Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

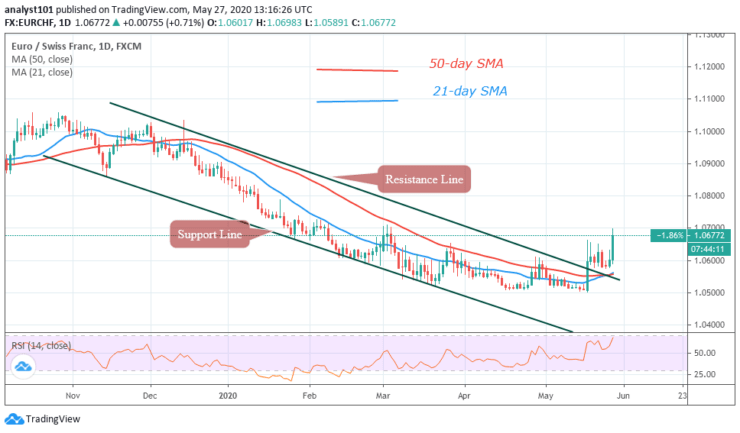

Key Resistance Levels: 1.09000, 1.10000, 1.11000

Key Support Levels: 1.05400, 1.05200, 1.05000

EUR/CHF Price Long-term Trend: Bullish

EUR/CHF pair is currently in a bear market. The pair has broken out of the resistance line of the descending channel. As the price closes above the resistance line, the upward move is likely to continue. The pair is rising and approaching level 1.07000. The EUR/CHF is likely to face resistance at the current high.

Daily Chart Indicators Reading:

The pair is at level 68 of the Relative Strength index period 14. It is approaching the overbought region. This implies that the market is in the uptrend zone and above the centerline 50. The 50-day SMA and 21-day SMA are sloping upward indicating the bull market.

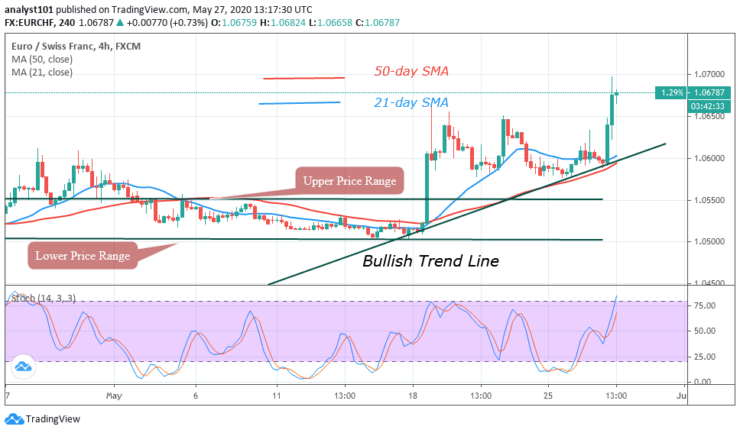

EUR/CHF Medium-term Trend: Bullish

On the 4-hour chart, the EUR/CHF pair was earlier in a sideways trend. The price rebounded to break out of the upper price range. During the uptrend, the pair rebounded again to break the resistance at 1.06500. The price is likely to face another resistance as it moved up.

4-hour Chart Indicators Reading

The 50-day and 21-day SMA are sloping upward indicating the uptrend. The pair is above 50% range of the daily stochastic. EUR/CHF pair is in a bullish momentum. On May 18, the moving averages have a bullish crossover. The 21-day SMA crosses over the 50-day SMA indicating the uptrend.

General Outlook for EUR/CHF

The pair is in an upward move approaching level 1.07000. At the moment, the price is finding penetration difficult at the current high. It may retrace to level 1.065000 and resume upward move.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus