Teenus koopiate kauplemiseks. Meie Algo avab ja sulgeb tehingud automaatselt.

L2T Algo pakub väga tulusaid signaale minimaalse riskiga.

24/7 krüptovaluuta kauplemine. Sel ajal kui sina magad, me kaupleme.

10-minutiline seadistamine oluliste eelistega. Kasutusjuhend on ostuga kaasas.

Edukus 79%. Meie tulemused erutavad teid.

Kuni 70 tehingut kuus. Saadaval on üle 5 paari.

Kuutellimused algavad 58 naelast.

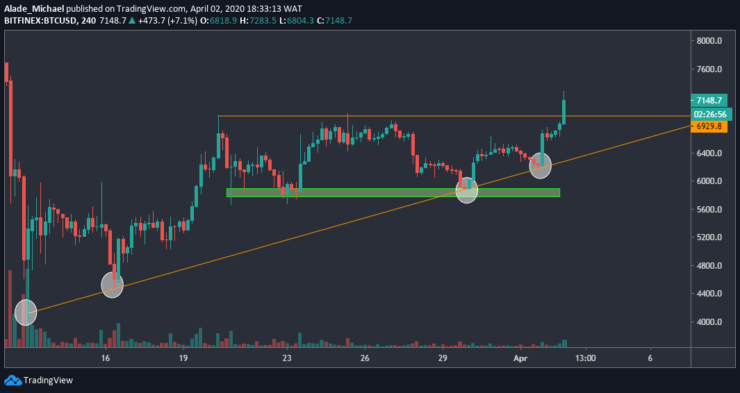

• The next price target for Bitcoin is $8000 if the $7000 level can act as support

• Bitcoin hits $7200 following a 14% increase in a day.

Following yesterday’s rejection at $6635, Bitcoin saw about 5% drops but later found a rebound level at $6170, which is now acting as support for the ongoing increase. Bitcoin is currently trading around $7200 following current breakout. In case Bitcoin fails to hold gain, the price is likely to roll back to $6900

Peamised resistentsuse tasemed: 7200, 7600, 8000 dollarit

Peamised tugitasemed: $ 6900, $ 6600, $ 6170

Bitcoini (BTC) hindade analüüs: igapäevane graafik - bullish

Bitcoin broke above $7000 after witnessing series of rejection around $6900 resistance. Taking a look at the chart, Bitcoin appeared to be starting a fresh increase. In the next few days, the price could hit $8000 level if price remains above the $6900 level. Before then, Bitcoin could encounter resistance at $7600.

In case of a retracement, the support to look out for is $6900. If Bitcoin drops lower, the closest support to watch is $6600 and $6170 support, where the price bounced back yesterday. So far, Bitcoin has shown strength over the past hours. We should expect a more positive movement in the next few days.

Bitcoini (BTC) hindade analüüs: 4H diagramm - bullish

Since the mid-March crash to $4000 on Bitfinex, Bitcoin has seen a lot of recovery, leaving many supports at $4400, $5880 and $6170 yesterday’s low, circled white on the 4-hours chart. Technically, these bullish footprints show that Bitcoin is stylishly reversing the trend.

Meanwhile, the $6900 resistance, which is a major concern for the bulls for the past three weeks just got broken a few minutes ago. If Bitcoin can close well above this resistance today, the next bullish target would be $7200 resistance, followed by $7600 and perhaps $8000 before the end of the week.

BITKOINI OSTKORRALDUS

Osta: 7011 dollarit

TP: 7200 dollarit

SL: 6866 dollarit

- Maakler

- Min Deposit

- Punktisumma

- Külastage maaklerit

- Auhinnatud krüptoraha kauplemisplatvorm

- Minimaalne sissemakse 100 dollarit,

- FCA ja Cysec on reguleeritud

- 20% tervitusboonus kuni 10,000 XNUMX dollarit

- Minimaalne tagatisraha $ 100

- Enne boonuse krediteerimist kontrollige oma kontot

- Üle 100 erineva finantstoote

- Investeerige juba 10 dollarilt

- Võimalik on loobumine samal päeval

- Fondi Moneta Markets konto vähemalt 250 dollariga

- 50% sissemakse boonuse taotlemiseks lubage vorm