Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

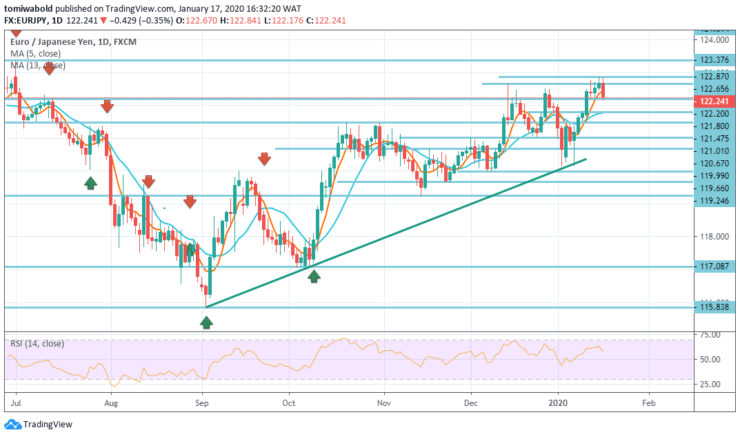

EURJPY Price Analysis – January 17

Increased selling surrounding the European currency is driving the currency to give part of its weekly gains and plunge back to the level of 122.40. Strengthening sentiment against the US dollar on Friday puts additional pressure on other pairs, and all this follows the anticipated results of recent US indicators.

Key Levels

Resistance Levels: 124.31, 123.37, 122.87

Support Levels: 121.47, 119.99, 115.83

EURJPY Long term Trend: Bullish

Progress from the level of 115.83 is currently considered as a correctional trend. Strong resistance is observed with horizontal resistance to inhibit growth. Nevertheless, a steady breakout of resistance may indicate a larger bullish price and aim the level at 127.50 key resistance as follows.

Although the trend is bullish, on the other hand, EURJPY is trading bearish in a narrow trading range of 122.75 – 122.16, and violation of this area may lead to a further bear trend for the currency pair.

EURJPY Short term Trend: Ranging

At the moment, the moving averages 5 and 13 crossings are losing 0.22% at 122.22 level, and breaking through the short-term horizontal support line may lead to the level of 121.80 and, finally, to the level of 121.45. On the other hand, the next rising barrier is at the level of 122.87 (January 16 high, 2020), followed by the level of 123.37.

EURJPY is trading with a bearish bias beneath the strong resistance level of 122.87 and seems to be aiming at the level of 122.20, as the euro is getting weaker.

Instrument: EURJPY

Order: Sell

Entry price:122.20

Stop: 122.65

Target: 121.80

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus