40 minor support may shift the intraday bias neutral and cause solidification around that zone, before activation of another rally.

Instrument: EURJPY

Order: Buy

Entry price: 120.78

Stop: 118.80

Target: 121.50

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus